MoneyGram 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

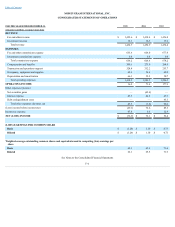

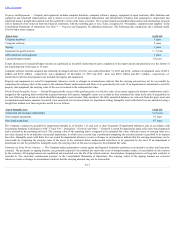

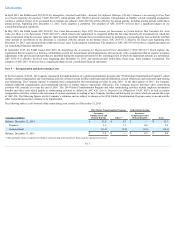

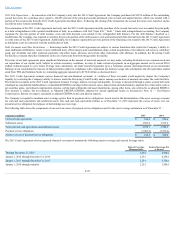

The following table is a reconciliation of the weighted-average amounts used in calculating earnings per share for the period ended December 31 :

(Amounts in millions) 2015

2014

2013

Basic common shares outstanding 62.1

65.3

71.6

Shares related to stock options —

0.1

0.2

Shares related to restricted stock units —

0.1

0.1

Diluted common shares outstanding 62.1

65.5

71.9

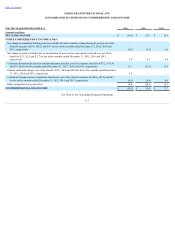

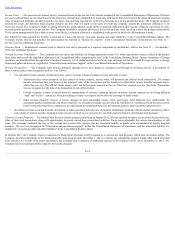

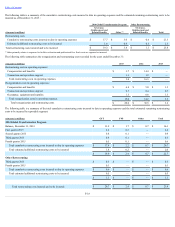

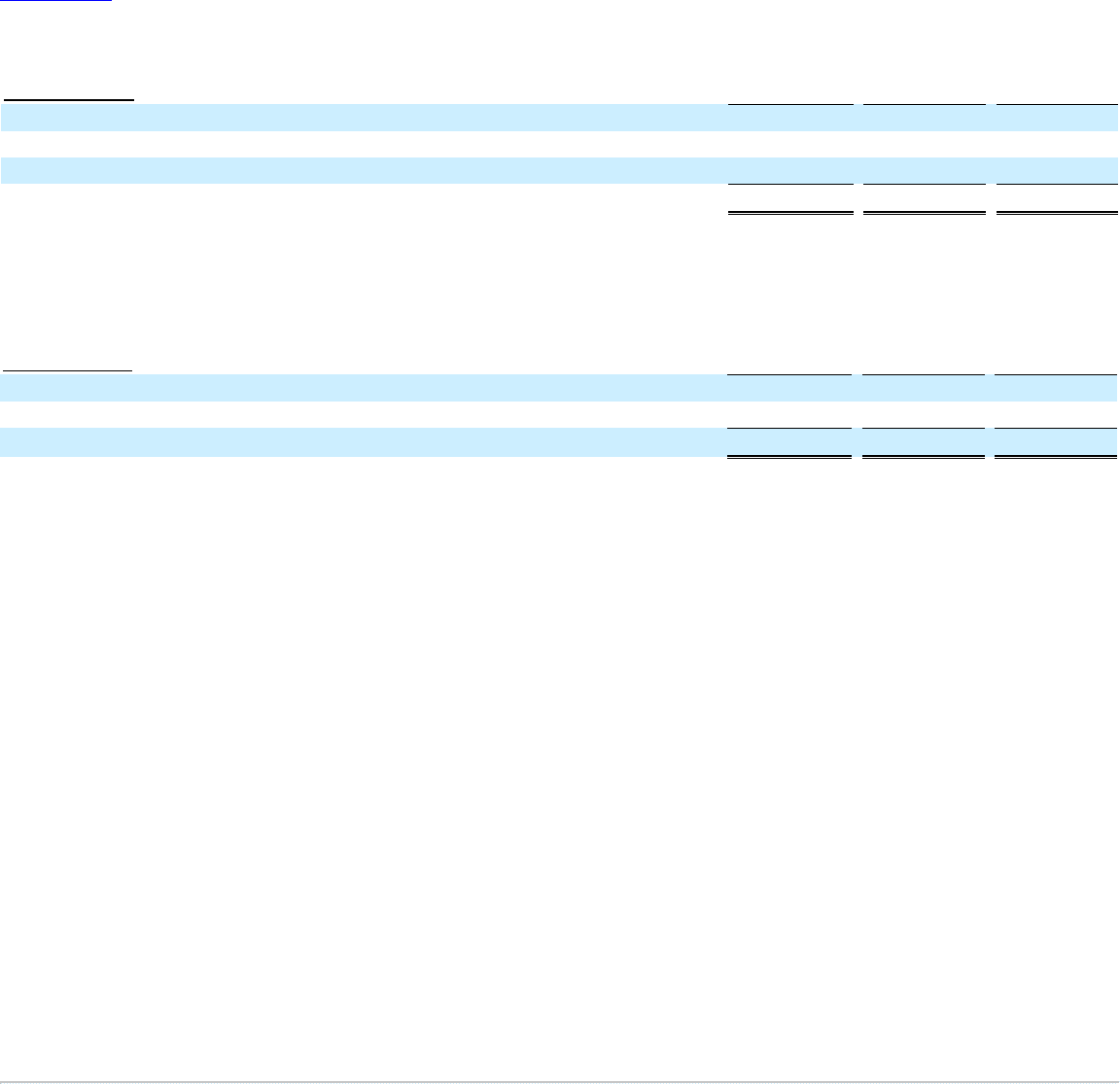

Potential common shares are excluded from the computation of diluted earnings per common share when the effect would be anti-dilutive. All potential common

shares are anti-dilutive in periods of net loss available to common stockholders. Stock options are anti-dilutive when the exercise price of these instruments is

greater than the average market price of the Company’s common stock for the period. The following table summarizes the weighted-average potential common

shares excluded from diluted (loss) income per common share as their effect would be anti-dilutive or their performance conditions are not met for the years ended

December 31 :

(Amounts in millions) 2015

2014

2013

Shares related to stock options 3.4

4.0

3.6

Shares related to restricted stock units 3.8

1.1

0.8

Shares excluded from the computation 7.2

5.1

4.4

Recent Accounting Pronouncements and Related Developments — In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting

Standards Update ("ASU") 2014-09, RevenuefromContractswithCustomers(Topic606) ("ASU 2014-09"). The new guidance sets forth a new five-step revenue

recognition model which replaces the prior revenue recognition guidance in its entirety and is intended to eliminate numerous industry-specific pieces of revenue

recognition guidance that have historically existed in GAAP. The underlying principle of the new standard is that a business or other organization will recognize

revenue to depict the transfer of promised goods or services to customers in an amount that reflects what it expects in exchange for the goods or services. The

standard also requires more detailed disclosures and provides additional guidance for transactions that were not addressed completely in the prior accounting

guidance. In August 2015, the FASB issued ASU 2015-14, RevenuefromContractswithCustomers(Topic606): DeferraloftheEffectiveDate. The amendment

in this ASU defers the effective date of ASU 2014-09 for all entities for one year. Public business entities should apply the guidance in ASU 2014-09 to annual

reporting periods beginning after December 15, 2017, including interim periods within those annual periods. Early adoption is permitted only as of annual

reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The Company is currently evaluating the

impact this standard will have on the consolidated financial statements.

In February 2015, the FASB issued ASU 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis, ("ASU 2015-02"). The new

consolidation standard amended the process that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. ASU

2015-02 is effective for the annual period ending after December 15, 2015, and for annual and interim periods thereafter. Early adoption is permitted. The adoption

of ASU 2015-02 will have no impact on our consolidated financial statements.

In April 2015, the FASB issued ASU 2015-03, Interest-ImputationofInterest(Subtopic835-30):SimplifyingthePresentationofDebtIssuance("ASU 2015-03"),

which changes the presentation of debt issuance costs in financial statements. Under ASU 2015-03, an entity presents such costs in the balance sheet as a direct

deduction from the related debt liability rather than as an asset. Amortization of the costs is reported as interest expense. The Company early adopted ASU 2015-03

on December 31, 2015 and the Consolidated Balance Sheet as of December 31, 2014 has been adjusted to apply the change in accounting principle retrospectively.

Debt issuance costs of $13.9 million previously reported as "Other assets" on the Consolidated Balance Sheet as of December 31, 2014 have been reclassified as a

direct deduction from the carrying amount of the related debt liability. There is no effect on our Consolidated Statement of Operations as a result of the change in

accounting principle.

In August 2015, the FASB issued ASU 2015-15, Interest-ImputedInterest(Subtopic835-30):PresentationandSubsequentMeasurementofDebtIssuanceCosts

AssociatedwithLine-of-CreditArrangements(“ASU 2015-15”), which clarifies that the guidance in ASU 2015-03 does not apply to line-of-credit arrangements.

ASU 2015-15 allows for an entity to defer and present debt issuance costs associated with line-of-credit arrangements as an asset and subsequently amortize the

debt issuance costs ratably over the term of the line-of-credit arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit

arrangement. The early adoption of ASU 2015-15 will have no impact on our consolidated financial statements.

F-16