MoneyGram 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

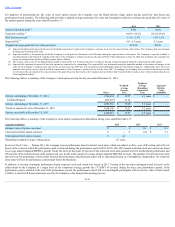

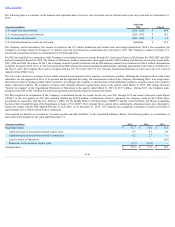

As of December 31, 2015 and 2014 , the gross liability for unrecognized tax benefits was $30.5 million and $31.7 million , respectively, all of which could impact

the effective tax rate if recognized. The increase in additions based on tax positions related to prior years is primarily due to a $6.5 million reclassification from

accounts payable for the recharacterization of securities losses as discussed above with no impact on our income tax expense. The Company accrues interest and

penalties for unrecognized tax benefits through “Income tax expense” in the Consolidated Statements of Operations. For the years ended December 31, 2015 , 2014

and 2013 the Company recorded approximately $1.9 million , $0.5 million and $1.1 million , respectively, in interest and penalties in its Consolidated Statements

of Operations. The Company’s interest and penalties increased $2.7 million in 2015 related to the same reclassification from accounts payable as noted above,

offset by a net income tax benefit of $0.8 million for a release of prior year positions. As of December 31, 2015 and 2014 , the Company had a total of $4.5 million

and $2.6 million , respectively, accrued for interest and penalties within "Accounts payable and other liabilities." As a result of the U.S. DOJ and security

adjustments being appealed, as detailed above, it is reasonably possible that there could be a significant increase or decrease to the total amount of unrecognized

tax benefits over the next 12 months. However, as of December 31, 2015 , it is not possible to reasonably estimate the expected change to the total amount of

unrecognized tax positions over the next 12 months .

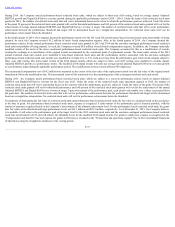

The Company does not consider its earnings in its foreign entities to be permanently reinvested. As of December 31, 2015 and 2014 , a deferred tax liability of $4.6

million and $6.3 million , respectively, was recognized for the unremitted earnings of its foreign entities.

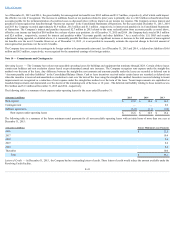

Note 14 — Commitments and Contingencies

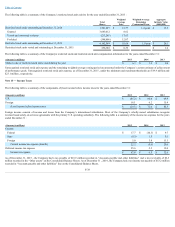

OperatingLeases — The Company has various non-cancelable operating leases for buildings and equipment that terminate through 2024 . Certain of these leases

contain rent holidays and rent escalation clauses based on pre-determined annual rate increases. The Company recognizes rent expense under the straight-line

method over the term of the lease. Any difference between the straight-line rent amounts and amounts payable under the leases are recorded as deferred rent in

“Accounts payable and other liabilities” in the Consolidated Balance Sheets. Cash or lease incentives received under certain leases are recorded as deferred rent

when the incentive is received and amortized as a reduction to rent over the term of the lease using the straight-line method. Incentives received relating to tenant

improvements are recognized as a reduction of rent expense under the straight-line method over the term of the lease. Tenant improvements are capitalized as

leasehold improvements and depreciated over the shorter of the remaining term of the lease or 10 years . The deferred rent liability relating to these incentives was

$0.2 million and $1.3 million at December 31, 2015 and 2014 , respectively.

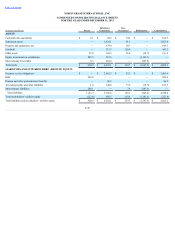

The following table is a summary of rent expense under operating leases for the years ended December 31 :

(Amounts in millions) 2015

2014

2013

Rent expense $ 17.8

$ 18.0

$ 16.2

Contingent rent —

—

0.2

Sublease agreements (1.0)

(1.1)

(1.0)

Rent expense under operating leases $ 16.8

$ 16.9

$ 15.4

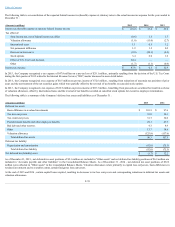

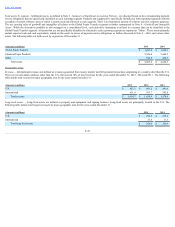

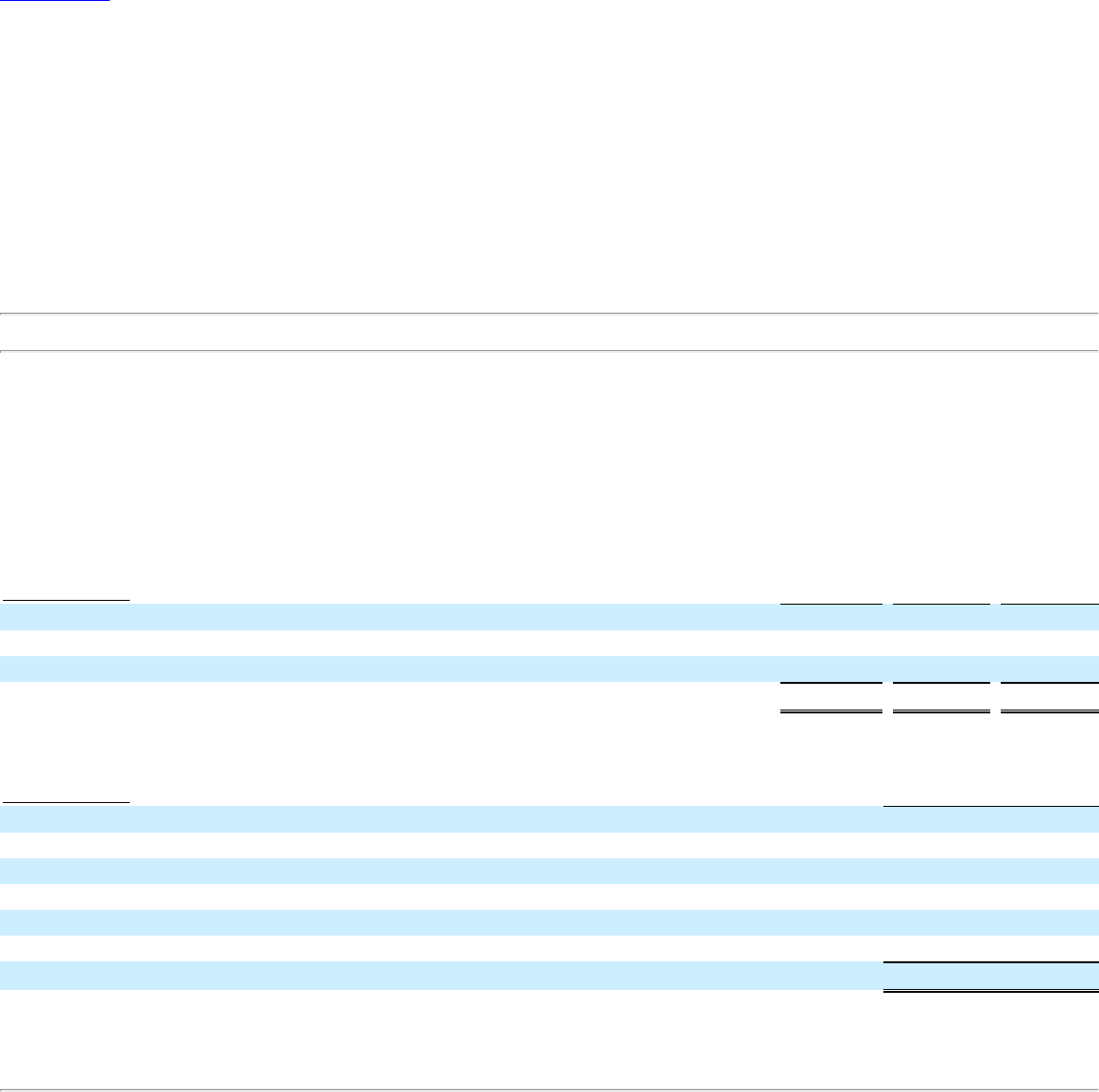

The following table is a summary of the future minimum rental payments for all non-cancelable operating leases with an initial term of more than one year at

December 31, 2015 :

(Amounts in millions) Future Minimum Lease Payments

2016 $ 12.5

2017 10.4

2018 9.4

2019 8.6

2020 8.2

Thereafter 10.0

Total $ 59.1

LettersofCredit — At December 31, 2015 , the Company had no outstanding letters of credit. These letters of credit would reduce the amount available under the

Revolving Credit Facility.

F-41