MoneyGram 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

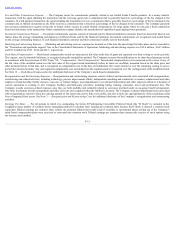

IncomeTaxes — The provision for income taxes is computed based on the pre-tax (loss) income included in the Consolidated Statements of Operations. Deferred

tax assets and liabilities are recorded based on the future tax consequences attributable to temporary differences that exist between the financial statement carrying

value of assets and liabilities and their respective tax basis, and operating loss and tax credit carry-forwards on a taxing jurisdiction basis. The Company measures

deferred tax assets and liabilities using enacted statutory tax rates that will apply in the years in which the Company expects the temporary differences to be

recovered or paid. The Company's ability to realize deferred tax assets depends on the ability to generate sufficient taxable income within the carry-back or carry-

forward periods provided for in the tax law. The Company establishes valuation allowances for its deferred tax assets based on a more-likely-than-not threshold.

To the extent management believes that recovery is not likely, a valuation allowance is established in the period in which the determination is made.

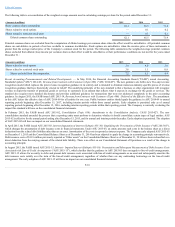

The liability for unrecognized tax benefits is recorded as a non-cash item in “Accounts payable and other liabilities” in the Consolidated Balance Sheets. The

Company records interest and penalties for unrecognized tax benefits in “Income tax expense” in the Consolidated Statements of Operations. See Note 13 —

IncomeTaxesfor additional disclosure.

TreasuryStock — Repurchased common stock is stated at cost and is presented as a separate component of stockholders’ deficit. See Note 11 — Stockholders’

Deficitfor additional disclosure.

ForeignCurrencyTranslation — The Company converts assets and liabilities of foreign operations to their U.S. dollar equivalents at rates in effect at the balance

sheet dates and records the translation adjustments in “Accumulated other comprehensive loss” in the Consolidated Balance Sheets. Income statements of foreign

operations are translated from the operation’s functional currency to U.S. dollar equivalents at the average exchange rate for the month. Foreign currency exchange

transaction gains and losses are reported in “Transaction and operations support” in the Consolidated Statements of Operations.

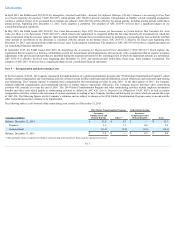

RevenueRecognition — The Company earns revenue primarily through service fees charged to consumers and through its investing activity. A description of

these revenues and revenue recognition policies is as follows:

• Fee and other revenue consists of transaction fees, service revenue, foreign exchange revenue and other revenue.

• Transaction fees consist primarily of fees earned on money transfer, money order, bill payment and official check transactions. The money

transfer transaction fees vary based on the principal value of the transaction and the locations in which these money transfers originate and to

which they are sent. The official check, money order and bill payment transaction fees are fixed fees charged on a per item basis. Transaction

fees are recognized at the time of the transaction or sale of the product.

• Foreign exchange revenue is earned from the management of currency exchange spreads on money transfer transactions involving different

“send” and “receive” currencies. Foreign exchange revenue is recognized at the time the exchange in funds occurs.

• Other revenue primarily consists of service charges on aged outstanding money orders and money order dispenser fees. Additionally, for

unclaimed payment instruments and money transfers, we recognize breakage income when the likelihood of consumer pick-up becomes remote

based on historical experience and there is no requirement for remitting balances to government agencies under unclaimed property laws.

• Investment revenue is earned from the investment of funds generated from the sale of payment instruments, primarily official checks and money orders,

and consists of interest income, dividend income, income received on our cost recovery securities and amortization of premiums and discounts.

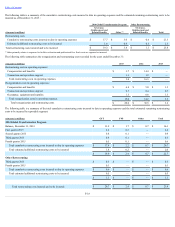

CustomerLoyaltyProgram— The MoneyGram Rewards loyalty program, introduced in January 2012, allowed enrolled members to earn points based on the face

value of their send transactions, along with opportunities for points earned from promotional activities. Points were redeemable for various denominations of gift

cards. The Company estimated the cost of the rewards and recorded this expense and the associated liability as points were accumulated by loyalty program

members. The cost was recognized in “Transaction and operational support” within the Consolidated Statements of Operations, and the associated liability was

included in “Accounts payable and other liabilities” in the Consolidated Balance Sheets.

In October 2013, the Company began to transition its MoneyGram Rewards loyalty program to a convenience card program, which does not feature points. The

Company provided participants in the MoneyGram Rewards program until December 7, 2013 to redeem any outstanding program points, after which all points

were canceled. As a result of the point cancellation, the Company had a reduction of marketing expense of $3.9 million in 2013. As of December 31, 2015 , the

Company has no remaining liability related to the loyalty program.

F-14