MoneyGram 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

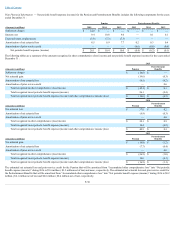

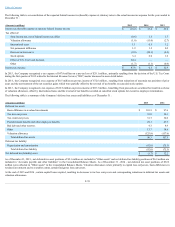

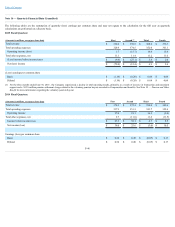

The following table is a summary of the Company’s restricted stock unit activity for the year ended December 31, 2015 :

Total

Shares

Weighted

Average

Price

Weighted-Average

Remaining

Contractual Term

Aggregate

Intrinsic Value

($000,000)

Restricted stock units outstanding at December 31, 2014 1,701,607

$ 15.77

1.4 years

$ 15.5

Granted 3,043,012

8.62

Vested and converted to shares (233,245)

17.63

Forfeited (348,806)

12.07

Restricted stock units outstanding at December 31, 2015 4,162,568

$ 10.68

1.0 year

$ 26.1

Restricted stock units vested and outstanding at December 31, 2015 256,388

$ 8.39

$ 1.6

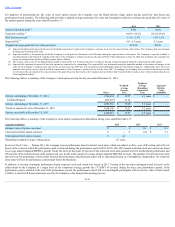

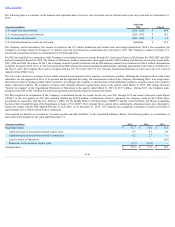

The following table is a summary of the Company's restricted stock and restricted stock unit compensation information for the years ended December 31 :

(Amounts in millions) 2015

2014

2013

Market value of restricted stock units vested during the year $ 6.3

$ 1.5

$ 0.8

Unrecognized restricted stock unit expense and the remaining weighted-average vesting period are presented under the Company’s current estimate of achievement

of performance goals. Unrecognized restricted stock unit expense, as of December 31, 2015 , under the minimum and maximum thresholds are $19.9 million and

$23.1 million , respectively.

Note 13 — Income Taxes

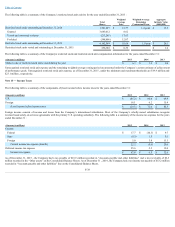

The following table is a summary of the components of (loss) income before income taxes for the years ended December 31 :

(Amounts in millions) 2015

2014

2013

U.S. $ (45.2)

$ 66.4

$ 69.9

Foreign 16.1

6.2

15.4

(Loss) income before income taxes $ (29.1)

$ 72.6

$ 85.3

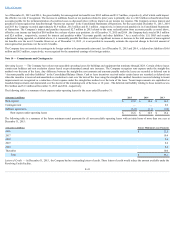

Foreign income consists of income and losses from the Company’s international subsidiaries. Most of the Company’s wholly-owned subsidiaries recognize

revenue based solely on services agreements with the primary U.S. operating subsidiary. The following table is a summary of the income tax expense for the years

ended December 31 :

(Amounts in millions) 2015

2014

2013

Current:

Federal $ 17.7

$ (10.3)

$ 9.7

State (0.5)

1.5

0.1

Foreign 5.0

3.8

11.1

Current income tax expense (benefit) 22.2

(5.0)

20.9

Deferred income tax expense 25.6

5.5

12.0

Income tax expense $ 47.8

$ 0.5

$ 32.9

As of December 31, 2015 , the Company had a tax payable of $16.9 million recorded in “Accounts payable and other liabilities” and a tax receivable of $6.3

million recorded in the “Other assets” on the Consolidated Balance Sheets. As of December 31 , 2014 , the Company had a net income tax payable of $53.2 million

recorded in “Accounts payable and other liabilities” line on the Consolidated Balance Sheets.

F-38