MoneyGram 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

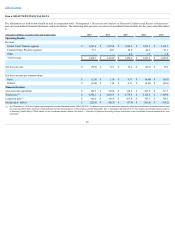

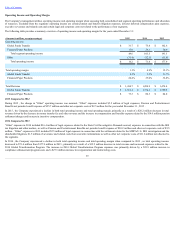

Financial Measures and Key Metrics

This Annual Report on Form 10-K includes financial information prepared in accordance with generally accepted accounting principles in the U.S. ("GAAP") as

well as certain non-GAAP financial measures that we use to assess our overall performance.

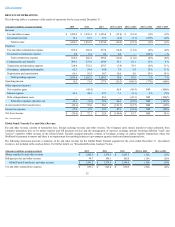

GAAP Measures — We utilize certain financial measures prepared in accordance with GAAP to assess the Company's overall performance. These measures

include, but are not limited to: fee and other revenue, fee and other commissions expense, fee and other revenue less commissions, operating income and operating

margin. Due to our regulatory capital requirements, we deem certain payment service assets as settlement assets. Settlement assets represent funds received or to be

received from agents for unsettled money transfers, money orders and customer payments. Settlement assets include settlement cash and cash equivalents,

receivables, net, interest-bearing investments and available-for-sale investments. See Note 2 —SummaryofSignificantAccountingPolicies of the Notes to the

Consolidated Financial Statements for additional disclosure.

Non-GAAP Measures — Generally, a non-GAAP financial measure is a numerical measure of financial performance, financial position, or cash flows that

excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP.

The non-GAAP financial measures should be viewed as a supplement to, and not a substitute for, financial measures presented in accordance with GAAP. We

strongly encourage investors and stockholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial

measure. While we believe that these metrics enhance investors' understanding of our business, these metrics are not necessarily comparable with similarly named

metrics of other companies. The following are non-GAAP financial measures we use to assess our overall performance:

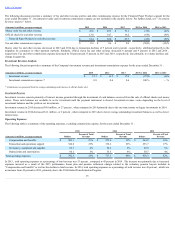

EBITDA (Earnings before interest, taxes, depreciation and amortization, including agent signing bonus amortization)

Adjusted EBITDA (EBITDA adjusted for certain significant items) — Adjusted EBITDA does not reflect cash requirements necessary to service interest or

principal payments on our indebtedness or tax payments that may result in a reduction in cash available.

Adjusted Free Cash Flow (Adjusted EBITDA less cash interest, cash taxes, cash payments for capital expenditures and cash payments for agent signing bonuses)

—Adjusted Free Cash Flow does not reflect cash payments related to the adjustment of certain significant items in Adjusted EBITDA.

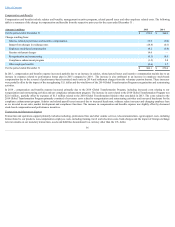

Constant Currency — Constant currency metrics assume that amounts denominated in foreign currencies are translated to the U.S. dollar at rates consistent with

those in the prior year.

The Company utilizes specific terms related to our business throughout this document, including the following:

Corridor — With regard to a money transfer transaction, the originating "send" location and the designated "receive" location are referred to as a corridor.

Corridor mix — The relative impact of increases or decreases in money transfer transaction volume in each corridor versus the comparative prior period.

Face value — The principal amount of each completed transaction, excluding any fees related to the transaction.

Foreign currency — The impact of foreign currency exchange rate fluctuations is typically calculated as the difference between current period activity translated

using the current period’s currency exchange rates and the comparable prior-year period’s currency exchange rates. We use this method to calculate the impact of

changes in foreign currency exchange rates on revenues, commissions and other operating expenses for all countries where the functional currency is not the U.S.

dollar.

31