MoneyGram 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

the Company elected the Eurodollar rate as its primary interest basis. Under the terms of the 2013 Credit Agreement, the minimum interest rate applicable to

Eurodollar borrowings under the Term Credit Facility is 100 basis points plus the applicable margins previously referred to in this paragraph. Accordingly, any

increases in interest rates will adversely affect interest expense.

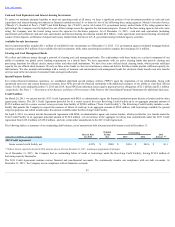

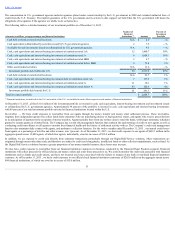

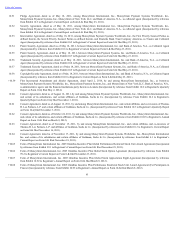

The tables below incorporate substantially all of our interest rate sensitive assets and assumptions that reflect changes in all interest rates pertaining to the balance

sheet. The “ramp” analysis assumes that interest rates change in even increments over the next 12 months. The “shock” analysis assumes interest rates change

immediately and remain at the changed level for the next twelve months. Components of our pre-tax (loss) income that are interest rate sensitive include

“Investment revenue,” “Investment commissions expense” and “Interest expense.” In the current interest rate environment where rates have been historically low,

our risk associated with interest rates is not material. A moderately rising interest rate environment would be generally beneficial to the Company because variable

rate assets exceed our variable rate liabilities, and certain of our variable rate liabilities will not react to increases in interest rates until those rates exceed the floor

set for the index rate on the corresponding debt.

The following table summarizes the changes to affected components of the income statement under various ramp scenarios as of December 31, 2015 :

Basis Point Change in Interest Rates

Down

Down

Down

Up

Up

Up

( Amounts in millions) 200

100

50

50

100

200

Investment revenue $ (7.6)

$ (6.6)

$ (4.6)

$ 5.8

$ 11.6

$ 23.2

Investment commissions expense 2.1

1.9

1.5

(2.0)

(4.5)

(11.4)

Interest expense NM

NM

NM

NM

(1.2)

(4.5)

Change in pretax income $ (5.5)

$ (4.7)

$ (3.1)

$ 3.8

$ 5.9

$ 7.3

NM = Not meaningful

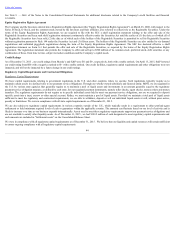

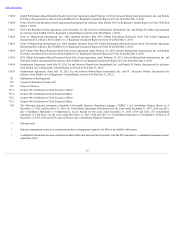

The following table summarizes the changes to affected components of the income statement under various shock scenarios as of December 31, 2015 :

Basis Point Change in Interest Rates

Down

Down

Down

Up

Up

Up

(Amounts in millions) 200

100

50

50

100

200

Investment revenue $ (8.3)

$ (8.3)

$ (7.7)

$ 10.7

$ 21.3

$ 42.5

Investment commissions expense 2.3

2.3

2.2

(3.9)

(9.7)

(23.5)

Interest expense NM

NM

NM

(0.8)

(4.5)

(11.8)

Change in pretax income $ (6.0)

$ (6.0)

$ (5.5)

$ 6.0

$ 7.1

$ 7.2

NM = Not meaningful

Foreign Currency Risk

We are exposed to foreign currency risk in the ordinary course of business as we offer our products and services through a network of agents and financial

institutions with locations in more than 200 countries and territories. By policy, we do not speculate in foreign currencies; all currency trades relate to underlying

transactional exposures.

Our primary source of foreign exchange risk is transactional risk. This risk is predominantly incurred in the money transfer business in which funds are frequently

transferred cross-border and we settle with agents in multiple currencies. Although this risk is somewhat limited due to the fact that these transactions are short-

term in nature, we currently manage some of this risk with forward contracts to protect against potential short-term market volatility. The primary currency pairs,

based on volume, that are traded against the dollar in the spot and forward markets include the European euro, Mexican peso, British pound and Indian rupee. The

tenor of forward contracts is typically less than 30 days.

Realized and unrealized gains or losses on transactional currency and any associated revaluation of balance sheet exposures are recorded in “Transaction and

operations support” in the Consolidated Statements of Operations. The fair market value of any open forward contracts at period end are recorded in “Other assets”

or "Accounts payable and other liabilities" in the Consolidated Balance Sheets. The net effect of changes in foreign exchange rates and the related forward

contracts for the year ended December 31, 2015 was a gain of $11.4 million .

Additional foreign currency risk is generated from fluctuations in the U.S. dollar value of future foreign currency-denominated earnings. In 2015 , fluctuations in

the euro exchange rate (net of transactional hedging activities) resulted in a net decrease to our operating income of $9.0 million .

53