MoneyGram 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The market for money transfer services remains very competitive, consisting of a small number of large competitors and a large number of small, niche

competitors, and we will continue to encounter competition from new technologies that allow consumers to send and receive money in a variety of ways. We

generally compete for money transfer consumers on the basis of trust, convenience, availability of outlets, price, technology and brand recognition.

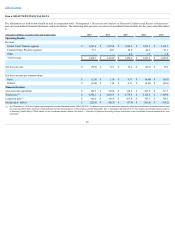

We are monitoring consumer behavior to ensure that we maintain growth. Pricing actions from our competitors may result in pricing changes for our products and

services. On April 17, 2014, Walmart announced the launch of the Walmart white label money transfer service, a program operated by a competitor of

MoneyGram, which allows consumers to transfer money between its U.S. store locations. This program limits consumers to transferring $900 per transaction. As a

result, the Company's Walmart U.S. to U.S. transactions declined 40 percent and 37 percent for the years ended December 31, 2015 and 2014 , respectively. In

addition, on October 31, 2014, we introduced lower prices for our money transfer product in the U.S. to U.S. market and, as a result, have seen improvements

including a reduction in the decline of transactions over $50 and an increase in average face value per transaction for the year ended December 31, 2015 .

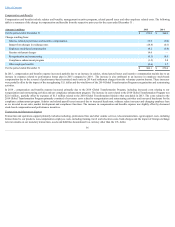

We continue to see a trend among state, federal and international regulators towards enhanced scrutiny of anti-money laundering compliance programs, as well as

consumer fraud prevention and education. Compliance with laws and regulations is a highly complex and integral part of our day-to-day operations, thus we have

continued to increase our compliance personnel headcount and make investments in our compliance-related technology and infrastructure. In the first quarter of

2013 , a compliance monitor was selected pursuant to a requirement of our settlement with the MDPA and U.S. DOJ. We have received three annual reports from

the compliance monitor, which have resulted in us continuing to make investments in various areas of our compliance systems and operations. We incurred $11.5

million and $6.5 million of expense directly related to the compliance monitor for the years ended December 31, 2015 and 2014 , respectively.

Anticipated Trends for 2016

This discussion of trends expected to impact our business in 2016 is based on information presently available and reflects certain assumptions, including

assumptions regarding future economic conditions. Differences in actual economic conditions during 2016 compared with our assumptions could have a material

impact on our results. See “ CautionaryStatements RegardingForward-Looking Statements ” and Part I, Item 1A, “ RiskFactors” of this Annual Report on

Form 10-K for additional factors that could cause results to differ materially from those contemplated by the following forward-looking statements.

Throughout 2015 , global economic conditions remained weak. We cannot predict the duration or extent of the severity of the current economic conditions, nor the

extent to which these conditions could negatively affect our business, operating results or financial condition. Also, the decrease in the price of oil could adversely

affect economic conditions and lead to reduced job opportunities in certain regions that constitute a significant portion of our total money transfer volume, which

could result in a decrease in our transaction volume. While the money remittance industry has generally been resilient during times of economic softness, the

current global economic conditions have continued to adversely impact the demand for money remittances.

We continue to review markets in which we may have an opportunity to increase prices based on increased brand awareness, loyalty and competitive positioning.

We are monitoring consumer behavior to ensure that we continue our market share growth. We continue to monitor the U.S. to U.S. corridor for pricing actions

from our competitors which may also result in pricing changes for our products and services. As a result of our agent expansion and retention efforts, commissions

expense may increase.

For our Financial Paper Products segment, we expect the decline in overall paper-based transactions to continue primarily due to continued migration by customers

to other payment methods. We also expect the underlying balances to remain stable or move commensurate with the transaction volume.

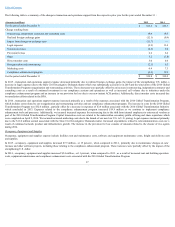

In February 2014, we announced the 2014 Global Transformation Program, which consists of three key components: reorganization and restructuring, compliance

enhancement and a focus on Digital/Self-Service revenue. Reorganization and restructuring activities related to the 2014 Global Transformation Program are

centered around facilities and headcount rationalization, system efficiencies and headcount right-shoring and outsourcing. The Company expects to complete these

activities in early 2016 . As a result of the reorganization and restructuring program, we estimate $25 million of annual pre-tax cost savings will be generated

exiting fiscal year 2015 .

We anticipate making investments of approximately $25.0 million related to the compliance enhancement program in 2016 , compared to $48.9 million and $49.0

million in 2015 and 2014 , respectively.

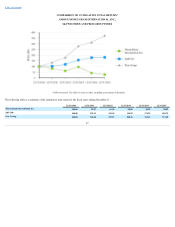

We believe that our investment in innovative products and services, particularly Digital/Self-Service solutions such as moneygram.com, mobile solutions, account

deposit and kiosk-based services, positions the Company to enhance revenue growth and diversify our product offerings. Digital/Self-Service solutions represented

12 percent of money transfer revenue for 2015 and we are anticipating it to reach 15 percent to 20 percent by the end of 2017. For the years ended December 31,

2015 , 2014 and 2013 , the Digital/Self-Service channel generated revenue of $150.1 million , $97.0 million and $71.6 million , respectively.

30