MoneyGram 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

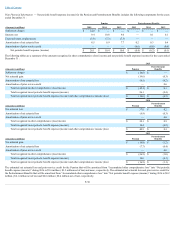

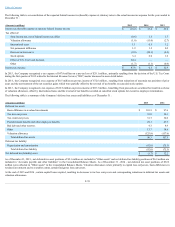

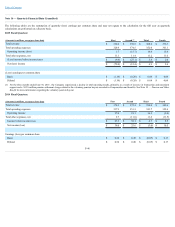

The following table is a summary of the amounts and expiration dates of tax loss carry-forwards (not tax effected) and credit carry-forwards as of December 31,

2015 :

(Amounts in millions)

Expiration

Date

Amount

U.S. capital loss carry-forwards 2016 - 2020

$ 58.8

U.S. net operating loss carry-forwards 2020 - 2035

$ 18.2

U.S. tax credit carry-forwards 2023 - 2035

$ 9.9

U.S. federal minimum tax credit carry-forwards Indefinite

$ 21.8

The Company, and its subsidiaries, file income tax returns in the U.S. federal jurisdiction and various states and foreign jurisdictions. With a few exceptions, the

Company is no longer subject to foreign or U.S. federal, state and local income tax examinations for years prior to 2011. The Company is subject to foreign, U.S.

federal and certain state income tax examinations for 2011 through 2014.

The IRS has completed its examination of the Company’s consolidated income tax returns through 2013 and issued Notices of Deficiency for 2005-2007 and 2009

and an Examination Report for 2008. The Notices of Deficiency disallow among other items approximately $900.0 million of deductions on securities losses in the

2007, 2008 and 2009 tax returns. In 2013, the Company reached a partial settlement with the IRS allowing ordinary loss treatment on $186.9 million of deductions

in dispute. In January 2015, the U.S. Tax Court granted the IRS's motion for summary judgment upholding the remaining adjustments in the Notices of Deficiency.

On July 27, 2015, the Company filed a notice of appeal with the U.S. Tax Court. The U.S. Tax Court has transferred jurisdiction over the case to the U.S. Court of

Appeals for the Fifth Circuit.

The Tax Court's decision is a change in facts which warranted reassessment of the Company's uncertain tax position. Although the Company believes that it has

substantive tax law arguments in favor of its position and has appealed the ruling, the reassessment resulted in the Company determining that it is no longer more

likely than not that its existing position will be sustained. Accordingly, the Company re-characterized certain deductions relating to securities losses to be capital in

nature, rather than ordinary. The Company recorded a full valuation allowance against these losses in the quarter ended March 31, 2015. This change increased

"Income tax expense" in the Consolidated Statements of Operations in the quarter ended March 31, 2015 by $63.7 million . During 2015 , the Company made

payments to the IRS of $61.0 million for federal tax payments and associated interest related to the matter.

The IRS completed its examination of the Company’s consolidated income tax returns for the tax years 2011 through 2013 and issued a Revenue Agent Report

(“RAR”) in the first quarter of 2015 that included disallowing $100.0 million of deductions related to payments the Company made to the United States

government in connection with the U.S. Attorney’s Office for the Middle District of Pennsylvania ("MDPA") and the Asset Forfeiture and Money Laundering

Section of the Criminal Division of the Department of Justice ("U.S. DOJ"). The Company filed a protest letter contesting the adjustment and is now scheduled to

discuss this matter with the IRS Appeals Division in early 2016. As of December 31, 2015 , the Company has recognized a cumulative income tax benefit of

approximately $23.3 million related to these deductions.

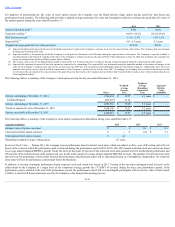

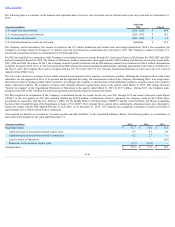

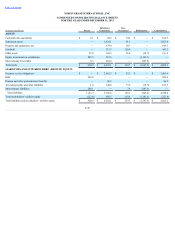

Unrecognized tax benefits are recorded in “Accounts payable and other liabilities” in the Consolidated Balance Sheets. The following table is a reconciliation of

unrecognized tax benefits for the years ended December 31 :

(Amounts in millions) 2015

2014

2013

Beginning balance $ 31.7

$ 52.0

$ 51.6

Additions based on tax positions related to prior years 8.3

0.3

0.9

Additions based on tax positions related to current year 0.2

2.7

—

Lapse in statute of limitations —

—

(0.5)

Reductions for tax positions of prior years (9.7)

(23.3)

—

Ending balance $ 30.5

$ 31.7

$ 52.0

F-40