MoneyGram 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

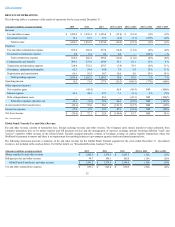

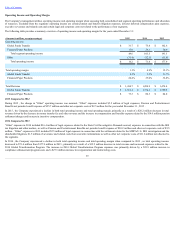

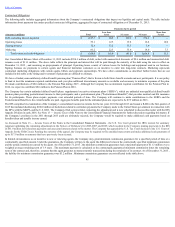

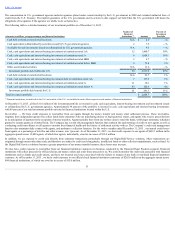

The following table is a reconciliation of our non-GAAP financial measures to the related GAAP financial measures for the years ended December 31:

(Amounts in millions)

2015

2014

2013

(Loss) income before income taxes

$ (29.1)

$ 72.6

$ 85.3

Interest expense

45.3

44.2

47.3

Depreciation and amortization

66.1

55.5

50.7

Amortization of agent signing bonuses

60.4

53.8

42.8

EBITDA

142.7

226.1

226.1

Significant items impacting EBITDA:

Stock-based and contingent performance compensation (1)

26.9

6.9

14.1

Compliance enhancement program

26.5

26.7

2.8

Reorganization and restructuring costs

20.0

30.5

3.2

Pension settlement charge (2)

13.8

—

—

Direct monitor costs

11.5

6.5

—

Legal and contingent matters (3)

1.7

16.4

2.5

Net securities gains

—

(45.4)

—

Losses related to agent closures

—

7.4

—

Capital transaction costs (4)

—

2.1

—

Debt extinguishment (5)

—

—

45.3

Severance and related costs

—

—

1.5

Adjusted EBITDA

$ 243.1

$ 277.2

$ 295.5

Adjusted EBITDA growth, as reported (12)%

Adjusted EBITDA growth, constant currency adjusted (10)%

Adjusted EBITDA

$ 243.1

$ 277.2

$ 295.5

Cash payments for interest

(42.1)

(41.1)

(43.9)

Cash taxes, net

(64.4)

(6.4)

(8.0)

Payments related to IRS tax matter

61.0

—

—

Cash payments for capital expenditures

(109.9)

(85.8)

(48.8)

Cash payments for agent signing bonuses

(87.3)

(93.9)

(45.0)

Adjusted Free Cash Flow

$ 0.4

$ 50.0

$ 149.8

(1) Stock-based compensation, contingent performance awards payable after three years and certain incentive compensation.

(2) Non-cash charge resulting from the partial buyout of the defined benefit pension plan.

(3) Fees and expenses related to certain legal and contingent matters.

(4) Professional and legal fees incurred for the April 2, 2014 equity transactions.

(5) Debt extinguishment costs in connection with the 2013 Credit Agreement and Note Repurchase.

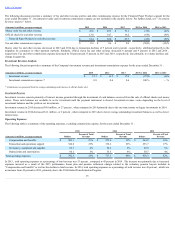

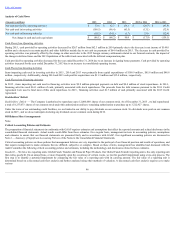

2015 Compared to 2014

The Company generated EBITDA of $142.7 million and $226.1 million for the years ended December 31, 2015 and 2014 , respectively. The decrease of $83.4

million was primarily due to the decrease in revenue mostly as a result of the strengthening of the U.S. dollar and an increase in compensation and benefits expense

of $34.1 million as a result of an increase in stock-based and contingent performance compensation and a $13.8 million pension settlement charge, which are listed

as EBITDA adjustments in the table above. In addition, we did not have net securities gains in 2015 as compared to $45.4 million in 2014.

In 2015 , Adjusted EBITDA decreased $34.1 million , or 12 percent , primarily due to the same factors impacting EBITDA offset by changes in the EBITDA

adjustments previously discussed.

For 2015 , Adjusted Free Cash Flow decreased $49.6 million or 99 percent . The decrease was a result of decline in Adjusted EBITDA and increased capital

expenditures, partially offset by decreased cash payments for agent signing bonuses.

41