MoneyGram 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

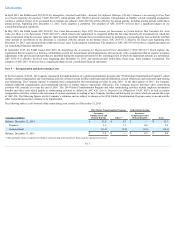

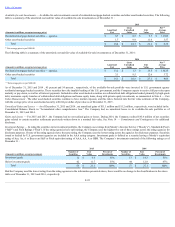

Fee and Other Commissions Expense — The Company incurs fee commissions primarily related to our Global Funds Transfer products. In a money transfer

transaction, both the agent initiating the transaction and the receiving agent earn a commission that is generally based on a percentage of the fee charged to the

consumer. In a bill payment transaction, the agent initiating the transaction receives a commission that is generally based on a percentage of the fee charged to the

consumer and, in limited circumstances, the biller receives a commission that is based on a percentage of the fee charged to the consumer. The Company generally

does not pay commissions to agents on the sale of money orders, except, in certain limited circumstances, for large agents where we may pay a fixed commission

based on total money order transactions. Other commissions expense includes the amortization of capitalized agent signing bonus payments.

InvestmentCommissionsExpense — Investment commissions expense consists of amounts paid to financial institution customers based on short-term interest rate

indices times the average outstanding cash balances of official checks sold by the financial institution. Investment commissions are recognized each month based

on the average outstanding balances of each financial institution customer and their contractual variable rate for that month.

MarketingandAdvertisingExpense — Marketing and advertising costs are expensed as incurred or at the time the advertising first takes place and are recorded in

the “Transaction and operations support” line in the Consolidated Statements of Operations. Marketing and advertising expense was $59.4 million , $64.7 million

and $57.4 million for 2015 , 2014 and 2013 , respectively.

Stock-BasedCompensation — Stock-based compensation awards are measured at fair value at the date of grant and expensed over their vesting or service periods.

The expense, net of estimated forfeitures, is recognized using the straight-line method. The Company accounts for modifications to its share-based payment awards

in accordance with the provisions of ASC Topic 718, " Compensation-StockCompensation."Incremental compensation cost is measured as the excess, if any, of

the fair value of the modified award over the fair value of the original award immediately before its terms are modified, measured based on the share price and

other pertinent factors at that date, and is recognized as compensation cost on the date of modification (for vested awards) or over the remaining vesting or service

period (for unvested awards). Any unrecognized compensation cost remaining from the original award is recognized over the vesting period of the modified award.

See Note 12 — Stock-BasedCompensationfor additional disclosure of the Company’s stock-based compensation.

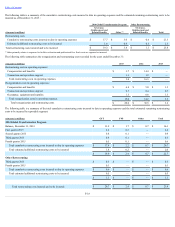

ReorganizationandRestructuringExpenses—Reorganization and restructuring expenses consist of direct and incremental costs associated with reorganization,

restructuring and related activities, including technology; process improvement efforts; independent consulting and contractors; severance; outplacement and other

employee related benefits; facility closures, cease-use or related charges; asset impairments or accelerated depreciation and other expenses related to relocation of

various operations to existing or new Company facilities and third-party providers, including hiring, training, relocation, travel and professional fees. The

Company records severance-related expenses once they are both probable and estimable related to severance provided under an on-going benefit arrangement.

One-time, involuntary benefit arrangements and other exit costs are recognized when the liability is incurred. The Company evaluates impairment issues associated

with reorganization activities when the carrying amount of the assets may not be fully recoverable, and also reviews the appropriateness of the remaining useful

lives of impacted fixed assets. See Note 3 — ReorganizationandRestructuringCostsfor additional disclosure of the Company’s reorganization and restructuring

activities.

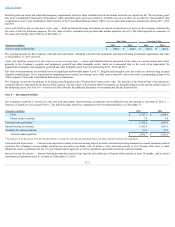

Earnings Per Share — For all periods in which it is outstanding, the Series D Participating Convertible Preferred Stock (the "D Stock") is included in the

weighted-average number of common shares outstanding utilized to calculate basic earnings per common share because the D Stock is deemed a common stock

equivalent. Diluted earnings per common share reflects the potential dilution that could result if securities or incremental shares arising out of the Company’s

stock-based compensation plans were exercised or converted into common stock. Diluted earnings per common share assumes the exercise of stock options using

the treasury stock method.

F-15