MoneyGram 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We believe that our investment in innovative products and services, particularly Digital/Self-Service solutions such as moneygram.com, mobile solutions, account

deposit and kiosk-based services, positions the Company to enhance revenue growth and diversify our product offerings. For the year ended December 31, 2015 ,

the money transfer fee and other revenue from the Digital/Self-Service channel grew 55 percent from 2014 and accounted for $150.1 million , or 12 percent , of

total money transfer fee and other revenue for the year ended December 31, 2015 .

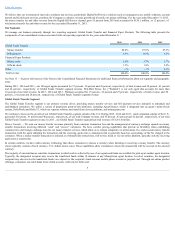

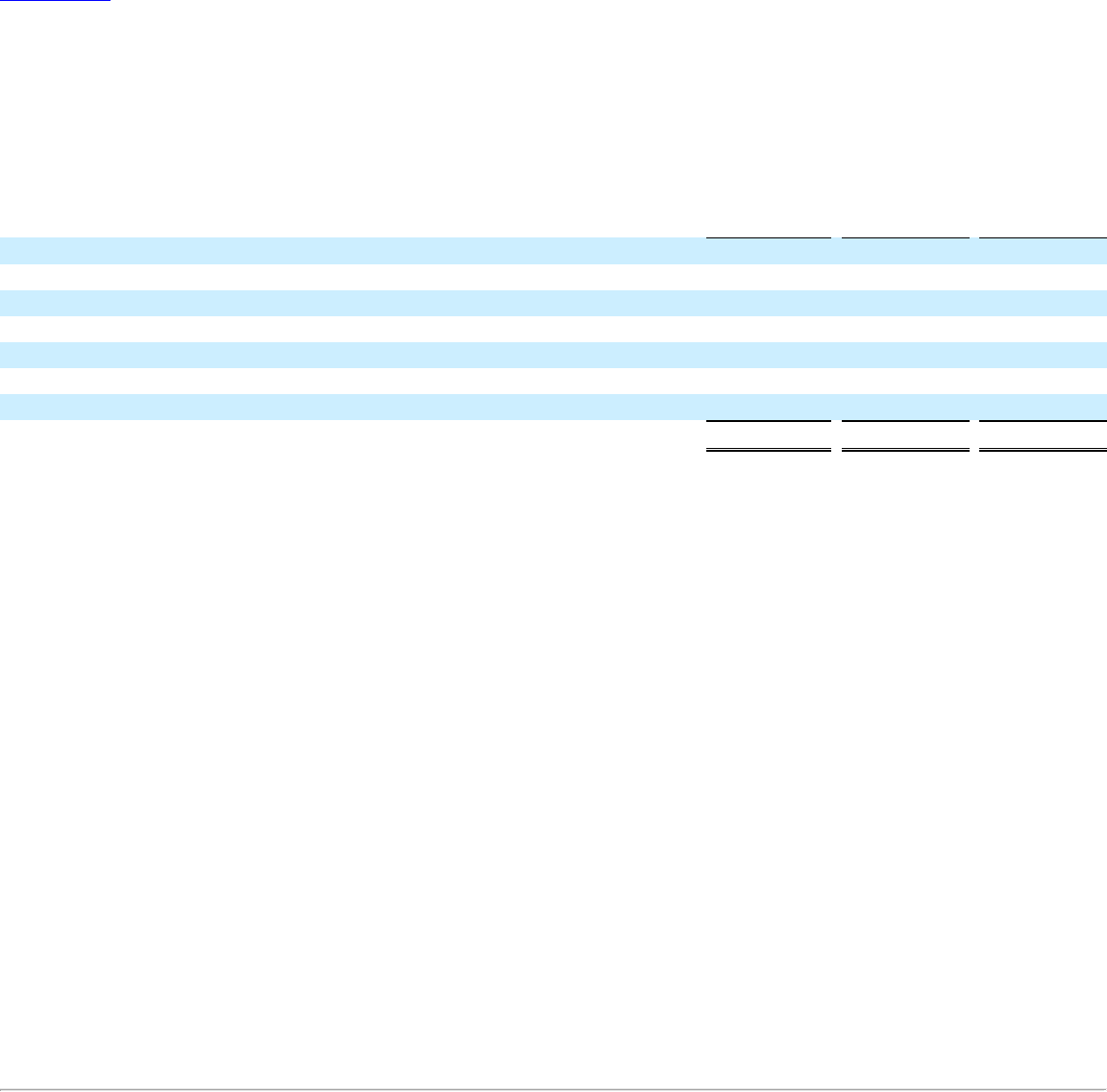

Our Segments

We manage our business primarily through two reporting segments: Global Funds Transfer and Financial Paper Products. The following table presents the

components of our consolidated revenue associated with our reporting segments for the years ended December 31 :

2015

2014

2013

Global Funds Transfer

Money transfer 88.0%

87.6%

87.3%

Bill payment 6.9%

6.9%

6.9%

Financial Paper Products

Money order 3.6%

3.7%

3.7%

Official check 1.5%

1.8%

2.0%

Other —%

—%

0.1%

Total revenue 100.0%

100.0%

100.0%

See Note 15 —SegmentInformationof the Notes to the Consolidated Financial Statements for additional financial information about our segments and geographic

areas.

During 2015 , 2014 and 2013 , our 10 largest agents accounted for 37 percent , 39 percent and 43 percent , respectively, of total revenue and 38 percent , 41 percent

and 44 percent , respectively, of Global Funds Transfer segment revenue. Wal-Mart Stores, Inc. (“Walmart”) is our only agent that accounts for more than

10 percent of our total revenue. In 2015 , 2014 and 2013 , Walmart accounted for 19 percent , 22 percent and 27 percent , respectively, of total revenue, and 20

percent , 23 percent and 28 percent , respectively, of Global Funds Transfer segment revenue.

Global Funds Transfer Segment

The Global Funds Transfer segment is our primary revenue driver, providing money transfer services and bill payment services primarily to unbanked and

underbanked consumers. We utilize a variety of proprietary point-of-sale platforms, including AgentConnect, which is integrated into an agent’s point-of-sale

system, DeltaWorks and Delta T3, which are separate software and stand-alone device platforms, and moneygram.com.

We continue to focus on the growth of our Global Funds Transfer segment outside of the U.S. During 2015 , 2014 and 2013 , sends originated outside of the U.S.

generated 43 percent , 41 percent and 40 percent , respectively, of our total Company revenue, and 45 percent , 43 percent and 42 percent , respectively, of our total

Global Funds Transfer segment revenue. In 2015 , our Global Funds Transfer segment had total revenue of $1,361.4 million .

MoneyTransfer—We earn our money transfer revenues primarily from consumer transaction fees and the management of currency exchange spreads on money

transfer transactions involving different “send” and “receive” currencies. We have corridor pricing capabilities that provide us flexibility when establishing

consumer fees and foreign exchange rates for our money transfer services, which allow us to remain competitive in all locations. In a cash-to-cash money transfer

transaction, both the agent initiating the transaction and the receiving agent earn a commission that is generally based on a percentage of the fee charged to the

consumer. When a money transfer transaction is initiated at a MoneyGram-owned store, full-service kiosk or via our online platform, typically only the receiving

agent earns a commission.

In certain countries, we have multi-currency technology that allows consumers to choose a currency when initiating or receiving a money transfer. The currency

choice typically consists of local currency, U.S. dollars and/or euros. These capabilities allow consumers to know the amount that will be received in the selected

currency.

The majority of our remittances constitute transactions in which cash is collected by one of our agents and funds are available for pick-up at another agent location.

Typically, the designated recipient may receive the transferred funds within 10 minutes at any MoneyGram agent location. In select countries, the designated

recipient may also receive the transferred funds via a deposit to the recipient’s bank account, mobile phone account or prepaid card. Through our online product

offerings, consumers can remit funds from a bank account, credit card or debit card.

5