MoneyGram 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

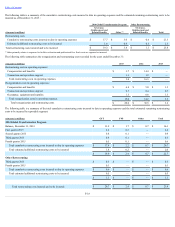

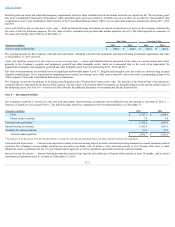

The Company did not complete any acquisitions in 2015 . In 2014 , the Company completed two acquisitions .As a result of the acquisitions, the Company

acquired agent contracts valued at $4.4 million , which are amortized over lives of six to eight years, acquired developed technology valued at $1.1 million , which

is amortized over lives ranging from five to seven years, and entered into non-compete agreements valued at $0.6 million , which are amortized over lives ranging

between three to five years.

Intangible asset amortization expense for 2015 , 2014 and 2013 was $2.7 million , $2.1 million and $0.7 million , respectively. The estimated future intangible

asset amortization expense is $2.6 million , $2.3 million , $1.7 million , $0.8 million and $0.7 million for 2016 , 2017 , 2018 , 2019 and 2020 , respectively.

Note 9 — Debt

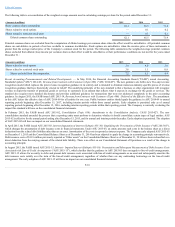

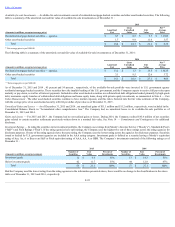

The following is a summary of the Company's outstanding debt as of December 31:

(Amounts in millions, except percentages)

Effective Interest

Rate

2015

2014

Senior secured credit facility due 2020 4.25%

$ 954.3

$ 964.1

Unamortized debt discount

(0.6)

(0.6)

Unamortized debt issuance costs

(11.1)

(13.9)

Total debt, net

$ 942.6

$ 949.6

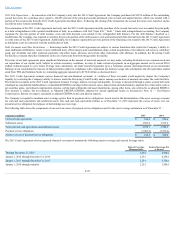

2013 Credit Agreement — On March 28, 2013, the Company, as borrower, entered into an Amended and Restated Credit Agreement (the "2013 Credit

Agreement") with Bank of America, N.A. ("BOA"), as administrative agent, the financial institutions party thereto as lenders and the other agents party thereto.

The 2013 Credit Agreement provides for (i) a senior secured five-year revolving credit facility up to an aggregate principal amount of $125.0 million (the

"Revolving Credit Facility") and (ii) a senior secured seven-year term loan facility of $850.0 million (the "Term Credit Facility"). The proceeds of the Term Credit

Facility were used to repay in full all outstanding indebtedness under the $540.0 million Credit Agreement, with BOA, as Administrative Agent, and the lenders

party thereto (the "2011 Credit Agreement"), to purchase all $325.0 million of the outstanding second lien notes held by Goldman, Sachs & Co. ("Goldman

Sachs"), to pay certain costs, fees and expenses relating to the 2013 Credit Agreement and for general corporate purposes. The Revolving Credit Facility includes a

sub-facility that permits the Company to request the issuance of letters of credit up to an aggregate amount of $50.0 million , with borrowings available for general

corporate purposes.

On April 2, 2014, the Company, as borrower, entered into a First Incremental Amendment and Joinder Agreement (the "Incremental Agreement") with BOA, as

administrative agent, and various lenders. The Incremental Agreement provided for (a) a tranche under the Term Credit Facility in an aggregate principal amount

of $130.0 million (the "Tranche B-1 Term Loan Facility") to be made available to the Company under the 2013 Credit Agreement, (b) an increase in the Revolving

Credit Facility under the 2013 Credit Agreement from $125.0 million to $150.0 million and (c) certain other amendments to the 2013 Credit Agreement including,

without limitation, (i) amendments to certain of the conditions precedent with respect to these incremental borrowings, (ii) an increase in the maximum secured

leverage ratio with which the Company is required to comply as of the last day of each fiscal quarter, and (iii) amendments to permit the Company to borrow up to

$300.0 million under the Term Credit Facility for share repurchases exclusively from affiliates of Thomas H. Lee Partners L.P. ("THL") and Goldman Sachs. The

Company borrowed $130.0 million under the Tranche B-1 Term Loan Facility on April 2, 2014, and the proceeds were used to fund a portion of the share

repurchases from THL reducing the remaining limit for such purchases to $170.0 million . See Note 11 — Stockholders'Deficitfor additional disclosure on the

share repurchases.

The 2013 Credit Agreement is secured by substantially all of the non-financial assets of the Company and its material domestic subsidiaries that guarantee the

payment and performance of the Company’s obligations under the 2013 Credit Agreement.

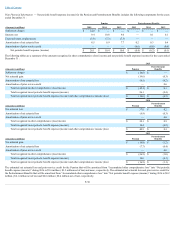

The Company may elect an interest rate under the 2013 Credit Agreement at each reset period based on the BOA prime bank rate or the Eurodollar rate. The

interest rate election may be made individually for the Term Credit Facility and each draw under the Revolving Credit Facility. The interest rate will be either the

“alternate base rate” (calculated in part based on the BOA prime rate) plus either 200 or 225 basis points (depending on the Company's secured leverage ratio or

total leverage ratio, as applicable, at such time) or the Eurodollar rate plus either 300 or 325 basis points (depending on the Company's secured leverage ratio or

total leverage ratio, as applicable, at such time). In connection with the initial funding under the 2013 Credit Agreement, the Company elected the Eurodollar rate

as its primary interest basis. Under the terms of the 2013 Credit Agreement, the minimum interest rate applicable to Eurodollar borrowings under the Term Credit

Facility is 100 basis points plus the applicable margins previously referred to in this paragraph.

Fees on the daily unused availability under the Revolving Credit Facility are 50 basis points. As of December 31, 2015 , the Company had no outstanding letters of

credit and no borrowings under the Revolving Credit Facility, leaving $150.0 million of availability thereunder.

F-25