MoneyGram 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• our ability to retain partners to operate our official check and money order businesses;

• our ability to adequately protect our brand and intellectual property rights and to avoid infringing on the rights of others;

•our ability to attract and retain key employees;

• our ability to manage risks related to the operation of retail locations and the acquisition or start-up of businesses;

• any restructuring actions and cost reduction initiatives that we undertake may not deliver the expected results and these actions may adversely affect our

business;

•our ability to maintain effective internal controls;

• our capital structure and the special voting rights provided to designees of THL on our Board of Directors; and

• the risks and uncertainties described in the “ RiskFactors” and “ Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations”

sections of this Annual Report on Form 10-K, as well as any additional risk factors that may be described in our other filings with the SEC from time to time.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Enterprise Risk Management

Risk is an inherent part of any business. Our most prominent risk exposures are credit, interest rate and foreign currency exchange. See Part 1, Item 1A “ Risk

Factors” of this Annual Report on Form 10-K for a description of the principal risks to our business. Appropriately managing risk is important to the success of

our business, and the extent to which we effectively manage each of the various types of risk is critical to our financial condition and profitability. Our risk

management objective is to monitor and control risk exposures to produce steady earnings growth and long-term economic value.

Management implements policies approved by our Board of Directors that cover our investment, capital, credit and foreign currency practices and strategies. The

Board receives periodic reports regarding each of these areas and approves significant changes to policy and strategy. The Asset/Liability Committee composed of

senior management, routinely reviews investment and risk management strategies and results. The Credit Committee, composed of senior management, routinely

reviews credit exposure to our agents.

The following is a discussion of the risks we have deemed most critical to our business and the strategies we use to manage and mitigate such risks. While

containing forward-looking statements related to risks and uncertainties, this discussion and related analyses are not predictions of future events. Our actual results

could differ materially from those anticipated due to various factors discussed under “ CautionaryStatementsRegardingForward-LookingStatements” and under

“ RiskFactors” in Part 1, Item 1A of this Annual Report on Form 10-K.

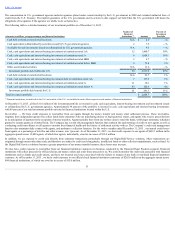

Credit Risk

Credit risk, or the potential risk that we may not collect amounts owed to us, affects our business primarily through receivables, investments and derivative

financial instruments. In addition, the concentration of our cash, cash equivalents and investments at large financial institutions exposes us to credit risk.

InvestmentPortfolio — Credit risk from our investment portfolio relates to the risk that we may be unable to collect the interest or principal owed to us under the

legal terms of the various securities. Our primary exposure to credit risk arises through the concentration of a large amount of our investment portfolio at a few

large banks, also referred to as financial institution risk, as well as a concentration in securities issued by, or collateralized by, U.S. government agencies.

At December 31, 2015 , the Company’s investment portfolio of $2.8 billion was primarily comprised of cash and cash equivalents consisting of interest-bearing

deposit accounts, non-interest bearing transaction accounts and U.S. government money market securities and interest-bearing investments consisting of time

deposits and certificates of deposit. Based on investment policy restrictions, investments are limited to those rated A- or better by two of the following three rating

agencies: Moody's, S&P and Fitch. If the rating agencies have split ratings, the Company uses the highest two out of three ratings across the agencies for disclosure

purposes. If none of the three rating agencies have the same rating, the Company uses the lowest rating across the agencies for disclosure purposes. No maturity of

interest-bearing investments exceeds 24 months from the date of purchase.

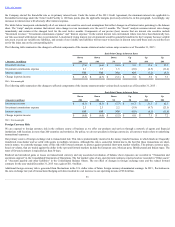

The financial institutions holding significant portions of our investment portfolio may act as custodians for our asset accounts, serve as counterparties to our

foreign currency transactions and conduct cash transfers on our behalf for the purpose of clearing our payment instruments and related agent receivables and agent

payables. Through certain check clearing agreements and other contracts, we are required to utilize several of these financial institutions.

50