MoneyGram 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Description of the Business and Basis of Presentation

References to “MoneyGram,” the “Company,” “we,” “us” and “our” are to MoneyGram International, Inc. and its subsidiaries and consolidated entities.

NatureofOperations — MoneyGram offers products and services under its two reporting segments: Global Funds Transfer ("GFT") and Financial Paper Products

("FPP"). The GFT segment provides global money transfer services and bill payment services to consumers. We primarily offer services through third-party

agents, including retail chains, independent retailers, post offices and other financial institutions. We also offer Digital/Self-Service solutions such as

moneygram.com, mobile solutions, account deposit and kiosk-based services. Additionally, we have Company-operated retail locations in the U.S. and Western

Europe. The FPP segment provides official check outsourcing services and money orders through financial institutions and agent locations.

Basisof Presentation — The accompanying consolidated financial statements of MoneyGram are prepared in conformity with generally accepted accounting

principles in the United States of America (“GAAP”). The Consolidated Balance Sheets are unclassified due to the timing uncertainty surrounding the payment of

settlement obligations.

Useof Estimates— The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the

reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. These estimates and assumptions are based on historical experience, future expectations and other factors and

assumptions the Company believes to be reasonable under the circumstances. These estimates and assumptions are reviewed on an ongoing basis and are revised

when necessary. Changes in estimates are recorded in the period of change. Actual amounts may differ from these estimates.

PrinciplesofConsolidation — The consolidated financial statements include the accounts of MoneyGram International, Inc. and its subsidiaries. Intercompany

profits, transactions and account balances have been eliminated in consolidation.

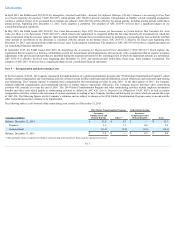

The Company participates in various trust arrangements (special purpose entities or “SPEs”) related to official check processing agreements with financial

institutions and structured investments within the investment portfolio. Working in cooperation with certain financial institutions, the Company historically

established separate consolidated SPEs that provided these financial institutions with additional assurance of its ability to clear their official checks. The Company

maintains control of the assets of the SPEs and receives all investment revenue generated by the assets. The Company remains liable to satisfy the obligations of

the SPEs, both contractually and by operation of the Uniform Commercial Code, as issuer and drawer of the official checks. As the Company is the primary

beneficiary and bears the primary burden of any losses, the SPEs are consolidated in the consolidated financial statements. The assets of the SPEs are recorded in

the Consolidated Balance Sheets in a manner consistent with the assets of the Company based on the nature of the asset. Accordingly, the obligations have been

recorded in the Consolidated Balance Sheets under “Payment service obligations.” The investment revenue generated by the assets of the SPEs is allocated to the

FPP segment in the Consolidated Statements of Operations. For the years ending December 31, 2015 and 2014 , the Company’s SPEs had settlement assets and

payment service obligations of $2.1 million and $3.1 million , respectively.

Note 2 — Summary of Significant Accounting Policies

Cashandcashequivalents—The Company defines cash and cash equivalents and settlement cash and cash equivalents as cash on hand and all highly liquid debt

instruments with original maturities of three months or less at the purchase date.

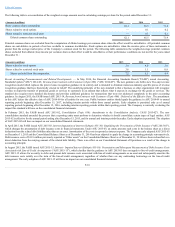

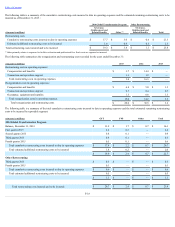

Settlementassetsandpaymentserviceobligations—Settlement assets represent funds received or to be received from agents for unsettled money transfers, money

orders and consumer payments. The Company records corresponding payment service obligations relating to amounts payable under money transfers, money

orders and consumer payment service arrangements. Settlement assets consist of settlement cash and cash equivalents, receivables and investments. Payment

service obligations primarily consist of: outstanding payment instruments; amounts owed to financial institutions for funds paid to the Company to cover clearings

of official check payment instruments, remittances and clearing adjustments; amounts owed to agents for funds paid to consumers on behalf of the Company;

commissions owed to financial institution customers and agents for instruments sold; amounts owed to investment brokers for purchased securities and unclaimed

instruments owed to various states. These obligations are recognized by the Company at the time the underlying transactions occur.

F-10