MoneyGram 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

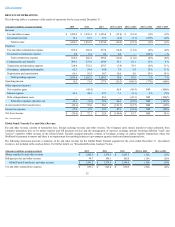

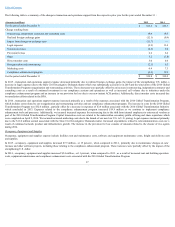

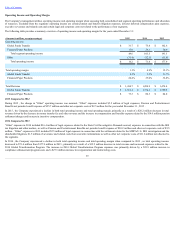

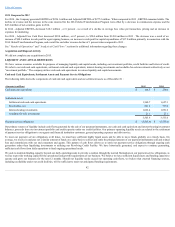

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Adjusted Free Cash Flow

We believe that EBITDA (earnings before interest, taxes, depreciation and amortization, including agent signing bonus amortization), Adjusted EBITDA

(EBITDA adjusted for certain significant items), Adjusted Free Cash Flow (Adjusted EBITDA less cash interest, cash taxes, cash payments for capital

expenditures and cash payments for agent signing bonuses) and constant currency measures (which assume that amounts denominated in foreign currencies are

translated to the U.S. dollar at rates consistent with those in the prior year) provide useful information to investors because they are indicators of the strength and

performance of our ongoing business operations. These calculations are commonly used as a basis for investors, analysts and other interested parties to evaluate

and compare the operating performance and value of companies within our industry. In addition, our debt agreements require compliance with financial measures

similar to Adjusted EBITDA. EBITDA, Adjusted EBITDA, Adjusted Free Cash Flow and constant currency are financial and performance measures used by

management in reviewing results of operations, forecasting, allocating resources and establishing employee incentive programs. We also present Adjusted

EBITDA, constant currency adjusted, which provides information to investors regarding MoneyGram's performance without the effect of foreign currency

exchange rate fluctuations year over year.

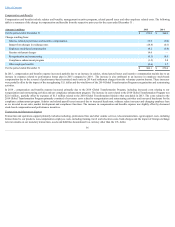

Although we believe that EBITDA, Adjusted EBITDA and Adjusted Free Cash Flow enhance investors' understanding of our business and performance, these

non-GAAP financial measures should not be considered in isolation or as substitutes for the accompanying GAAP financial measures. These metrics are not

necessarily comparable with similarly named metrics of other companies.

40