MoneyGram 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

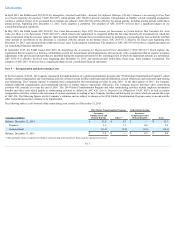

Contractual Maturities — Actual maturities may differ from contractual maturities as borrowers may have the right to call or prepay obligations, sometimes

without call or prepayment penalties. Maturities of residential mortgage-backed and other asset-backed securities depend on the repayment characteristics and

experience of the underlying obligations.

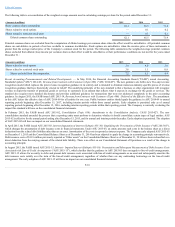

FairValue Determination—The Company uses various sources of pricing for its fair value estimates of its available-for-sale portfolio. The percentage of the

portfolio for which the various pricing sources were used is as follows as of December 31, 2015 and 2014 : 95 percent used a third-party pricing service and 5

percent used broker quotes.

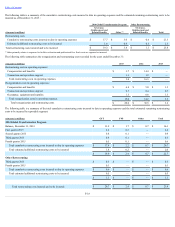

Note 6 — Derivative Financial Instruments

The Company uses forward contracts to manage its foreign currency needs and foreign currency exchange risk arising from its assets and liabilities denominated in

foreign currencies. While these contracts may mitigate certain foreign currency risk, they are not designated as hedges for accounting purposes. These contracts

will result in gains and losses which are reported in the "Transaction and operations support" line item in the Consolidated Statements of Operations. The Company

may also report gains and losses from the spread differential between the rate set for its transactions and the actual cost of currency at the time the Company buys

or sells in the open market. The “Transaction and operations support” line in the Consolidated Statements of Operations and the "Net cash provided by operating

activities" line in the Consolidated Statements of Cash Flows include the following losses (gains) related to assets and liabilities denominated in foreign currencies,

for the years ended December 31 :

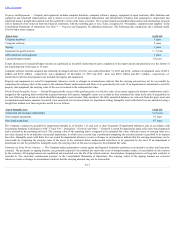

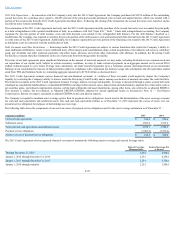

(Amounts in millions) 2015

2014

2013

Net realized foreign currency losses (gains) $ 21.3

$ 25.0

$ (3.3)

Net (gains) losses from the related forward contracts (32.7)

(24.0)

5.3

Net (gains) losses from foreign currency transactions and related forward contracts $ (11.4)

$ 1.0

$ 2.0

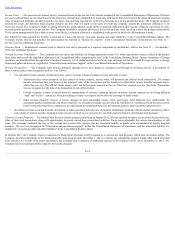

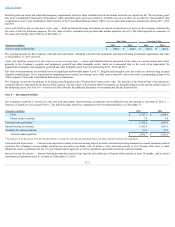

As of December 31, 2015 and 2014 , the Company had $295.8 million and $242.5 million , respectively, of outstanding notional amounts relating to its forward

contracts. As of December 31, 2015 and 2014 , the Company reflects the following fair values of derivative forward contract instruments in its Consolidated

Balance Sheets:

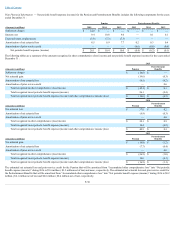

Gross Amount of Recognized

Assets

Gross Amount of Offset

Net Amount of Assets

Presented in the Consolidated

Balance Sheets

(Amounts in millions) Balance Sheet Location

2015

2014

2015

2014

2015

2014

Forward contracts Other assets

$ 1.0

$ 5.3

$ (0.2)

$ (0.5)

$ 0.8

$ 4.8

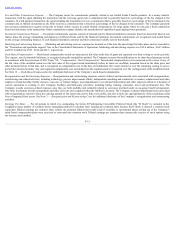

Gross Amount of Recognized

Liabilities

Gross Amount of Offset

Net Amount of Liabilities

Presented in the Consolidated

Balance Sheets

(Amounts in millions) Balance Sheet Location

2015

2014

2015

2014

2015

2014

Forward contracts Accounts payable and other liabilities

$ 0.3

$ 0.8

$ (0.2)

$ (0.5)

$ 0.1

$ 0.3

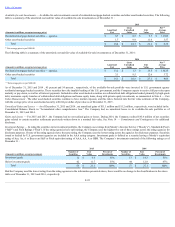

The Company's forward contracts are primarily executed with counterparties governed by International Swaps and Derivatives Association agreements that

generally include standard netting arrangements. Asset and liability positions from forward contracts and all other foreign exchange transactions with the same

counterparty are net settled upon maturity.

The Company is exposed to credit loss in the event of non-performance by counterparties to its derivative contracts. The Company actively monitors its exposure

to credit risk through the use of credit approvals and credit limits, and by selecting major international banks and financial institutions as counterparties. Collateral

generally is not required of the counterparties or of the Company. In the unlikely event the counterparty fails to meet the contractual terms of the derivative

contract, the Company’s risk is limited to the fair value of the instrument. The Company has not had any historical instances of non-performance by any

counterparties, nor does it anticipate any future instances of non-performance.

F-23