MoneyGram 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

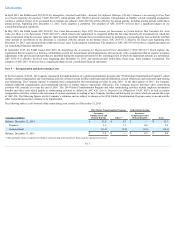

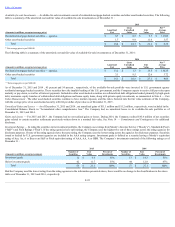

In April 2015, the FASB issued ASU 2015-05, Intangibles—GoodwillandOther—Internal-UseSoftware(Subtopic350-40):Customer’sAccountingforFeesPaid

inaCloudComputingArrangement("ASU 2015-05"), which amends ASC 350-40 to provide customers with guidance on whether a cloud computing arrangement

contains a software license to be accounted for as internal use software. ASU 2015-05 will be effective for annual periods, including interim periods within those

annual periods, beginning after December 15, 2015. Early adoption is permitted. The adoption of ASU 2015-05 will not have a significant impact on our

consolidated financial statements.

In May 2015, the FASB issued ASU 2015-07, FairValue Measurement(Topic 820):Disclosures forInvestments inCertainEntities ThatCalculate NetAsset

ValueperShare(orItsEquivalent)("ASU 2015-07"), which removes the requirement to categorize within the fair value hierarchy all investments for which fair

value is measured using the net asset value per share practical expedient. Instead, those investments must be included as a reconciling line item so that the total fair

value amount of investments in the disclosure is consistent with the amount on the balance sheet. ASU 2015-07 is effective for fiscal years beginning after

December 15, 2015, and interim periods within those fiscal years. Early adoption is permitted. The adoption of ASU 2015-07 will not have a significant impact on

our consolidated financial statements.

In September 2015, the FASB issued ASU 2015-16, Simplifying the Accounting for Measurement-Period Adjustments ("ASU 2015-16") which replaces the

requirement that an acquirer in a business combination account for measurement period adjustments retrospectively with a requirement that an acquirer recognize

adjustments to the provisional amounts that are identified during the measurement period in the reporting period in which the adjustment amounts are determined.

ASU 2015-16 is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Early adoption is permitted. The

adoption of ASU 2015-16 will not have a significant impact on our consolidated financial statements.

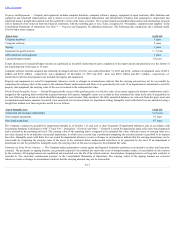

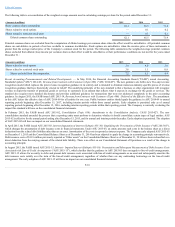

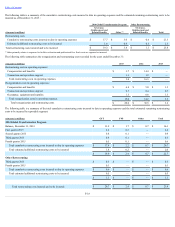

Note 3 — Reorganization and Restructuring Costs

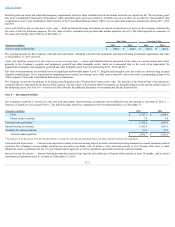

In the first quarter of 2014 , the Company announced the implementation of a global transformation program (the "2014 Global Transformation Program"), which

includes certain reorganization and restructuring activities centered around facilities and headcount rationalization, system efficiencies and headcount right-shoring

and outsourcing. The Company expects to complete these reorganization and restructuring activities in early 2016 . In the third quarter of 2015 , the Company

initiated additional reorganization and restructuring activities to further improve operational efficiencies. The Company projects that these other restructuring

activities will conclude at or near the end of 2016 . The 2014 Global Transformation Program and other restructuring activities include employee termination

benefits and other costs which qualify as restructuring activities as defined by ASC 420, Exit or Disposal Cost Obligations ("ASC 420"), as well as certain

reorganization activities related to the relocation of various operations to existing or new Company facilities and third-party providers which are outside the scope

of ASC 420. The following figures are the Company’s estimates and are subject to change as the 2014 Global Transformation Program comes to an end and the

other restructuring activities continue to be implemented.

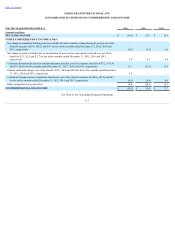

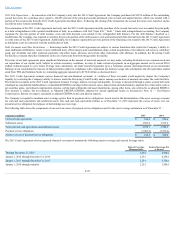

The following table is a roll-forward of the restructuring costs accrual as of December 31, 2015 :

2014 Global Transformation Program

Other Restructuring

(Amounts in millions)

Severance,

Outplacement and

Related Benefits

Other (1)

Severance,

Outplacement and

Related Benefits

Total

Balance, December 31, 2014 $ 12.6

$ 0.7

$ —

$ 13.3

Expenses 3.1

1.3

0.6

5.0

Cash payments (11.9)

(2.0)

(0.4)

(14.3)

Balance, December 31, 2015 $ 3.8

$ —

$ 0.2

$ 4.0

(1) Other primarily relates to expenses for facilities relocation and professional fees. Such costs are expensed as incurred.

F-17