MoneyGram 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

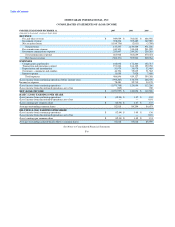

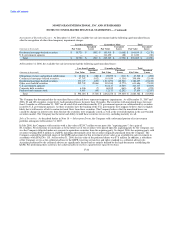

Intangible assets with finite lives are amortized using a straight-line method over their respective useful lives. The useful lives of

intangibles assets are as follows:

Customer lists primarily 9-15 years

Patents 15 years

Noncompetition agreements 3 years

Trademarks 36-40 years

Developed technology 5 years

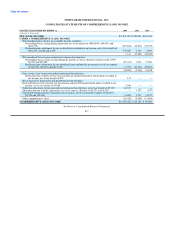

Goodwill is tested for impairment using a fair-value based approach. The Company assesses goodwill at the reporting unit level, which is

determined to be the lowest level at which management reviews cash flows for a business. Goodwill, which is generated solely through

acquisitions, is allocated to the reporting unit in which the acquired business operates. The carrying value of the reporting unit is

compared to its estimated fair value; any excess of carrying value over fair value is deemed to be an impairment. Intangible, and other

long-lived, assets are tested for impairment by comparing the carrying value of the assets to the estimated future undiscounted cash flows.

If an impairment is determined to exist for goodwill and intangible assets, the carrying value of the asset is reduced to the estimated fair

value. For all periods presented, substantially all of the Company's goodwill is allocated to the Money Transfer reporting unit. The

impairment tests are performed for goodwill in November of each fiscal year, as well as when an impairment indicator is identified.

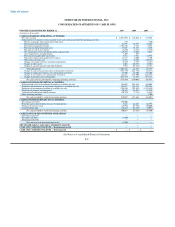

Payments on Long-Term Contracts — We make incentive payments to certain agents and financial institution customers as an incentive

to enter into long-term contracts. The payments are generally required to be refunded pro rata in the event of nonperformance or

cancellation by the customer. Payments are capitalized and amortized over the life of the related agent or financial institution contracts as

management is satisfied that such costs are recoverable through future operations, minimums, penalties or refunds in case of early

termination. Amortization of payments on long-term contracts is recorded in "Fees commission expense" in the Consolidated Statements

of (Loss) Income. The carrying values of these incentive payments are reviewed whenever events or changes in circumstances indicate

that the carrying amounts may not be recoverable in accordance with the provisions of SFAS No. 144, Accounting for the Impairment

and Disposal of Long-Lived Assets.

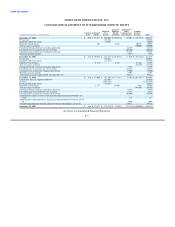

Income Taxes — Prior to the Distribution, income taxes were determined on a separate return basis as if MoneyGram had not been

eligible to be included in the consolidated income tax return of Viad and its affiliates. The provision for income taxes is computed based

on the pretax income included in the Consolidated Statements of (Loss) Income. Deferred income taxes result from temporary differences

between the financial reporting basis of assets and liabilities and their respective tax-reporting basis. Deferred tax assets and liabilities are

measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected

to reverse. Valuation allowances are recorded to reduce deferred tax assets when it is more likely than not that a tax benefit will not be

realized.

The Company adopted the provisions of FIN No. 48, Accounting for Uncertainty in Income Taxes, on January 1, 2007. The cumulative

effect of applying FIN No. 48 is reported as an adjustment to the opening balance of retained income. As a result of the implementation

of FIN No. 48, the Company recognized a $29.6 million increase in the liability for unrecognized tax benefits, a $7.6 million increase in

deferred tax assets and a $22.0 million reduction to the opening balance of retained income. The $29.6 million increase in the liability for

unrecognized tax benefits is recorded as a non-cash item in "Accounts payable and other liabilities" in the Consolidated Balance Sheets.

The Company records interest and penalties for unrecognized tax benefits in "Income tax expense" in the Consolidated Statements of

(Loss) Income.

Treasury Stock — Repurchased common stock is stated at cost and is presented as a separate reduction of stockholders' equity.

F-16