MoneyGram 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

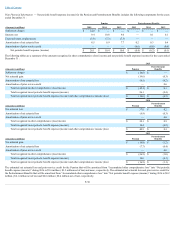

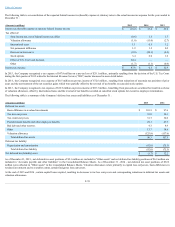

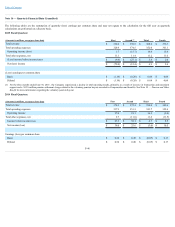

The following table is a reconciliation of the expected federal income tax (benefit) expense at statutory rates to the actual income tax expense for the years ended in

December 31 :

(Amounts in millions) 2015

2014

2013

Income tax (benefit) expense at statutory federal income tax rate $ (10.2)

$ 25.4

$ 29.8

Tax effect of:

State income tax, net of federal income tax effect (0.6)

1.5

1.7

Valuation allowance (1.0)

(13.0)

(2.7)

International taxes 1.1

0.5

3.2

Net permanent difference 1.2

1.5

0.2

Decrease in tax reserve (8.8)

(20.3)

(0.5)

Stock options 3.4

6.0

1.6

Effect of U.S. Tax Court decision 64.4

—

—

Other (1.7)

(1.1)

(0.4)

Income tax expense $ 47.8

$ 0.5

$ 32.9

In 2015 , the Company recognized a tax expense of $47.8 million on a pre-tax loss of $29.1 million , primarily resulting from the decision of the U.S. Tax Court

during the first quarter of 2015 related to the Internal Revenue Service (“IRS”) matter discussed in more detail below.

In 2014 , the Company recognized a tax expense of $0.5 million on pre-tax income of $72.6 million , resulting from reductions of uncertain tax positions of prior

years and the tax treatment of the net securities gains which were partially offset by the reversal of tax benefits on canceled stock options.

In 2013 , the Company recognized a tax expense of $32.9 million on pre-tax income of $85.3 million , benefiting from proceeds on securities that result in a release

of valuation allowance, offset by international taxes and the reversal of tax benefits recorded on cancelled stock options for executive employee terminations.

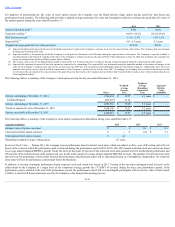

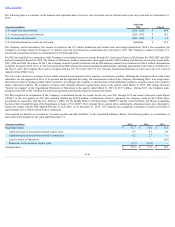

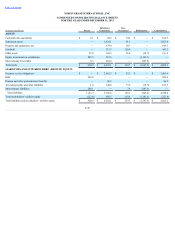

The following table is a summary of the Company’s deferred tax assets and liabilities as of December 31 :

(Amounts in millions) 2015

2014

Deferred tax assets:

Basis difference in revalued investments $ 101.5

$ 97.6

Tax loss carryovers 35.8

50.1

Tax credit carryovers 31.7

30.2

Postretirement benefits and other employee benefits 29.1

47.7

Bad debt and other reserves 4.3

4.9

Other 13.7

14.6

Valuation allowance (125.8)

(137.6)

Total deferred tax assets 90.3

107.5

Deferred tax liability:

Depreciation and amortization (92.0)

(75.3)

Total deferred tax liability (92.0)

(75.3)

Net deferred tax (liability) asset $ (1.7)

$ 32.2

As of December 31, 2015 , net deferred tax asset positions of $5.1 million are included in “Other assets” and net deferred tax liability positions of $6.8 million are

included in “Accounts payable and other liabilities” in the Consolidated Balance Sheets. As of December 31 , 2014 , net deferred tax asset positions of $32.2

million were reflected in "Other assets" in the Consolidated Balance Sheets. Valuation allowances relate primarily to capital loss carryovers, basis differences in

revalued investments and to a smaller extent, certain foreign tax loss carryovers.

At the end of 2015 and 2014 , certain capital losses expired, resulting in decreases to tax loss carryovers and corresponding reductions in deferred tax assets and

valuation allowances.

F-39