MoneyGram 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

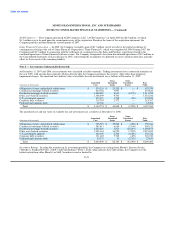

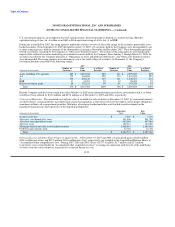

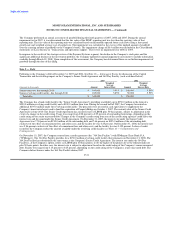

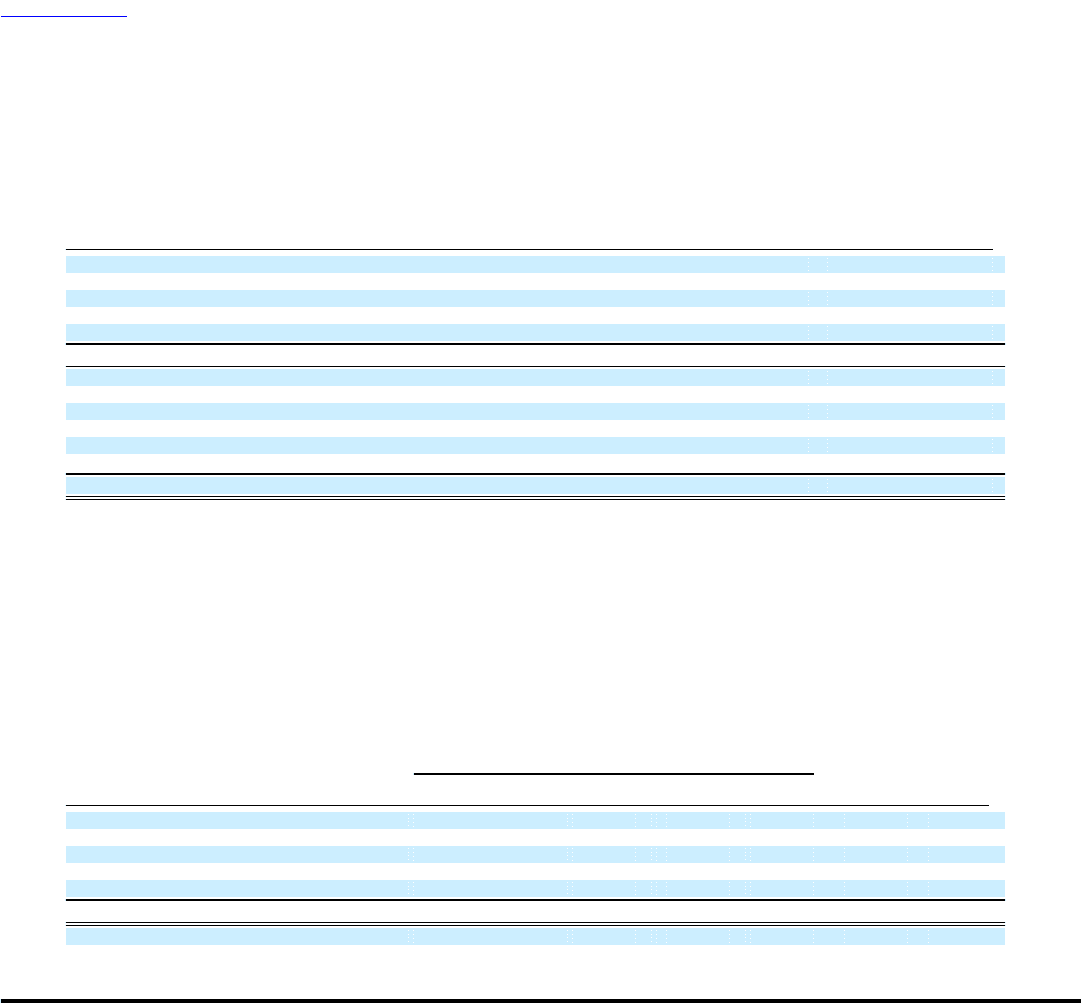

As a result of these developments, the Company recognized $1.2 billion of other-than-temporary impairments in December 2007 as

shown below:

(Amounts in thousands)

Other asset-backed securities

Direct exposure to sub-prime $ (76,282)

Indirect exposure to sub-prime — high grade (170,386)

Indirect exposure to sub-prime — mezzanine (393,137)

Other (401,766)

Total other asset-backed securities (1,041,571)

Obligations of states and political subdivisions (115)

Commercial mortgage-backed securities (93,257)

Residential mortgage-backed securities (38,751)

U.S. government agencies —

Corporate debt securities (5,989)

Preferred and common stock (7,404)

Total $ (1,187,087)

Impairments in 2006 related to investments backed by automobile, aircraft, manufactured housing, bank loans and insurance securities

collateral. Impairments in 2005 related primarily to investments backed by aircraft and manufactured housing collateral.

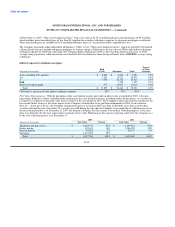

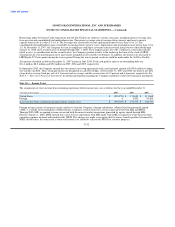

Exposure to Sub-prime Mortgages: The Company holds securities classified in "Other asset-backed securities" that are collateralized by

sub-prime mortgages. At December 31, 2007, $273.0 million, or less than 7 percent of the fair value of the Company's $4,187.4 million

investment portfolio, had direct exposure to sub-prime mortgages as collateral. Nearly all of these securities had investment grade ratings.

In considering securities collateralized by sub-prime mortgages, it is important to note the vintage, or year of origination, of the

mortgages as the industry loss experience in pre-2006 vintages appears to be much lower than the 2006 and 2007 vintages. Of the

Company's $273.0 million direct exposure to sub-prime mortgages, $247.5 million relates to sub-prime mortgages originated prior to

2006. Following is the fair value of securities collateralized by sub-prime mortgages at December 31, 2007 by vintage (based on the

original security issuance date) and rating:

Direct exposure to subprime mortgages

Vintage Percent

2003 and of Total

(Amounts in thousands) 2007 2006 2005 2004 Earlier Total Portfolio

AAA, including U.S. agencies $ 10,169 $ 29,928 $ 40,097 0.9%

AA $ 3,025 $ 16,347 17,089 $ 35,078 49,404 120,943 2.9%

A 6,194 14,880 72,559 14,317 107,950 2.6%

BBB 3,199 3,199 0.1%

Below investment grade 136 704 840 0.0%

Total $ 3,025 $ 22,541 $ 45,473 $ 108,341 $ 93,649 $ 273,029 6.5%

Vintage as a percent of total direct exposure 1% 8% 17% 40% 34% 100%

F-24