MoneyGram 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

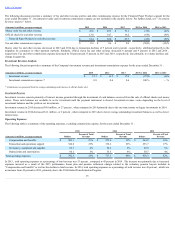

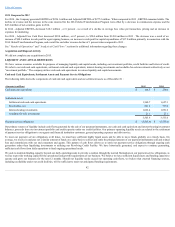

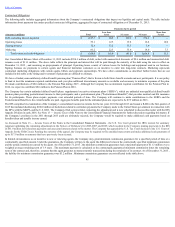

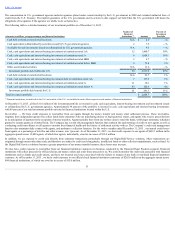

ContractualObligations

The following table includes aggregated information about the Company’s contractual obligations that impact our liquidity and capital needs. The table includes

information about payments due under specified contractual obligations, aggregated by type of contractual obligation as of December 31, 2015 :

Payments due by period

(Amounts in millions) Total

Less than

1 year

1-3 years

3-5 years

More than

5 years

Debt, including interest payments $ 1,125.3

$ 50.9

$ 100.3

$ 974.1

$ —

Operating leases 59.1

12.5

19.8

16.8

10.0

Signing bonuses 72.4

33.2

33.3

5.9

—

Marketing 81.2

22.3

33.6

18.0

7.3

Total contractual cash obligations $ 1,338.0

$ 118.9

$ 187.0

$ 1,014.8

$ 17.3

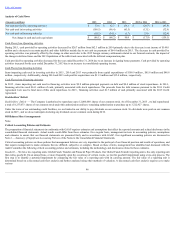

Our Consolidated Balance Sheet at December 31, 2015 includes $954.3 million of debt, netted with unamortized discounts of $0.6 million and unamortized debt

issuance costs of $11.1 million . The above table reflects the principal and interest that will be paid through the maturity of the debt using the rates in effect on

December 31, 2015 , and assuming no prepayments of principal. Operating leases consist of various leases for buildings and equipment used in our business.

Signing bonuses are payments to certain agents and financial institution customers as an incentive to enter into long-term contracts. Marketing represents

contractual marketing obligations with certain agents, billers and corporate sponsorships. We have other commitments as described further below that are not

included in this table as the timing and/or amount of payments are difficult to estimate.

We have a funded, noncontributory defined benefit pension plan ("Pension Plan") that is frozen to both future benefit accruals and new participants. It is our policy

to fund at least the minimum required contribution each year plus additional discretionary amounts as available and necessary to minimize expenses of the plan.

We made contributions of $8.0 million to the Pension Plan during 2015 . Although the Company has no minimum required contribution for the Pension Plan in

2016, we expect to contribute $8.0 million to the Pension Plan in 2016 .

The Company has certain unfunded defined benefit plans: supplemental executive retirement plans (“SERPs”), which are unfunded non-qualified defined benefit

pension plans providing postretirement income to their participants; and a postretirement plan ("Postretirement Benefits") that provides medical and life insurance

for its participants. These plans require payments over extended periods of time. The Company will continue to make contributions to the SERPs and the

Postretirement Benefits to the extent benefits are paid. Aggregate benefits paid for the unfunded plans are expected to be $7.9 million in 2016 .

The IRS completed its examination of the Company’s consolidated income tax returns for the tax years 2011 through 2013 and issued a RAR in the first quarter of

2015 that included disallowing $100.0 million of deductions related to restitution payments the Company made to the United States government in connection with

the DPA with the MDPA and the U.S. DOJ. The Company filed a protest letter contesting the adjustment and is now scheduled to discuss this matter with the IRS

Appeals Division in early 2016. See Note 13 — IncomeTaxesof the Notes to the Consolidated Financial Statements for further discussion regarding this matter. If

the Company’s positions in the 2011 through 2013 audit are ultimately rejected, the Company would be required to make additional cash payments based on

benefits taken and taxable income earned.

As discussed in Note 13 — Income Taxes of the Notes to the Consolidated Financial Statements , the U.S. Tax Court granted the IRS's motion for summary

judgment upholding the remaining adjustments in the Notices of Deficiency for 2005-2007 and 2009, which resulted in the Company making payments to the IRS

of $61.0 million for federal tax payments and associated interest related to the matter. The Company has appealed the U.S. Tax Court decision to the U.S. Court of

Appeals for the Fifth Circuit. Pending the outcome of the appeal, the Company may be required to file amended state returns and make additional cash payments of

up to $17.0 million on amounts that have previously been accrued.

In limited circumstances as an incentive to new or renewing agents, the Company may grant minimum commission guarantees for a specified period of time at a

contractually specified amount. Under the guarantees, the Company will pay to the agent the difference between the contractually specified minimum commission

and the actual commissions earned by the agent. As of December 31, 2015 , the minimum commission guarantees had a maximum payment of $11.3 million over a

weighted average remaining term of 1.9 years . The maximum payment is calculated as the contractually guaranteed minimum commission times the remaining

term of the contract and, therefore, assumes that the agent generates no money transfer transactions during the remainder of its contract. As of December 31, 2015 ,

the liability for minimum commission guarantees was $3.2 million . Minimum commission guarantees are not reflected in the table above.

45