MoneyGram 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES

Our common stock is traded on the NASDAQ Stock Market LLC under the symbol “MGI.” As of March 1, 2016 , there were 8,643 stockholders of record of our

common stock.

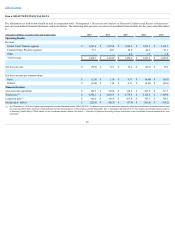

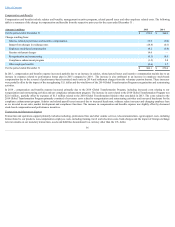

The high and low sales prices for our common stock for the periods presented were as follows for the respective periods:

2015

2014

Fiscal Quarter High

Low

High

Low

First $ 9.58

$ 7.55

$ 20.35

$ 17.02

Second $ 11.00

$ 7.74

$ 18.60

$ 12.61

Third $ 10.66

$ 7.75

$ 14.94

$ 12.54

Fourth $ 10.92

$ 6.21

$ 12.93

$ 8.15

The Board of Directors has authorized the repurchase of a total of 12,000,000 common shares, as announced in our press releases issued on November 18, 2004,

August 18, 2005 and May 9, 2007. The repurchase authorization is effective until such time as the Company has repurchased 12,000,000 common shares. The

Company may consider repurchasing shares which would be subject to limitations in our debt agreements. Common stock tendered to the Company in connection

with the exercise of stock options or vesting of restricted stock is not considered repurchased shares under the terms of the repurchase authorization. As of

December 31, 2015 , the Company had repurchased 8,277,073 common shares under the terms of the repurchase authorization and has remaining authorization to

repurchase up to 3,722,927 shares. During the three months ended December 31, 2015 , the Company did not repurchase any common shares.

On April 2, 2014, the Company repurchased 8,185,092 common shares from THL at a price of $16.25 per share. These repurchases are separate from, and do not

affect, the Company's repurchase program described above.

The terms of our debt agreements place significant limitations on the amount of restricted payments we may make, including dividends on our common stock and

repurchases of our capital stock. Subject to certain customary conditions, we may (i) make restricted payments in an aggregate amount not to exceed $50.0 million

(without regard to a pro forma leverage ratio calculation), (ii) make restricted payments up to a formulaic amount determined based on incremental build-up of our

consolidated net income in future periods (subject to compliance with maximum pro forma leverage ratio calculation) and (iii) repurchase capital stock from THL

and Goldman Sachs in a remaining aggregate amount up to $170.0 million . As a result, our ability to declare or pay dividends or distributions to the stockholders

of the Company’s common stock is materially limited at this time. No dividends were paid on our common stock in 2015 or 2014 . See Note 11 — Stockholders’

Deficitof the Notes to the Consolidated Financial Statements for additional disclosure.

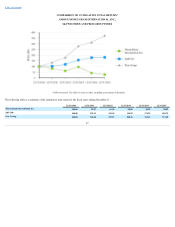

STOCKHOLDER RETURN PERFORMANCE

The Company's peer group consists of companies that are in the money remittance and payment industries, along with companies that effectively capture our

competitive landscape given the products and services that we provide. Our peer group is comprised of the following companies: Euronet Worldwide Inc., Fiserv,

Inc., Global Payments Inc., Green Dot Corporation, Heartland Payment Systems, Inc., Higher One Holdings, Inc., MasterCard, Inc., Total System Services, Inc.,

Visa, Inc. and The Western Union Company. In 2015 , Xoom Corporation was removed from the Company’s peer group due its acquisition by PayPal Holdings,

Inc.

The following graph compares the cumulative total return from December 31, 2010 to December 31, 2015 for our common stock, our peer group index of payment

services companies and the S&P 500 Index. The graph assumes the investment of $100 in each of our common stock, our peer group and the S&P 500 Index on

December 31, 2010 , and the reinvestment of all dividends as and when distributed. The graph is furnished and shall not be deemed “filed” with the SEC or subject

to Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is not to be incorporated by reference into any filing of the Company,

whether made before or after the date hereof, regardless of any general incorporation language in such filing.

26