MoneyGram 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

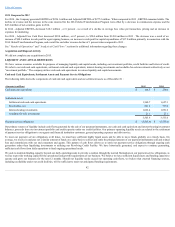

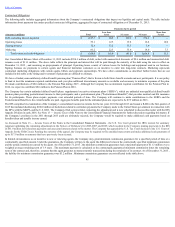

CompensationandBenefits

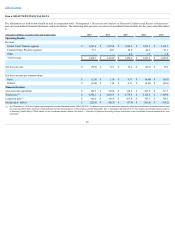

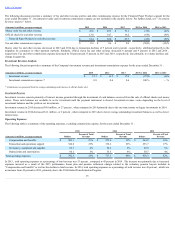

Compensation and benefits include salaries and benefits, management incentive programs, related payroll taxes and other employee related costs. The following

table is a summary of the change in compensation and benefits from the respective prior year for the years ended December 31 :

(Amounts in millions) 2015

2014

For the period ended December 31 $ 275.0

$ 264.9

Change resulting from:

Salaries, related payroll taxes and incentive compensation 35.9

(9.0)

Impact from changes in exchange rates (18.8)

(0.1)

Employee stock-based compensation 14.2

(5.8)

Pension settlement charges 14.0

—

Reorganization and restructuring (9.1)

18.5

Compliance enhancement program (1.5)

2.8

Other employee benefits (0.6)

3.7

For the period ended December 31 $ 309.1

$ 275.0

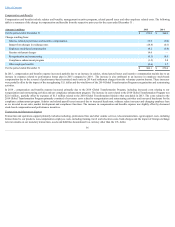

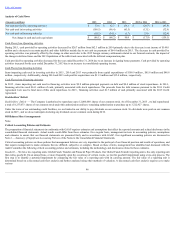

In 2015 , compensation and benefits expense increased partially due to an increase in salaries, related payroll taxes and incentive compensation mainly due to an

increase in expenses related to performance bonus plan in 2015 compared to 2014 . The increase is also attributed to an increase in employee stock-based

compensation due to the reversal of performance-based restricted stock units in 2014 and settlement charges from the voluntary pension buyout. These increases

were partially offset by the impact of the strengthening U.S. dollar and the wind down of the 2014 Global Transformation Program reorganization and restructuring

activities.

In 2014 , compensation and benefits expense increased primarily due to the 2014 Global Transformation Program, including increased costs relating to our

reorganization and restructuring activities and our compliance enhancement program. The increase in costs related to the 2014 Global Transformation Program was

$22.6 million , partially offset by expenses of $1.3 million related to the 2010 Global Transformation Initiative that concluded in 2013. The costs related to the

2014 Global Transformation Program primarily consisted of severance costs related to reorganization and restructuring activities and increased headcount for the

compliance enhancement program. Salaries and related payroll taxes increased due to increased headcount, ordinary salary increases and changing employee base

as we invested in our sales, market development and compliance functions. The increase in compensation and benefits expense was slightly offset by decreased

stock-based compensation and performance incentives.

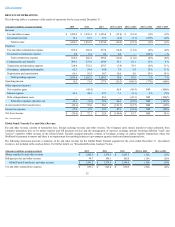

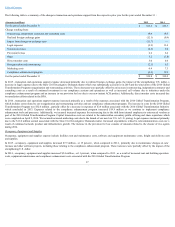

TransactionandOperationsSupport

Transaction and operations support primarily includes marketing, professional fees and other outside services, telecommunications, agent support costs, including

forms related to our products, non-compensation employee costs, including training, travel and relocation costs, bank charges and the impact of foreign exchange

rate movements on our monetary transactions, assets and liabilities denominated in a currency other than the U.S. dollar.

36