MoneyGram 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company’s licensed entity, MoneyGram Payment Systems, Inc. (“MPSI”), is regulated by various U.S. state agencies that generally require the Company to

maintain a pool of assets with an investment rating of A or higher (“permissible investments”) in an amount equal to the payment service obligations, as defined by

each state, for those regulated payment instruments, namely teller checks, agent checks, money orders and money transfers. The regulatory payment service assets

measure varies by state, but in all cases excludes investments rated below A-. The most restrictive states may also exclude assets held at banks that do not belong to

a national insurance program, varying amounts of accounts receivable balances and/or assets held in one of the SPEs. The regulatory payment service obligations

measure varies by state, but in all cases is substantially lower than the Company’s payment service obligations as disclosed in the Consolidated Balance Sheets as

the Company is not regulated by state agencies for payment service obligations resulting from outstanding cashier’s checks or for amounts payable to agents and

brokers.

Our primary overseas operating subsidiary, MoneyGram International Ltd., is a licensed payment institution in the United Kingdom, enabling us to offer our

money transfer service in the European Economic Area. We are also subject to licensing or other regulatory requirements in various other jurisdictions. Licensing

requirements may include minimum net worth, provision of surety bonds or letters of credit, compliance with operational procedures, agent oversight and the

maintenance of settlement assets in an amount equivalent to outstanding payment service obligations, as defined by our various regulators.

The regulatory and contractual requirements do not require the Company to specify individual assets held to meet its payment service obligations, nor is the

Company required to deposit specific assets into a trust, escrow or other special account. Rather, the Company must maintain a pool of liquid assets sufficient to

comply with the requirements. No third party places limitations, legal or otherwise, on the Company regarding the use of its individual liquid assets. The Company

is able to withdraw, deposit or sell its individual liquid assets at will, with no prior notice or penalty, provided the Company maintains a total pool of liquid assets

sufficient to meet the regulatory and contractual requirements. Regulatory requirements also require MPSI to maintain positive net worth, with certain states

requiring that MPSI maintain positive tangible net worth. The Company was in compliance with its contractual and financial regulatory requirements as of

December 31, 2015 .

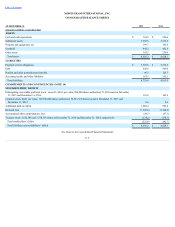

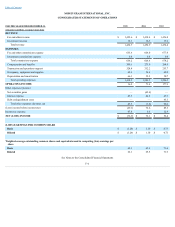

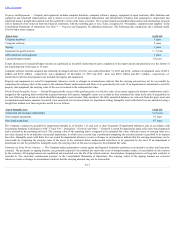

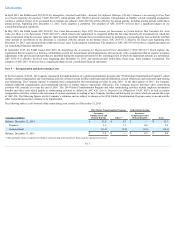

The following table summarizes the amount of Settlement assets and Payment service obligations as of December 31 :

(Amounts in millions) 2015

2014

Settlement assets:

Settlement cash and cash equivalents $ 1,560.7

$ 1,657.3

Receivables, net 861.4

757.6

Interest-bearing investments 1,062.4

1,091.6

Available-for-sale investments 21.1

27.1

3,505.6

3,533.6

Payment service obligations $ (3,505.6)

$ (3,533.6)

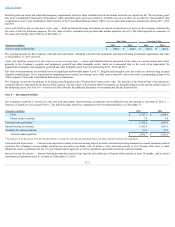

Receivables,net (includedinsettlementassets) — The Company has receivables due from financial institutions and agents for payment instruments sold and

amounts advanced by the Company to certain agents for operational and local regulatory purposes. These receivables are outstanding from the day of the sale of

the payment instrument until the financial institution or agent remits the funds to the Company. The Company provides an allowance for the portion of the

receivable estimated to become uncollectible based on its history of collection experience, known collection issues, such as agent suspensions and bankruptcies,

consumer credit card chargebacks and insufficient funds and other matters the Company identifies in its routine collection monitoring. Receivables are generally

considered past due one day after the contractual remittance schedule, which is typically one to three days after the sale of the underlying payment instrument.

Receivables are generally written off against the allowance one year after becoming past due.

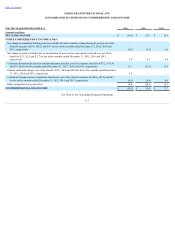

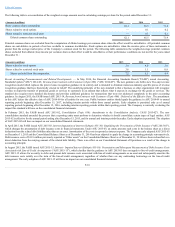

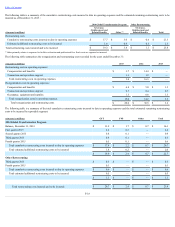

The following summary details the activity within the allowance for credit losses for the years ended December 31 :

(Amounts in millions) 2015

2014

2013

Beginning balance $ 10.7

$ 10.7

$ 11.7

Provision 20.4

11.1

9.6

Write-offs, net of recoveries (21.9)

(11.1)

(10.6)

Ending balance $ 9.2

$ 10.7

$ 10.7

F-11