MoneyGram 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

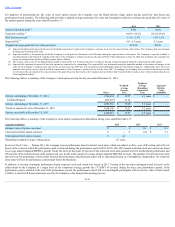

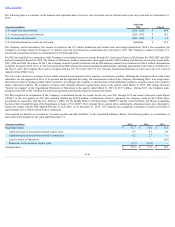

Minimum Commission Guarantees — In limited circumstances as an incentive to new or renewing agents, the Company may grant minimum commission

guarantees for a specified period of time at a contractually specified amount. Under the guarantees, the Company will pay to the agent the difference between the

contractually specified minimum commission and the actual commissions earned by the agent. Expenses related to the guarantee are recognized in the “Fee and

other commissions expense” line in the Consolidated Statements of Operations.

As of December 31, 2015 , the liability for minimum commission guarantees was $3.2 million and the maximum amount that could be paid under the minimum

commission guarantees was $11.3 million over a weighted-average remaining term of 1.9 years . The maximum payment is calculated as the contractually

guaranteed minimum commission multiplied by the remaining term of the contract and, therefore, assumes that the agent generates no money transfer transactions

during the remainder of its contract. However, under the terms of certain agent contracts, the Company may terminate the contract if the projected or actual volume

of transactions falls beneath a contractually specified amount. Minimum commission guarantees paid in 2015 and 2014 were $0.2 million and $1.8 million ,

respectively, or 6 percent and 47 percent , respectively, of the estimated maximum payment for the year.

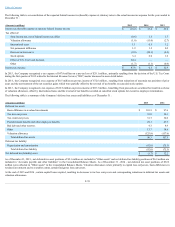

Other Commitments — The Company has agreements with certain co-investors to provide funds related to investments in limited partnership interests. As of

December 31, 2015 , the total amount of unfunded commitments related to these agreements was $0.3 million .

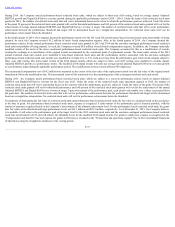

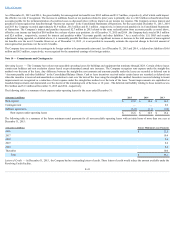

LegalProceedings— The matters set forth below are subject to uncertainties and outcomes that are not predictable. The Company accrues for these matters as any

resulting losses become probable and can be reasonably estimated. Further, the Company maintains insurance coverage for many claims and litigation alleged. In

relation to various legal matters, including those described below, the Company had $16.3 million and $17.3 million of liability recorded in the “Accounts payable

and other liabilities” line in the Consolidated Balance Sheets as of December 31, 2015 and 2014 , respectively. A charge of $2.4 million , $12.8 million and $0.2

million were recorded in the “Transaction and operations support” line in the Consolidated Statements of Operations during 2015 , 2014 and 2013 , respectively,

for legal proceedings.

Litigation Commenced Against the Company:

ClassActionSecuritiesLitigation- On April 15, 2015, a putative securities class action lawsuit was filed in the Superior Court of the State of Delaware, County of

New Castle, against MoneyGram, all of its directors, certain of its executive officers, THL, Goldman Sachs and the underwriters of the secondary public offering

of the Company’s common stock that closed on April 2, 2014 (the “2014 Offering”). The lawsuit was brought by the Iron Workers District Council of New

England Pension Fund seeking to represent a class consisting of all purchasers of the Company’s common stock pursuant and/or traceable to the Company’s

registration statement and prospectus, and all documents incorporated by reference therein, issued in connection with the 2014 Offering. The lawsuit alleges

violations of Sections 11, 12(a)(2) and 15 of the Securities Act of 1933, as amended (the "Securities Act"), due to allegedly false and misleading statements in

connection with the 2014 Offering and seeks unspecified damages and other relief. On May 19, 2015, MoneyGram and the other defendants filed a notice of

removal to the federal district court of the District of Delaware. On June 18, 2015, the plaintiff filed a motion to remand the case back to Delaware State Court. The

Company believes that the claims are without merit and intends to vigorously defend against the lawsuit. The Company is unable to predict the outcome, or the

possible loss or range of loss, if any, related to this matter.

OtherMatters— The Company is involved in various other claims and litigation that arise from time to time in the ordinary course of the Company's business.

Management does not believe that after final disposition any of these matters is likely to have a material adverse impact on the Company's financial condition,

results of operations and cash flows.

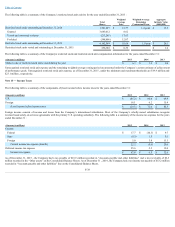

Government Investigations

State Civil Investigative Demands — MoneyGram has received Civil Investigative Demands from a working group of nine state attorneys general who have

initiated an investigation into whether the Company took adequate steps to prevent consumer fraud during the period from 2007 to 2014. On February 11, 2016, the

Company entered into a settlement agreement with 49 states and the District of Columbia to settle any civil or administrative claims such attorneys general may

have asserted under their consumer protection laws through the date of the settlement agreement in connection with the investigation. Under the settlement

agreement, the Company will make a non-refundable payment of $13.0 million to the participating states to be used by the states to provide restitution to

consumers. The Company also agreed to implement certain enhancements to its compliance program and provide periodic reports to the states party to the

settlement agreement. As of December 31, 2015, the Company had accrued $13.0 million in connection with the investigation.

OtherMatters— The Company is involved in various other government inquiries and other matters that arise from time to time. Management does not believe that

after final disposition any of these other matters is likely to have a material adverse impact on the Company’s financial condition, results of operations and cash

flows.

F-42