MoneyGram 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

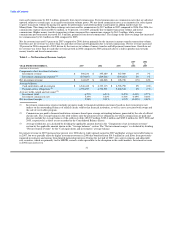

percent over 2005 due to higher yields on the portfolio from rising short-term interest rates and the benefit from previously impaired

investments and income from limited partnership interests, but was partially offset by lower average investable balances.

Investment commissions expense in 2007 increased two percent compared to the prior year, reflecting higher commissions paid to

financial institution customers resulting from an increase of 5 basis points in the average federal funds rate over the prior year. Investment

commissions expense in 2006 increased four percent compared to the prior year as rising short-term rates resulted in higher commissions

paid to financial institution customers and increased the amount of the cost of receivables sold. The impact of rising rates in 2006 was

significantly offset by lower swap costs. Lower swap costs are the result of maturing high rate swaps replaced by lower rate swaps,

increases in short-term rates and lower notional swap balances.

The Company had $1.4 billion of outstanding swaps with an average fixed pay rate of 4.3 percent at December 31, 2007, compared to

$2.6 billion with an average fixed pay rate of 4.3 percent at December 31, 2006. Approximately $1.4 billion of swaps matured during

2007. The run off of the lower priced swaps during 2007 increased investment commission expense over the same period in the prior

year. Approximately seven percent of the notional value of our swaps will roll off during the first quarter of 2008. The remaining balance

will roll off beginning in 2009 and continuing through 2012. In the first quarter of 2008, the Company terminated three outstanding

swaps with a notional value of $32.0 million in connection with the sale of the investments related to these swaps.

Net investment revenue decreased 1 percent in 2007 compared to 2006 reflecting the benefit of pre-tax cash flow on previously impaired

investments and income from limited partnerships recorded in 2006 and higher investment commission expense in 2007. Net investment

margin decreased 3 basis points to 2.28 percent in 2007 compared to 2006, reflecting a decrease in net investment revenue and somewhat

offset by an increase in average investable balances. During 2006, net investment revenue increased 14 percent compared to 2005, with

the net investment margin increasing 40 basis points to 2.31 percent. During 2006, the average federal funds rate increased 175 basis

points and the average 5-year U.S. Treasury Note increased 70 basis points. These changes in interest rates are representative of the flat

yield curve environment in which we operated in 2006. During 2005, the average federal funds rate increased 187 basis points and the

average 5-year U.S. Treasury Note increased 62 basis points. The 2006 and 2005 margins benefited from the investment revenue items

discussed above, as well as the lower swap costs.

In January 2008, we commenced a process to realign our investment portfolio away from asset-backed securities into highly liquid assets.

We anticipate the realigned portfolio will be comprised primarily of cash equivalents and government and government agency securities.

In addition, the Company began a restructuring of its official check business model by changing its commission structure and exiting

certain large customer relationships. As a result, we anticipate that our net investment margins will be adversely affected on a going

forward basis by the lower yields in our realigned portfolio. While we expect our commission re-pricing initiatives under the official

check restructuring to substantially offset the impact of the lower yields from the realigned portfolio, we will not know the final results of

the re-pricing initiatives for some time.

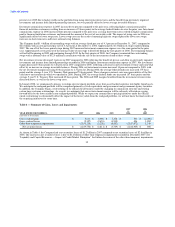

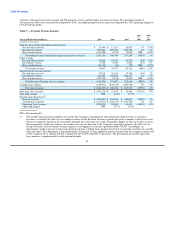

Table 4 — Summary of Gains, Losses and Impairments

2007 2006

vs. vs.

YEAR ENDED DECEMBER 31, 2007 2006 2005 2006 2005

(Amounts in thousands)

Gross realized gains $ 5,611 $ 5,080 $ 7,378 $ 531 $ (2,298)

Gross realized losses (2,157) (2,653) (4,535) 496 1,882

Other-than-temporary impairments (1,193,210) (5,238) (6,552) (1,187,972) 1,314

Net securities losses $ (1,189,756) $ (2,811) $ (3,709) $ (1,186,945) $ 898

As shown in Table 4, the Company had a net securities losses of $1.2 billion in 2007 compared to net securities losses of $2.8 million in

2006. The increase in net securities losses is due to $1.2 billion of other-than-temporary impairments recorded in December 2007. See

"Liquidity and Capital Resources — Impact of Credit Market Disruption" for further discussion of the other-than-temporary impairments.

32