MoneyGram 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

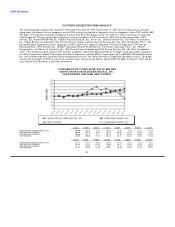

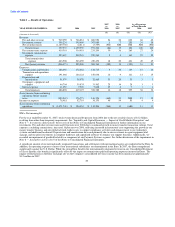

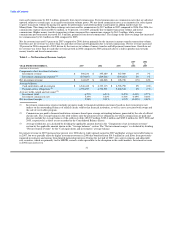

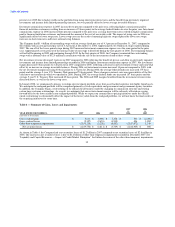

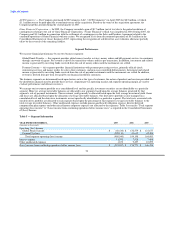

RESULTS OF OPERATIONS

Summary

Following are significant items affecting operating results from continuing operations in 2007:

• During 2007, we recorded $1.2 billion of net securities losses resulting from the decline in the value of our investment portfolio.

This resulted in a net loss from continuing operations of $1.1 billion for 2007.

• Fee and other revenue increased 24 percent to $949.1 million in 2007 from $766.9 million in 2006, driven primarily by continued

growth in money transfer transaction volume. Our Global Funds Transfer segment fee and other revenue grew 25 percent in 2007

over 2006, driven by 28 percent growth in money transfer transaction revenue and 27 percent growth in transaction volume.

• Expenses increased 16 percent in 2007 over 2006, driven primarily by increased transaction and operations support costs, increased

headcount and increased infrastructure costs supporting the growth in our money transfer business and increases in depreciation and

amortization.

During September 2007, the asset-backed securities market and broader credit markets began to experience significant disruption, with a

general lack of liquidity in the markets and deterioration in fair value of mortgage-backed securities triggered by concerns surrounding

sub-prime mortgages. In late November and December 2007, the asset-backed securities and credit markets experienced further

substantial deterioration under increasing concerns over defaults on mortgages and debt in general, as well as an increasingly negative

view towards all structured investments and the credit market. In December 2007, we began to experience adverse changes to the cash

flows from some of our asset-backed investments. As the market continued its substantial deterioration, we identified a need for

additional capital and commenced a plan in January 2008 to realign our investment portfolio away from asset-backed securities and into

highly liquid assets through the sale of a substantial portion of the investment portfolio. As a result of these developments, we recognized

$1.2 billion of other-than-temporary impairments in December 2007. See "Liquidity and Capital Resources — Impact of Credit Market

Disruption" for further information. The declines in the portfolio did not have an immediate impact on our liquidity, but rather created a

need for long-term capital.

In December 2007, we completed our strategic review of our Payment Systems segment. As a result of this review, we have begun to

restructure our official check business model by changing our commission structure and exiting certain large customer relationships. This

restructuring will enable us to continue providing these essential services by focusing on small- to mid-sized institutions. We expect to

exit contracts with most of our top ten official check customers, who together account for approximately $2 billion of our official check

payment service obligations. Included in the top ten official check customers are the financial institutions for which we maintain special

purpose entities ("SPEs"). With the sale of investments and the Capital Transaction (defined below), we believe we have sufficient

liquidity to manage the exiting of these customers without disruption to daily operating liquidity needs.

Capital Transaction

The Company completed a recapitalization transaction on March 25, 2008 pursuant to which the Company received a substantial infusion

of both equity and debt capital (the "Capital Transaction") to support the long term needs of the business and to provide necessary capital

due to the investment portfolio losses. The equity component consisted of a $760.0 million private placement of participating convertible

preferred stock. The debt component consisted of the issuance of $500.0 million of senior secured second lien notes with a ten year

maturity. Additionally, we entered into a senior secured amended and restated credit agreement amending the Company's existing

$350.0 million debt facility to increase the facility by $250.0 million to a total facility size of $600.0 million. The new facility includes

$350.0 million in two term loan tranches and a $250.0 million revolving credit facility. For a description of the terms of the equity and

debt components of the Capital Transaction discussed below, see "Management's Discussion and Analysis of Financial Condition and

Results of Operations — Liquidity and Capital Resources — Sale of Investments and Capital Transaction" and Note 18 Subsequent

Events of the Notes to Consolidated Financial Statements.

The net proceeds of the Capital Transaction were used to invest in cash equivalents to supplement our unrestricted assets.

27