MoneyGram 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

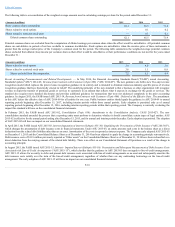

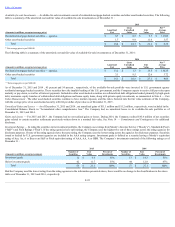

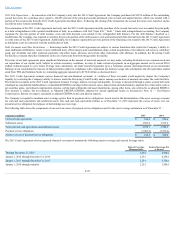

Note 4 — Fair Value Measurement

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability, or the exit price, in an orderly transaction between

market participants on the measurement date. A three-level hierarchy is used for fair value measurements based upon the observability of the inputs to the

valuation of an asset or liability as of the measurement date. Under the hierarchy, the highest priority is given to unadjusted quoted prices in active markets for

identical assets or liabilities (Level 1), followed by observable inputs (Level 2) and unobservable inputs (Level 3). A financial instrument’s level within the

hierarchy is based on the lowest level of any input that is significant to the fair value measurement. The following is a description of the Company’s valuation

methodologies used to estimate the fair value for assets and liabilities:

Assetsandliabilitiesthataremeasuredatfairvalueonarecurringbasis:

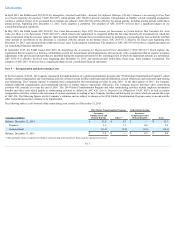

• Available-for-saleinvestments— For U.S. government agency securities and residential mortgage-backed securities collateralized by U.S. government

agency securities, fair value measures are generally obtained from independent sources, including a pricing service. Because market quotes are generally

not readily available or accessible for these specific securities, the pricing service generally measures fair value through the use of pricing models and

observable inputs for similar assets and market data. Accordingly, these securities are classified as Level 2 financial instruments.

For other asset–backed securities and investments in limited partnerships, market quotes are generally not available. The Company will utilize a broker

quote to measure market value, if available. Because the inputs and assumptions that brokers use to develop prices are unobservable, most valuations that

are based on brokers' quotes are classified as Level 3. If no broker quote is available, the Company will utilize a fair value measurement from a pricing

service. The pricing service utilizes pricing models based on market observable data and indices, such as quotes for comparable securities, yield curves,

default indices, interest rates and historical prepayment speeds. Observability of market inputs to the valuation models used for pricing certain of the

Company's investments has deteriorated with the disruption to the credit markets as overall liquidity and trading activity in these sectors has been

substantially reduced. Accordingly, other asset-backed securities valued using third-party pricing models are classified as Level 3.

• Derivativefinancialinstruments — Derivatives consist of forward contracts to manage income statement exposure to foreign currency exchange risk

arising from the Company’s assets and liabilities denominated in foreign currencies. The Company’s forward contracts are well-established products,

allowing the use of standardized models with market-based inputs. These models do not contain a high level of subjectivity and the inputs are readily

observable. Accordingly, the Company has classified its forward contracts as Level 2 financial instruments. See Note 6 — Derivative Financial

Instrumentsfor additional disclosure on the Company's forward contracts.

• Deferredcompensation— The assets associated with the deferred compensation plan that are funded through voluntary contributions by the Company

consist of investments in money market securities and mutual funds. These investments were classified as Level 1 as there are quoted market prices for

these funds.

F-19