MoneyGram 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

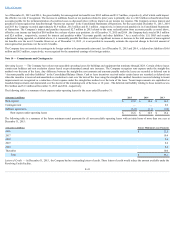

TreasuryStock — The Board of Directors has authorized the repurchase of a total of 12,000,000 shares. As of December 31, 2015 , the Company has repurchased

8,277,073 shares of common stock under this authorization and has remaining authorization to repurchase up to 3,722,927 shares.

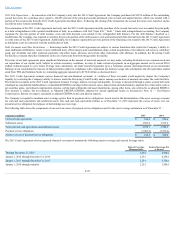

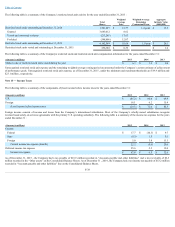

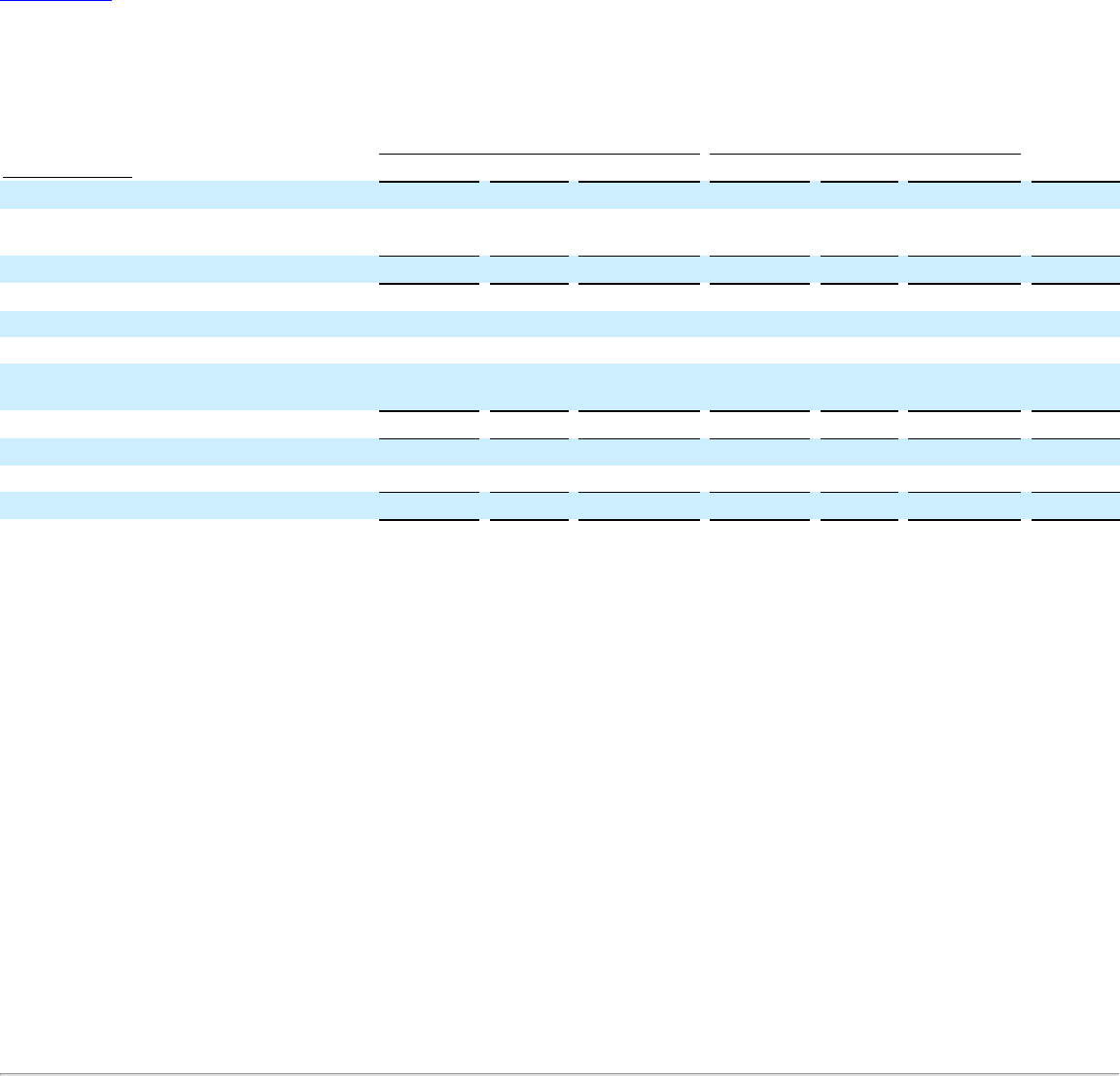

The following table is a summary of the Company’s authorized, issued and outstanding stock as of December 31 :

D Stock

Common Stock

Treasury

Stock(Shares in thousands) Authorized

Issued

Outstanding

Authorized

Issued

Outstanding

December 31, 2012 200

109

109

162,500

62,264

57,857

(4,407)

Stock options exercised and release of restricted

stock units —

—

—

—

—

106

106

December 31, 2013 200

109

109

162,500

62,264

57,963

(4,301)

Conversion of Series D convertible shares —

(38)

(38)

—

4,745

4,745

—

Repurchase and retirement of shares —

—

—

—

(8,185)

(8,185)

—

Stock repurchase —

—

—

—

—

(1,514)

(1,514)

Stock options exercised and release of restricted

stock units —

—

—

—

—

81

81

December 31, 2014 200

71

71

162,500

58,824

53,090

(5,734)

Stock repurchase —

—

—

—

—

(49)

(49)

Release of restricted stock units —

—

—

—

—

171

171

December 31, 2015 200

71

71

162,500

58,824

53,212

(5,612)

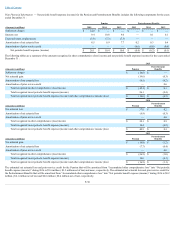

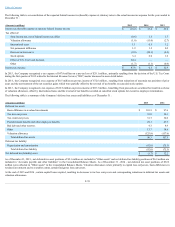

Participation Agreement between the Investors and Wal-Mart Stores, Inc. — THL and Goldman Sachs (collectively, the "Investors") have a Participation

Agreement with Wal-Mart Stores, Inc. (“Walmart”), under which the Investors are obligated to pay Walmart certain percentages of any accumulated cash

payments received by the Investors in excess of the Investors’ original investment in the Company. While the Company is not a party to, and has no obligations to

Walmart or additional obligations to the Investors under, the Participation Agreement, the Company must recognize the Participation Agreement in its consolidated

financial statements as the Company indirectly benefits from the agreement. Any future payments by the Investors to Walmart may result in an expense that could

be material to the Company’s financial position or results of operations, but would have no impact on the Company’s cash flows. As liquidity events are dependent

on many external factors and uncertainties, the Company does not consider a liquidity event to be probable at this time for any Investors, and has not recognized

any further liability or expense related to the Participation Agreement.

As a result of the transactions occurring on April 2, 2014 described below, the Investors made a payment of approximately $0.6 million to Walmart under the

Participation Agreement and the Company recognized expense and a corresponding increase to additional paid-in capital for the year ended December 31, 2014 .

There were no payments under the Participation Agreement for the years ended December 31, 2015 and 2013 .

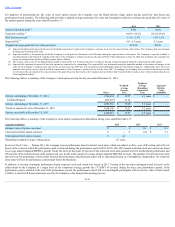

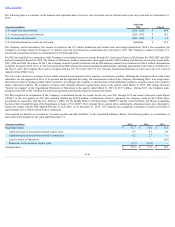

Equity Registration Rights Agreement — In connection with our recapitalization in 2008, the Company and the Investors entered into a Registration Rights

Agreement (the “Equity Registration Rights Agreement”) on March 25, 2008, as amended on May 18, 2011, with respect to the Series B Stock Participating

Convertible Preferred Stock of the Company, the Series B-1 Participating Convertible Preferred Stock of the Company, D Stock and common stock owned by the

Investors and their affiliates (collectively, the “Registrable Securities”). Under the terms of the Equity Registration Rights Agreement, the Company is required,

after a specified holding period, to use the Company's reasonable best efforts to promptly file with the Securities and Exchange Commission (the “SEC”) a shelf

registration statement relating to the offer and sale of the Registrable Securities. The Company is obligated to keep such shelf registration statement continuously

effective under the Securities Act of 1933, as amended (the “Securities Act”), until the earlier of (1) the date as of which all of the Registrable Securities have been

sold, (2) the date as of which each of the holders of the Registrable Securities is permitted to sell its Registrable Securities without registration pursuant to

Rule 144 under the Securities Act and (3) fifteen years . The holders of the Registrable Securities are also entitled to six demand registrations and unlimited

piggyback registrations during the term of the Equity Registration Rights Agreement. The Company has filed a shelf registration statement on Form S-3 with the

SEC that permits the offer and sale of the Registrable Securities, as required by the terms of the Equity Registration Rights Agreement. The registration statement

also permits the Company to offer and sell up to $500 million of its common stock, preferred stock, debt securities or any combination of these, from time to time,

subject to market conditions and the Company’s capital needs.

F-33