MoneyGram 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

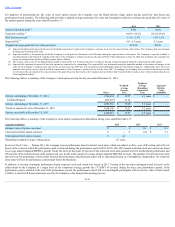

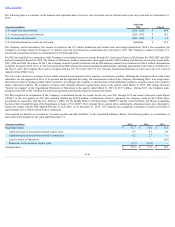

Totalassetsbysegment- Settlement assets, as defined in Note 2 - SummaryofSignificantAccountingPolicies, are allocated based on the corresponding payment

service obligations that are specifically identified to each reporting segment. Property and equipment is specifically identified to both reporting segments with the

exception of certain software, most of which is jointly used and allocated to each segment. There is an immaterial amount of software used for corporate purposes.

The net carrying value of goodwill and intangibles all relates to the Global Funds Transfer segment as further summarized in Note 8 - GoodwillandIntangible

Assets. While the derivatives portfolio is also managed on a consolidated level, each derivative instrument is utilized in a manner that can be identified to the

Global Funds Transfer segment. All assets that are not specifically identified or allocated to each reporting segment are reported as "Other.” These assets primarily

include reported cash and cash equivalents, which are the assets in excess of payment service obligations as further discussed in Note 9 - Debt,and various other

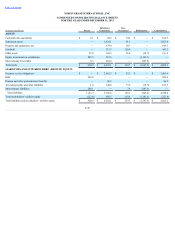

assets. The following table sets forth assets by segment as of December 31 :

(Amounts in millions) 2015

2014

Global Funds Transfer $ 1,982.0

$ 1,858.3

Financial Paper Products 2,326.4

2,464.5

Other 196.8

305.5

Total assets $ 4,505.2

$ 4,628.3

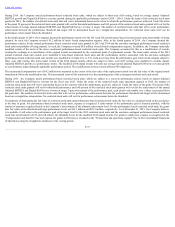

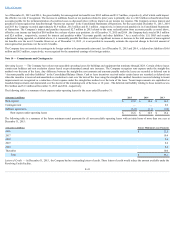

Geographicareas

Revenue—International revenues are defined as revenues generated from money transfer and bill payment transactions originating in a country other than the U.S.

There are no individual countries, other than the U.S., that exceed 10% of total revenues for the years ended December 31, 2015 , 2014 and 2013 . The following

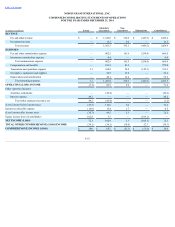

table details total revenue by major geographic area for the years ended December 31 :

(Amounts in millions) 2015

2014

2013

U.S. $ 823.3

$ 861.2

$ 891.6

International 611.4

593.7

582.8

Total revenue $ 1,434.7

$ 1,454.9

$ 1,474.4

Long-lived assets — Long-lived assets are defined as property and equipment and signing bonuses. Long-lived assets are principally located in the U.S. The

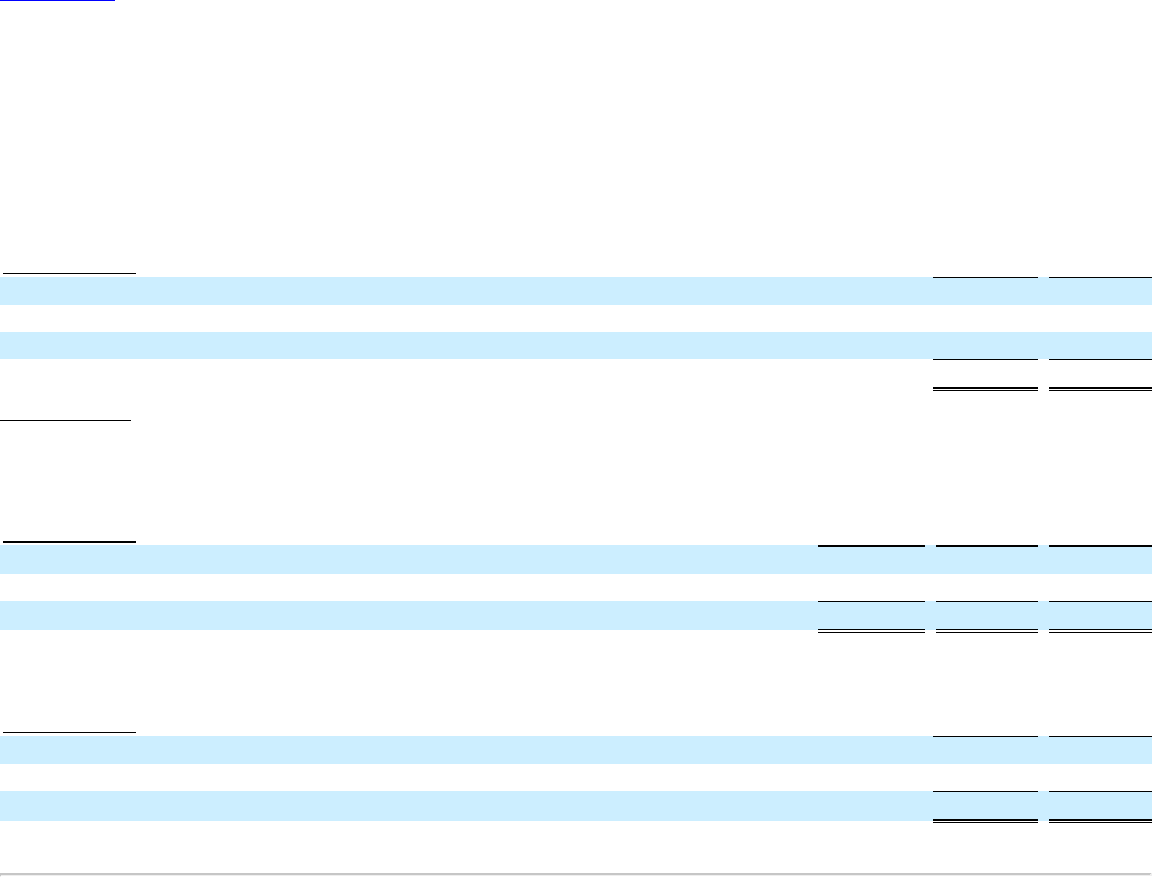

following table details total long-lived assets by major geographic area for the years ended December 31 :

(Amounts in millions) 2015

2014

U.S. $ 290.8

$ 235.1

International 33.8

31.3

Total long-lived assets $ 324.6

$ 266.4

F-45