MoneyGram 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

("SFAS") No. 115, Accounting for Certain Investments in Debt and Equity Securities. At December 31, 2006, the fair value of the

preferred shares was $7.8 million. In addition, one of our subsidiaries serves as the collateral advisor to the QSPE, receiving certain fees

and rights standard to a collateral advisor role. Activities performed by the collateral advisor are significantly limited and are entirely

defined by the legal documents establishing the QSPE. For performing these activities, the collateral advisor receives a quarterly fee

equal to ten basis points on the fair value of the collateral. The collateral advisor also received and recognized a one-time fee of

$0.4 million in 2006 for the placement of the preferred shares of the QSPE.

Other investing activity consisted of the use of cash of $70.5 million, $81.0 million and $47.4 million for 2007, 2006 and 2005,

respectively, for the purchase of property and equipment and development of software related to our continued investment in the money

transfer platform and compliance activities. Additionally, we acquired a 50 percent interest in a corporate aircraft in 2005 and the

remaining 50 percent interest in 2006. In 2007, we acquired PropertyBridge for $28.1 million. Also in 2007, we paid the remaining

$1.1 million of purchase price for ACH Commerce, which was to be paid upon the second anniversary of the acquisition under the terms

of the acquisition agreement. In 2006, we acquired Money Express, our former super agent in Italy and also received a payment from a

previous owner of Money Express. In 2005, we acquired ACH Commerce.

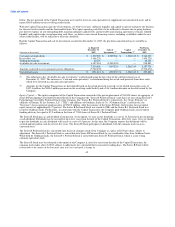

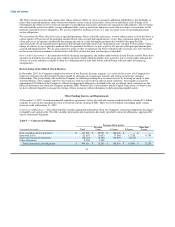

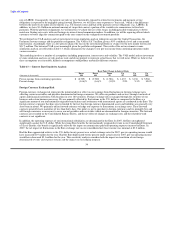

Table 12 — Cash Flows Provided By or Used in Financing Activities

YEAR ENDED DECEMBER 31, 2007 2006 2005

(Amounts in thousands)

Net debt activity $ 195,000 $ — $ —

Proceeds and tax benefit from exercise of stock options 7,674 24,643 16,798

Purchase of treasury stock (45,992) (67,856) (50,000)

Cash dividends paid (16,625) (14,445) (6,058)

Net cash provided by (used in) financing activities $ 140,057 $ (57,658) $ (39,260)

Table 12 summarizes the net cash flows used in financing activities. In 2007, we borrowed $195.0 million under our revolving credit

facility. Other sources of cash relate primarily to the exercise of share-based compensation, which provided $6.6 million, $21.9 million

and $15.0 million for 2007, 2006 and 2005, respectively. The exercise of share-based compensation generated tax benefits of

$1.1 million, $2.7 million and $1.8 million in 2007, 2006 and 2005, respectively. Cash used by financing activities related primarily to

our purchase of $46.0 million, $67.9 million and $50.0 million of treasury stock during 2007, 2006 and 2005, respectively. In addition,

we paid $16.6 million, $14.4 million and $6.1 million in dividends during 2007, 2006 and 2005, respectively.

Stockholders' Equity

On May 9, 2007, our Board of Directors approved an increase of our current authorization to purchase shares of common stock by an

additional 5,000,000 shares to a total of 12,000,000 shares. In 2007, we repurchased 1,620,000 shares of our common stock under this

authorization at an average cost of $28.39 per share. As of December 31, 2007, we have repurchased a total of 6,795,000 shares of our

common stock under this authorization and have remaining authorization to purchase up to 5,205,000 shares. We suspended the buyback

program in the fourth quarter of 2007.

On August 17, 2006, our Board of Directors approved a small stockholder selling/repurchasing program. This program enabled

MoneyGram stockholders with less than 100 shares of common stock as of August 21, 2006, to voluntarily purchase additional stock to

reach 100 shares or sell all of their shares back to us. We purchased a total of 66,191 shares related to this program, which ended as of

December 31, 2006.

During 2007, we paid $16.6 million in dividends on our common stock. Under the terms of the equity instruments and debt issued in

connection with the Capital Transaction, we are severely limited in our ability to pay dividends on our common stock. We do not

anticipate declaring any dividends on our common stock during 2008.

50