MoneyGram 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

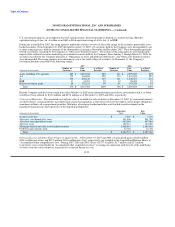

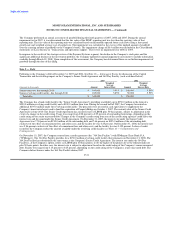

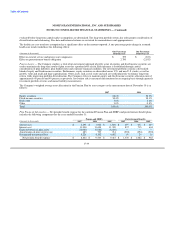

Borrowings under the Senior Credit Agreement and 364 Day Facility are subject to various covenants, including interest coverage ratio,

leverage ratio and consolidated total indebtedness ratio. The interest coverage ratio of earnings before interest and taxes to interest

expense must not be less than 3.5 to 1.0. The leverage ratio of total debt to total capitalization must be less than 0.5 to 1.0. The

consolidated total indebtedness ratio of total debt to earnings before interest, taxes, depreciation and amortization must be less than 3.0 to

1.0. At December 31, 2007, the Company was not in compliance with these covenants and received an initial waiver of default through

January 31, 2008 and a second waiver of default through May 1, 2008. The Company paid a fee of $1.2 million in connection with the

initial waiver. As consideration for the second waiver, the Company granted security to the lenders in the form of the stock of MPSI,

substantially all of its non-financial assets and various intangible assets related to its business. In addition, the interest rate increased to

LIBOR plus 275 basis points during the waiver period. During the waiver period, no draws could be made under the 364 Day Facility.

All amounts classified as debt on December 31, 2007 mature in June 2010. Total cash paid for interest on outstanding debt was

$11.6 million, $8.5 million and $5.8 million in 2007, 2006 and 2005, respectively.

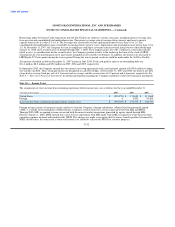

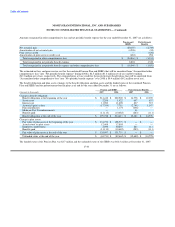

In September 2005, the Company entered into two interest rate swap agreements with a total notional amount of $150.0 million to hedge

our variable rate debt. These swap agreements are designated as cash flow hedges. At December 31, 2007 and 2006, the interest rate debt

swaps had an average fixed pay rate of 4.3 percent and an average variable receive rates of 4.5 percent and 4.6 percent, respectively. See

Note 5 — Derivative Financial Instruments for further information regarding the Company's portfolio of derivative financial instruments.

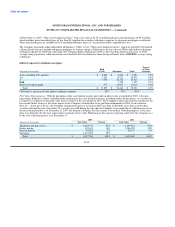

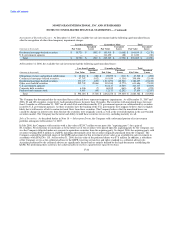

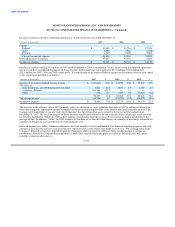

Note 10 — Income Taxes

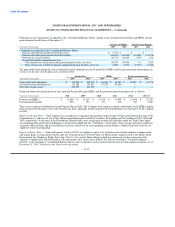

The components of (loss) income from continuing operations before income taxes are as follows for the year ended December 31:

(Amounts in thousands) 2007 2006 2005

United States $ (993,273) $ 171,681 $ 111,868

Foreign 6 5,092 34,508

(Loss) income from continuing operations before income taxes $ (993,267) $ 176,773 $ 146,376

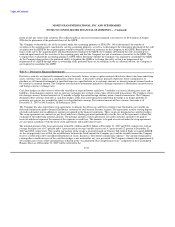

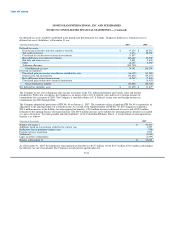

Foreign income consists of statutory income and losses from the Company's foreign subsidiaries. MoneyGram International Limited

("MIL"), a wholly owned subsidiary of MoneyGram, recognizes revenue based on a services agreement between MIL and MPSI.

Through 2005, MIL recognized revenue associated with the money transfer transactions generated by agents signed through MIL.

Effective January 1, 2006, MPSI entered into a new Services Agreement with MIL under which MIL recognizes revenue based on their

operating expenses incurred and reimbursed by MPSI. This change was made to recognize that the money transfer product is licensed by

MPSI and therefore, the transaction revenue and related costs should be reflected by MPSI for statutory purposes.

F-32