MoneyGram 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

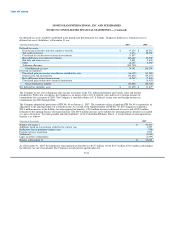

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

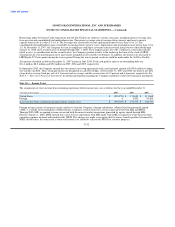

the deferred tax assets would be established in the period such determination was made. Temporary differences, which give rise to

deferred tax assets (liabilities), at December 31 are:

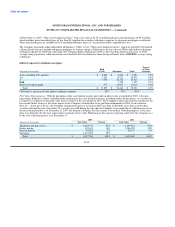

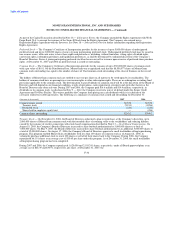

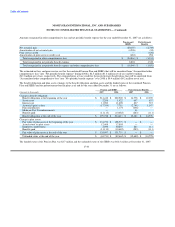

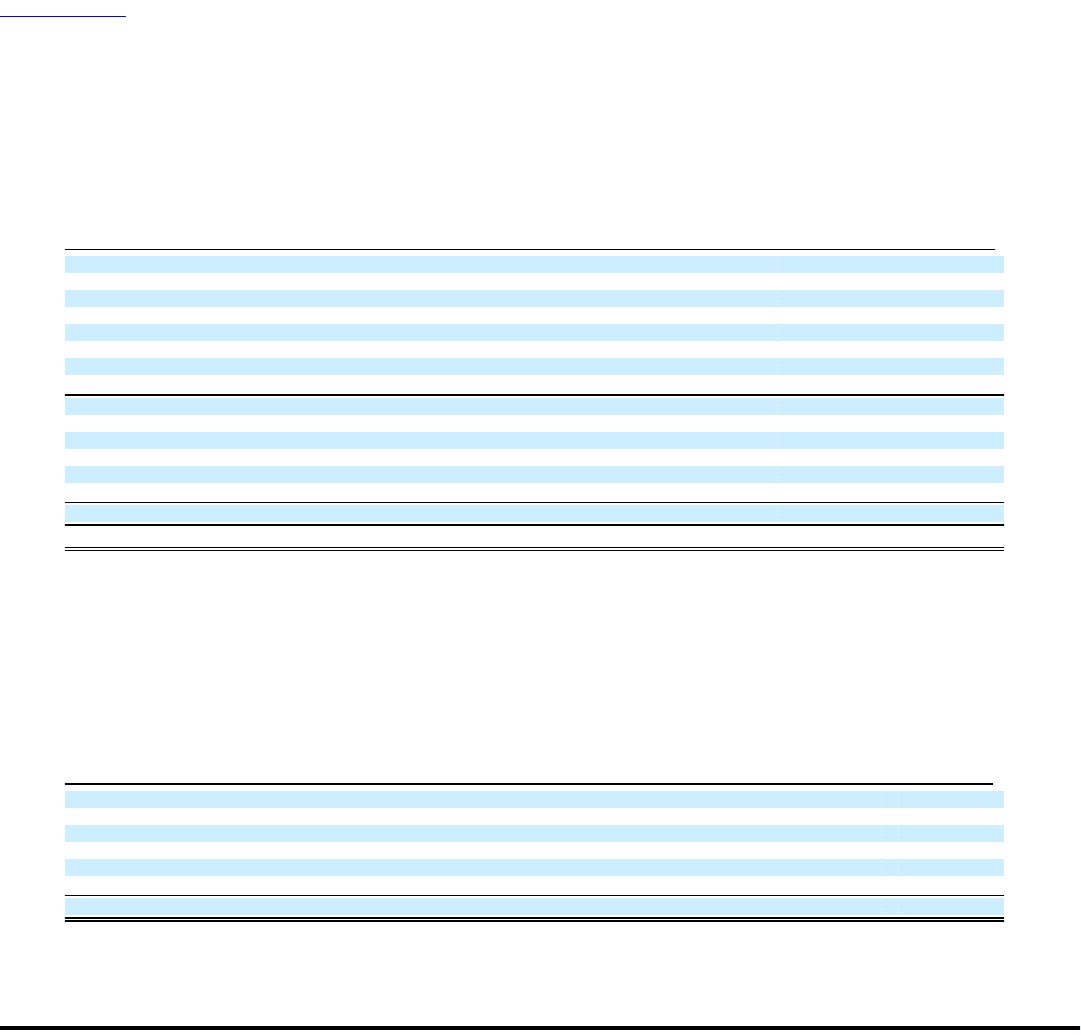

(Amounts in thousands) 2007 2006

Deferred tax assets:

Postretirement benefits and other employee benefits $ 37,274 $ 48,587

Tax credit carryovers 1,474 20,202

Unrealized loss on derivative financial investments 11,857 —

Basis difference in revalued investments 442,442 25,502

Bad debt and other reserves 2,801 2,630

Other 14,194 4,285

Valuation allowance (435,700) —

Total deferred tax asset 74,342 101,206

Deferred tax liabilities:

Unrealized gain on securities classified as available-for-sale (16,192) (15,083)

Depreciation and amortization (64,848) (59,673)

Basis difference in investment income (4,761) (7,820)

Unrealized gain on derivative financial instruments — (6,953)

Gross deferred tax liability (85,801) (89,529)

Net deferred tax (liability) asset $ (11,459) $ 11,677

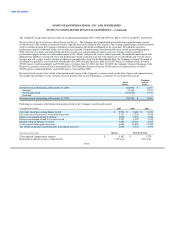

The Company or one of its subsidiaries files income tax returns in the U.S. federal jurisdiction and various states and foreign

jurisdictions. With a few exceptions, the Company is no longer subject to U.S. federal, state and local, or foreign income tax

examinations for years prior to 2004. The Company is currently subject to U.S. Federal, certain state and foreign income tax

examinations for 2004 through 2006.

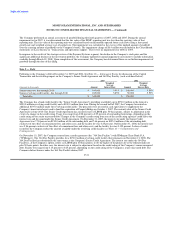

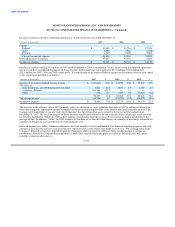

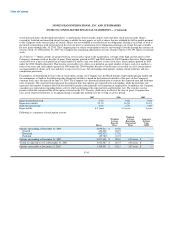

The Company adopted the provisions of FIN No. 48 on January 1, 2007. The cumulative effect of applying FIN No. 48 is reported as an

adjustment to the opening balance of retained income. As a result of the implementation of FIN No. 48, the Company recognized a

$29.6 million increase in the liability for unrecognized tax benefits, a $7.6 million increase in deferred tax assets and a $22.0 million

reduction to the opening balance of retained income. The $29.6 million increase in the liability for unrecognized tax benefits is recorded

as a non-cash item in "Accounts payable and other liabilities" in the Consolidated Balance Sheets. A reconciliation of unrecognized tax

benefits is as follows:

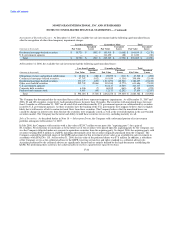

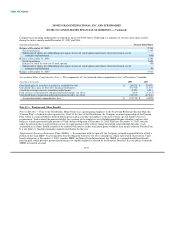

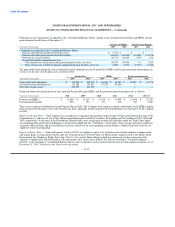

(Amounts in thousands) 2007

Balance at January 1 $ 33,351

Additions based on tax positions related to the current year 4,527

Reductions for tax positions of prior years (748)

Foreign currency translation 1,903

Settlements (1,965)

Lapse in statute of limitations (3,399)

Balance at December 31 $ 33,669

As of December 31, 2007, the liability for unrecognized tax benefits was $33.7 million. Of the $33.7 million, $31.0 million could impact

the effective tax rate if recognized. The Company records interest and penalties for

F-34