MoneyGram 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Notes contain covenants that, among other things, limit our ability to: incur or guarantee additional indebtedness; pay dividends or

make other restricted payments; make certain investments; create or incur certain liens; sell assets or subsidiary stock; transfer all or

substantially all of their assets or enter into merger or consolidation transactions and enter into transactions with affiliates. The covenants

also substantially restrict our ability to incur additional debt, create or incur liens and invest assets that are subject to restrictions for the

payment of payment service obligations. We are also required to maintain at least a 1:1 ratio of certain assets to outstanding payment

service obligations.

We can redeem the Notes after five years at specified premiums. Prior to the fifth anniversary, we may redeem some or all of the Notes at

a price equal to 100 percent of the principal amount thereof, plus accrued and unpaid interest, if any, plus a premium equal to the greater

of one percent or an amount calculated by discounting the sum of (a) the redemption payment that would be due upon the fifth

anniversary plus (b) all required interest payments due through such fifth anniversary using the treasury rate plus 50 basis points. Upon a

change of control, we are required to make an offer to repurchase the Notes at a price equal to 101 percent of the principal amount plus

accrued and unpaid interest. We are also required to make an offer to repurchase the Notes with proceeds of certain asset sales that have

not been reinvested in accordance with the terms of the Note or have not been used to repay certain debt.

Inter-creditor Agreement — In connection with the financing arrangements, the lenders under both the Senior Facility and the Notes have

agreed to be bound by the terms of an inter-creditor agreement under which the lenders have agreed to waive certain rights and limit the

exercise of certain remedies available to them for a limited period of time both before and following a default under the financing

arrangements.

Restructuring of the Official Check Business

In December 2007, the Company completed its review of our Payment Systems segment. As a result of this review, the Company has

begun to restructure our official check business model by changing our commission structure and exiting certain large customer

relationships. This restructuring will enable the Company to continue providing these essential services by focusing on small- to mid-

sized institutions. The Company expects to exit contracts with most of its top ten official check customers, who together account for

approximately $2 billion of the Company's official check payment obligations. Included in the top ten official check customers are the

financial institutions for which the Company maintains SPEs. With the sale of investments and the Capital Transaction, we believe that

we have sufficient liquidity to manage the exiting of these customers without disruption to daily operating liquidity needs.

Other Funding Sources and Requirements

At December 31, 2007, we had uncommitted repurchase agreements, letters of credit and various overdraft facilities totaling $2.3 billion

available to assist in the management of our investments and the clearing of PSO. There was $14.8 million outstanding under various

letters of credit at December 31, 2007.

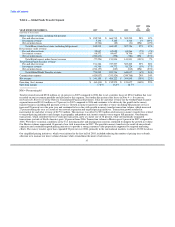

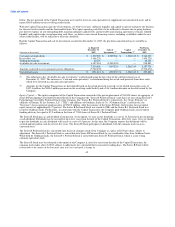

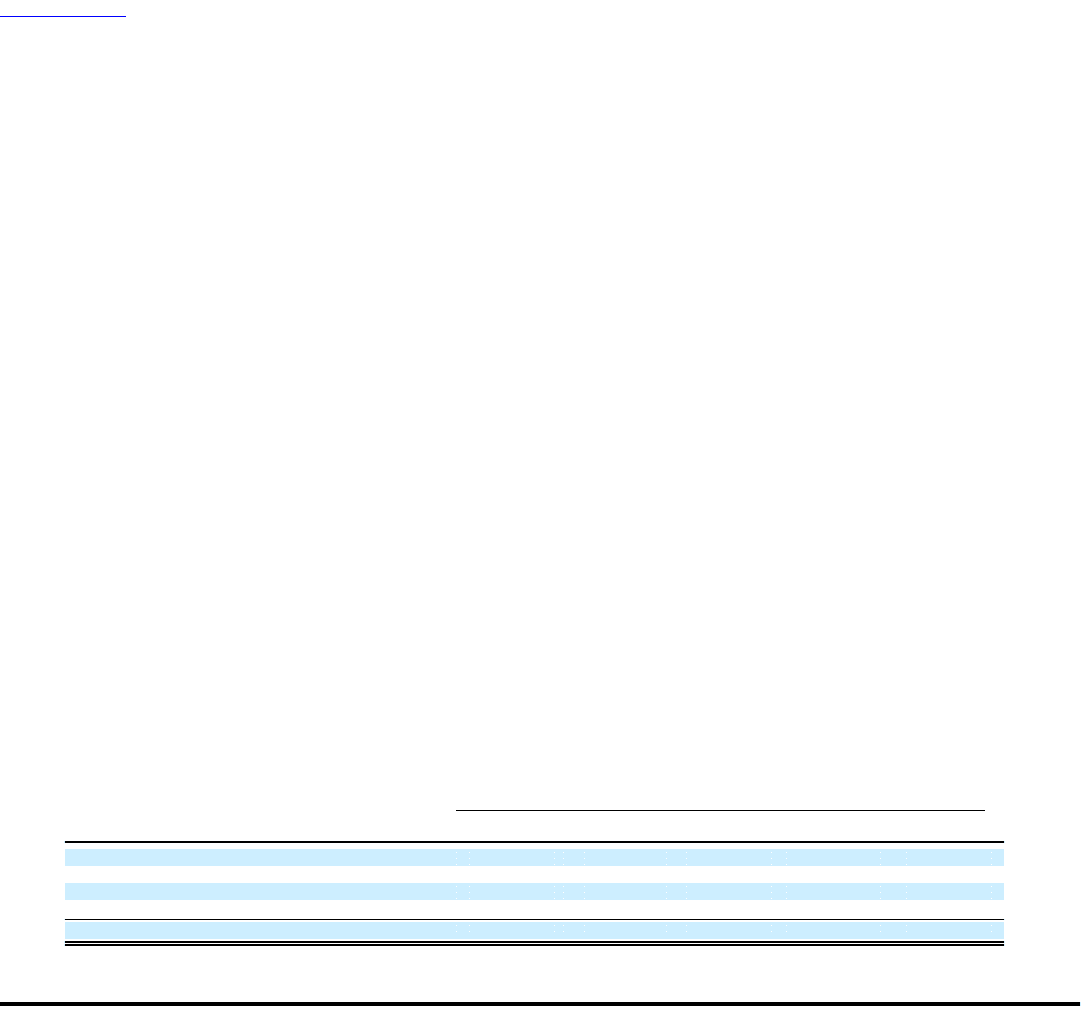

Contractual Obligations — The following table includes aggregated information about the Company's contractual obligations that impact

its liquidity and capital needs. The table includes information about payments due under specified contractual obligations, aggregated by

type of contractual obligation.

Table 9 — Contractual Obligations

Payments due by period

Less than More than

(Amounts in thousands) Total 1 year 1-3 years 4-5 years 5 years

Debt, including interest payments $ 417,920 $ 29,372 $ 388,548 $ — $ —

Operating leases 52,492 10,453 17,986 12,758 11,295

Derivative financial instruments (28,724) (5,507) (20,539) (2,678) —

Other obligations 3,928 3,928 — — —

Total contractual cash obligations $ 445,616 $ 38,246 $ 385,995 $ 10,080 $ 11,295

47