MoneyGram 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

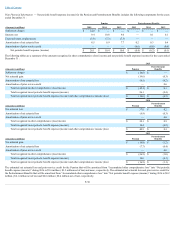

During 2014 , the Company issued performance-based restricted stock units, which are subject to three-year cliff vesting, based on average annual Adjusted

EBITDA growth and Digital/Self-Service revenue growth during the applicable performance period (2014 - 2016). Under the terms of the restricted stock units

granted in 2014 , the number of restricted stock units that will vest is determined based on the extent to which the performance goals are achieved. Under the terms

of the grant, 50 percent of the restricted stock units granted will vest for threshold performance and 100 percent of the restricted stock units granted will vest for the

achievement of average annual Adjusted EBITDA and Digital/Self-Service revenue at target. The number of restricted stock units that will vest for performance

achievement between the performance threshold and target will be determined based on a straight-line interpolation. No restricted stock units will vest for

performance achievement below the threshold.

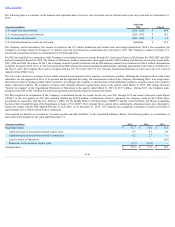

In the fourth quarter of 2014 , the Company deemed the performance metrics for the 2011 and 2012 performance-based restricted stock units not probable of being

attained. As such, the Company reversed $1.2 million of stock- based compensation expense. Also, in the fourth quarter of 2014 , the Company deemed the

performance metrics for the annual performance-based restricted stock units granted in 2013 and 2014 and the one-time contingent performance-based restricted

stock units not probable of being attained. As such, the Company reversed $9.0 million of stock-based compensation expense. In addition, the Company materially

modified certain of the terms of the above mentioned performance-based restricted stock units. The Company accounted for this as a modification of awards,

treating the exchange as a cancellation of the original awards accompanied by the concurrent grant of replacement awards. The terms under certain of the 2013

annual restricted stock unit awards were modified to time-based restricted stock units and the performance metrics associated with the one-time contingent

performance-based restricted stock unit awards were modified to exclude U.S. to U.S. walk-in revenue from the performance goal. Each award remains subject to

three -year cliff vesting. The terms under certain of the 2014 annual awards, which are subject to three -year cliff vesting, were modified to exclude annual

Adjusted EBITDA growth as a performance metric. The modified 2014 annual awards will only use average annual adjusted Digital/Self-Service revenue growth

as a performance target during the applicable performance period. The modifications to these awards affected 389 employees.

The incremental compensation cost of $4.2 million was measured as the excess of the fair value of the replacement award over the fair value of the original award

immediately before the modification date. The incremental costs will be amortized over the remaining term of the exchanged restricted stock unit award.

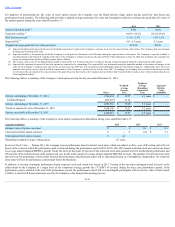

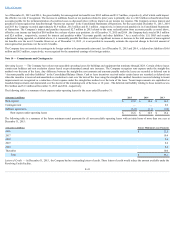

During 2015 , the Company issued performance-based restricted stock units, which are subject to a one-year performance period, based on annual Adjusted

EBITDA and Digital/Self-Service revenue for the fiscal year 2015. Under the terms of the restricted stock units agreement granted in 2015, the number of

restricted stock units that will vest is determined based on the extent to which the performance goals are achieved. Under the terms of the grant, 50 percent of the

restricted stock units granted will vest for threshold performance and 100 percent of the restricted stock units granted will vest for the achievement of the annual

Adjusted EBITDA and Digital/Self-Service revenue at target. Upon achievement of the performance goal, each award vests ratably over a three -year period from

the grant date. The number of restricted stock units that will vest for performance achievement between the performance threshold and target will be determined

based on a straight-line interpolation. No restricted stock units will vest for performance achievement below the threshold.

For purposes of determining the fair value of restricted stock units and performance-based restricted stock units, the fair value is calculated based on the stock price

at the time of grant. For performance-based restricted stock units, expense is recognized if achievement of the performance goal is deemed probable, with the

amount of expense recognized based on the Company’s best estimate of the ultimate achievement level. For the performance-based restricted stock units, the grant-

date fair values at the threshold and target performance levels are $12.7 million and $25.5 million , respectively. As of December 31, 2015 , the Company believes

it is probable it will achieve the performance goal at the target level for the 2015 restricted stock units and the one-time contingent performance-based restricted

stock unit award issued in 2013 and will achieve the threshold levels for the modified 2014 annual awards. For grants to employees, expense is recognized in the

“Compensation and benefits” line and expense for grants to Directors is recorded in the “Transaction and operations support” line in the Consolidated Statements

of Operations using the straight-line method over the vesting period.

F-37