MoneyGram 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

2013NoteRepurchase— In connection with the Company's entry into the 2013 Credit Agreement, the Company purchased all $325.0 million of the outstanding

second lien notes for a purchase price equal to 106.625 percent of the principal amount purchased, plus accrued and unpaid interest, which was funded with a

portion of the net proceeds from the 2013 Credit Agreement described above. Following the closing of the transaction, the second lien notes were canceled, and no

second lien notes remain outstanding.

The termination of the 2011 Credit Agreement and entry into the 2013 Credit Agreement and the purchase of the second lien notes were accounted for principally

as a debt extinguishment with a partial modification of debt, in accordance with ASC Topic 470, “ Debt." Under debt extinguishment accounting, the Company

expensed the pro-rata portion of debt issuance costs and debt discount costs related to the extinguished debt balance. For the debt balance classified as a

modification, the Company was required to amortize the pro-rata portion of the debt issuance costs and unamortized debt discount from the 2011 Credit Agreement

over the terms of the 2013 Credit Agreement. Additionally, the Company expensed the pro-rata portion of the financing costs related to the 2013 Credit Agreement

as third-party costs in connection with the modification of debt.

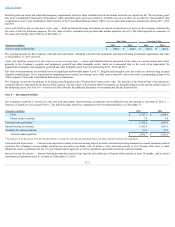

DebtCovenantsandOtherRestrictions — Borrowings under the 2013 Credit Agreement are subject to various limitations that restrict the Company’s ability to:

incur additional indebtedness; create or incur additional liens; effect mergers and consolidations; make certain acquisitions or investments; sell assets or subsidiary

stock; pay dividends and other restricted payments; and effect loans, advances and certain other transactions with affiliates. In addition, the Revolving Credit

Facility has covenants that place limitations on the use of proceeds from borrowings under the facility.

The terms of our debt agreements place significant limitations on the amount of restricted payments we may make, including dividends on our common stock and

our repurchase of our capital stock. Subject to certain customary conditions, we may (i) make restricted payments in an aggregate amount not to exceed $50.0

million (without regard to a pro forma leverage ratio calculation), (ii) make restricted payments up to a formulaic amount determined based on an incremental

build-up of our consolidated net income in future periods (subject to compliance with a maximum pro forma leverage ratio calculation) and (iii) repurchase capital

stock from THL and Goldman Sachs in a remaining aggregate amount up to $170.0 million as discussed above.

The 2013 Credit Agreement contains various financial and non-financial covenants. A violation of these covenants could negatively impact the Company's

liquidity by restricting the Company's ability to borrow under the Revolving Credit Facility and/or causing acceleration of amounts due under the credit facilities.

The financial covenants in the 2013 Credit Agreement measure leverage, interest coverage and liquidity. Leverage is measured through a senior secured debt ratio

calculated as consolidated indebtedness to consolidated EBITDA (earnings before interest, taxes, depreciation and amortization), adjusted for certain items such as

net securities gains, stock-based compensation expense, certain legal settlements and asset impairments, among other items, also referred to as adjusted EBITDA.

This measure is similar, but not identical, to Adjusted EBITDA (EBITDA adjusted for certain significant items) as discussed in Note 12 — Stock-Based

Compensation.Interest coverage is calculated as adjusted EBITDA to net cash interest expense.

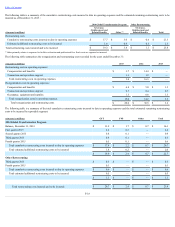

The Company is required to maintain asset coverage greater than its payment service obligations. Assets used in the determination of the asset coverage covenant

are cash and cash equivalents and settlement assets. Our cash and cash equivalents balance as of December 31, 2015 represents the excess of assets over our

payment service obligation for purposes of determining asset coverage.

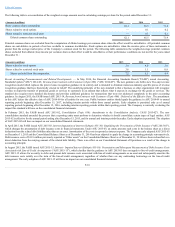

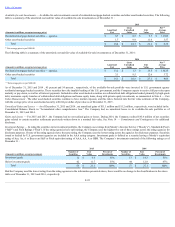

The following table shows the components of our assets in excess of payment service obligations used for the asset coverage calculation as of December 31 :

(Amounts in millions) 2015

2014

Cash and cash equivalents $ 164.5

$ 250.6

Settlement assets 3,505.6

3,533.6

Total cash and cash equivalents and settlement assets 3,670.1

3,784.2

Payment service obligations (3,505.6)

(3,533.6)

Assets in excess of payment service obligations $ 164.5

$ 250.6

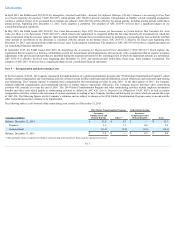

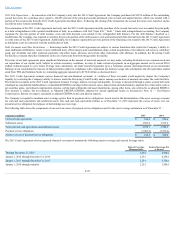

The 2013 Credit Agreement also has quarterly financial covenants to maintain the following interest coverage and secured leverage ratios:

Interest Coverage

Minimum Ratio

Secured Leverage Not

to Exceed

Through December 31, 2015 2.25:1

4.750:1

January 1, 2016 through December 31, 2016 2.25:1

4.250:1

January 1, 2017 through December 31, 2017 2.25:1

3.750:1

January 1, 2018 through maturity 2.25:1

3.500:1

F-26