MoneyGram 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

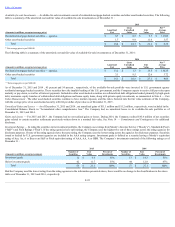

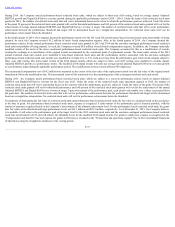

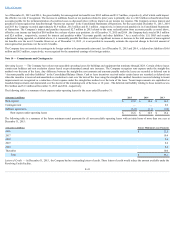

The following table summarizes the benefit obligation and accumulated benefit obligation for the Pension Plan, SERPs and Postretirement Benefits fair value of

plan assets as of December 31 :

Pension Plan

SERPs

Postretirement Benefits

(Amounts in millions) 2015

2014

2015

2014

2015

2014

Benefit obligation $ 132.5

$ 183.5

$ 70.7

$ 82.5

$ 1.0

$ 1.3

Accumulated benefit obligation 132.5

183.5

70.4

79.4

—

—

Fair value of plan assets 107.9

141.6

—

—

—

—

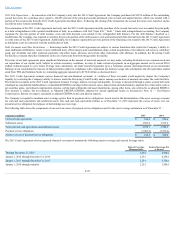

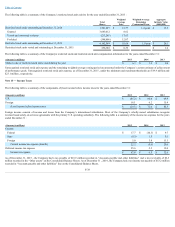

The following table summarizes the estimated future benefit payments for the Pension and Postretirement Benefits for the years ended December 31 :

(Amounts in millions) 2016

2017

2018

2019

2020

2021-2025

Pension $ 17.6

$ 15.2

$ 16.1

$ 14.8

$ 14.6

$ 67.4

Postretirement Benefits 0.1

0.1

0.1

0.1

0.1

0.3

Although the Company has no minimum required contribution for the Pension Plan in 2016 , we expect to contribute $8.0 million to the Pension Plan in 2016 . The

Company will continue to make contributions to the SERPs and the Postretirement Benefits to the extent benefits are paid. Aggregate benefits paid for the

unfunded plans are expected to be $7.9 million in 2016 .

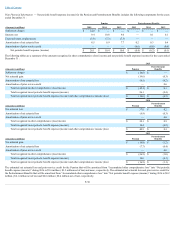

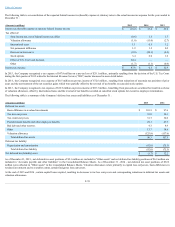

EmployeeSavingsPlan — The Company has an employee savings plan that qualifies under Section 401(k) of the Internal Revenue Code of 1986, as amended.

Contributions to, and costs of, the 401(k) defined contribution plan totaled $4.4 million , $4.1 million and $4.1 million in 2015 , 2014 and 2013 , respectively.

InternationalBenefitPlans— The Company’s international subsidiaries have certain defined contribution benefit plans. Contributions to, and costs related to,

international plans were $1.7 million , $2.4 million and $1.9 million for 2015 , 2014 and 2013 , respectively.

DeferredCompensationPlans — During 2015 the Company dissolved the rabbi trusts associated with the deferred compensation plan. At December 31 , 2015

and 2014 , the Company had a liability related to the deferred compensation plans of $0.2 million and $2.0 million , respectively, recorded in the “Accounts

payable and other liabilities” line in the Consolidated Balance Sheets. The rabbi trust had no market value at December 31 , 2015 and $10.0 million at December

31 , 2014 , recorded in “Other assets” in the Consolidated Balance Sheets. The Company made payments relating to the deferred compensation plans totaling $1.9

million and $0.4 million in 2015 and 2014 , respectively.

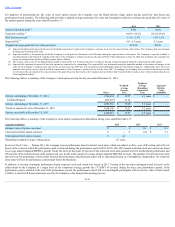

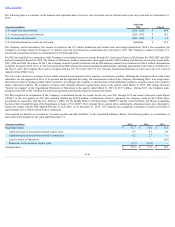

Note 11 — Stockholders' Deficit

CommonStock — The Company’s Amended and Restated Certificate of Incorporation, as amended, provides for the issuance of up to 162,500,000 shares of

common stock with a par value of $0.01 . The holders of MoneyGram common stock are entitled to one vote per share on all matters to be voted upon by its

stockholders. The holders of common stock have no preemptive, conversion or other subscription rights. There are no redemption or sinking fund provisions

applicable to the common stock. The determination to pay dividends on common stock will be at the discretion of the Board of Directors and will depend on

applicable laws and the Company’s financial condition, results of operations, cash requirements, prospects and such other factors as the Board of Directors may

deem relevant. The Company’s ability to declare or pay dividends or distributions to the holders of the Company’s common stock is restricted under the

Company’s 2013 Credit Agreement. No dividends were paid in 2015 , 2014 or 2013 .

PreferredStock — The Company’s Amended and Restated Certificate of Incorporation provides for the issuance of up to 7,000,000 shares of preferred stock that

may be issued in one or more series, with each series to have certain rights and preferences as shall be determined in the unlimited discretion of the Company’s

Board of Directors, including, without limitation, voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences.

SeriesDParticipatingConvertiblePreferredStock— In 2011, the Company issued 173,189 shares of D Stock to Goldman Sachs. Each share of D Stock has a

liquidation preference of $0.01 and is convertible into 125 shares of common stock by a stockholder other than Goldman Sachs which receives such shares by

means of (i) a widespread public distribution, (ii) a transfer to an underwriter for the purpose of conducting a widespread public distribution, (iii) a transfer in

which no transferee (or group of associated transferees) would receive 2 percent or more of any class of voting securities of the Company, or (iv) a transfer to a

transferee that would control more than 50 percent of the voting securities of the Company without any transfer from such transferor or its affiliates as applicable

(each of (i) — (iv), a “Widely Dispersed Offering”). The D Stock is non-voting while held by Goldman Sachs or any holder which receives such shares by any

means other than a Widely Dispersed Offering (a “non-voting holder”). Holders of D Stock other than Goldman Sachs and non-voting holders vote as a single class

with the holders of the common stock on an as-converted basis. The D Stock also participates in any dividends declared on the common stock on an as-converted

basis.

F-32