MoneyGram 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

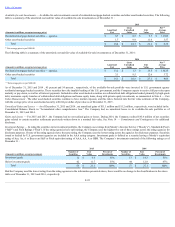

At December 31, 2015 , the Company was in compliance with its financial covenants: our interest coverage ratio was 5.93 to 1.00 and our secured leverage ratio

was 3.821 to 1.00. We continuously monitor our compliance with our debt covenants.

Debt Issuance Costs —The Company presents debt issuance costs as a direct deduction from the carrying amount of the related indebtedness per the early

adoption of ASU 2015-03 and amortizes these costs over the term of the related debt liability using the effective interest method. Expense of the debt issuance

costs during 2013 includes the write-off of a pro-rata portion of debt issuance costs in connection with the extinguishment of the 2011 Credit Agreement, as well as

payments on the second lien notes, the incremental term loan and the term debt. Amortization is recorded in “Interest expense” on the Consolidated Statements of

Operations.

In accordance with ASU 2015-15, the Company records debt issuance costs for its Revolving Credit Facility in Other assets on its Consolidated Balance Sheets

and related amortization is recorded in "Interest expense" on the Consolidated Statements of Operations. The unamortized costs associated with the Revolving

Credit Facility were $1.2 million and $1.7 million as of December 31, 2015 and 2014, respectively.

DebtDiscount— The Company records debt discount as a deduction from the carrying amount of the related indebtedness on its Consolidated Balance Sheets with

the respective debt discount amortization recorded in “Interest expense,” and the write-off of the debt discount recorded in "Debt extinguishment costs," on the

Consolidated Statements of Operations.

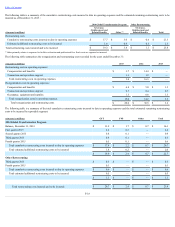

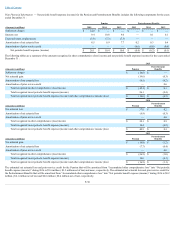

DebtExtinguishmentCosts—In 2015 and 2014 , there were no debt extinguishment costs. In 2013 , the Company recognized debt extinguishment costs of $45.3

million in connection with the termination of the 2011 Credit Agreement and entry into the 2013 Credit Agreement, which included $21.5 million in prepayment

penalty, $20.0 million of unamortized debt issuance costs, $2.3 million of debt discount upon prepayments and $1.5 million of debt modification costs.

InterestPaidinCash— The Company paid $42.1 million , $41.1 million and $43.9 million of interest in 2015 , 2014 and 2013 , respectively.

Maturities— At December 31, 2015 , debt totaling $912.6 million will mature in 2020, while debt principal totaling $41.7 million will be paid quarterly in

increments of approximately $2.5 million through 2020. Any borrowings under the Revolving Credit Facility will mature in 2018.

Note 10 — Pension and Other Benefits

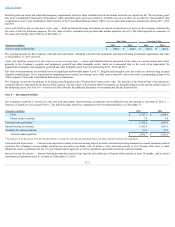

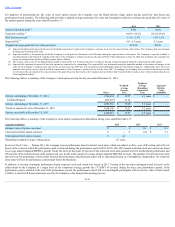

PensionBenefits — The Company's Pension Plan is a frozen, non-contributory funded plan under which no new service or compensation credits are accrued by

the plan participants. Cash accumulation accounts continue to be credited with interest credits until participants withdraw their money from the Pension Plan. It is

the Company’s policy to fund at least the minimum required contribution each year plus additional discretionary amounts as available and necessary to minimize

expenses of the plan.

Supplemental Executive Retirement Plans — The Company has obligations under various supplemental executive retirement plans (“SERPs”), which are

unfunded non-qualified defined benefit pension plans providing postretirement income to their participants. As of December 31, 2015 , all benefit accruals under

the SERPs are frozen with the exception of one plan for which service is frozen but future pay increases are reflected for active participants. It is the Company’s

policy to fund the SERPs as benefits are paid.

The Company's Pension Plan and SERPs are collectively referred to as our “Pension."

Postretirement Benefits Other Than Pensions — The Company has an unfunded defined benefit postretirement plan ("Postretirement Benefits") that provides

medical and life insurance for its participants. The Company amended the Postretirement Benefits to close it to new participants as of December 31, 2009 .

Effective July 1, 2011 , the Postretirement Benefits was amended to eliminate eligibility for participants eligible for Medicare coverage. As a result of this plan

amendment, the Company no longer receives the Medicare retiree drug subsidy. The Company’s funding policy is to make contributions to the Postretirement

Benefits as benefits are paid.

F-27