MoneyGram 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

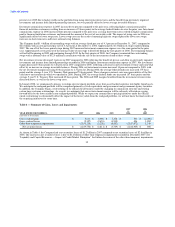

Compared to the $2.8 million of net securities losses recorded in 2006, the Company had net securities losses of $3.7 million in 2005,

primarily due to lower realized losses and lower impairments. Net securities losses of $2.8 million recorded in 2006 include impairments

related to investments backed by automobile, aircraft, manufactured housing, bank loans and insurance securities collateral. Impairments

in 2005 related primarily to investments backed by aircraft and manufactured housing collateral.

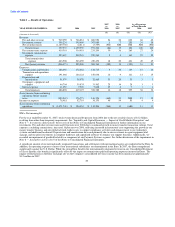

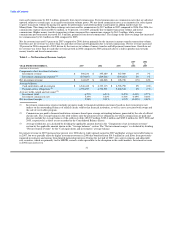

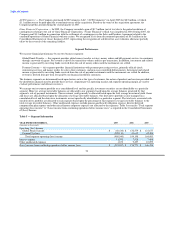

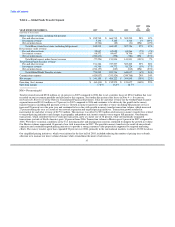

Expenses

Expenses represent operating expenses other than commissions. Following is a discussion of the operating expenses presented in Table 1.

Compensation and benefits — Compensation and benefits includes salaries and benefits, management incentive programs and other

employee related costs. Compensation and benefits increased $15.8 million, or 9 percent, in 2007 compared to 2006, resulting primarily

from an increase in salaries and benefits of $31.4 million, partially offset by a decrease of $16.7 million in incentive compensation

accruals. The increase in salaries and benefits is primarily due to a $24.6 million increase in salaries due to higher headcount supporting

the growth of the money transfer business, a $2.5 million increase in medical costs and a $2.4 million increase in payroll taxes. Incentive

compensation decreased $18.6 million due to the Company's 2007 performance and stock price decline, offset by a $2.0 million increase

in stock-based compensation expense. The increase in stock based compensation expense is due primarily to the high value of the

Company's stock price at the date of the 2007 grants, partially offset by a lower number of awards being earned in the current year. The

change in the Euro exchange rate, which is reflected in each of the amounts discussed above, increased compensation and benefits by

approximately $1.4 million compared to 2006. As of December 31, 2007, the number of employees increased 10 percent over 2006 as we

increased headcount for our support functions and continued to staff our retail locations in France and Germany. We expect to see a

double-digit increase in headcount in 2008, resulting in continued increases to compensation and benefits.

Compensation and benefits increased $39.5 million, or 30 percent, in 2006 compared to 2005, primarily driven by the hiring of additional

personnel, resulting in an increase in salary expense of $22.6 million, higher performance incentive accruals of $7.1 million and an

increase of $1.6 million of stock-based compensation expense. In 2006, the number of employees increased by 21 percent over 2005 to

drive and support money transfer growth.

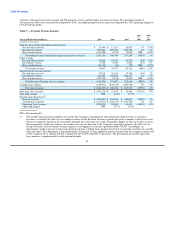

Transaction and operations support — Transaction and operations support expenses include marketing costs, professional fees and other

outside services costs, telecommunications and forms expense related to our products. Transaction and operations support costs increased

$26.9 million, or 16 percent, in 2007 compared to 2006, primarily due to higher costs related to the expansion of the money transfer

business and the global network, as well as an impairment of $6.4 million of goodwill related to a component of our Payment Systems

segment. See further discussion of the impairment recorded in Note 8 — Intangibles and Goodwill of the Notes to Consolidated Financial

Statements. Provision for loss increased in 2007 by $4.6 million over 2006, with no noticeable trends driving the increase. As our agent

base and transaction volumes continue to grow, we expect that provision for loss will increase; however, we expect this growth to be

much slower than agent base and transaction growth due to our underwriting and credit monitoring processes. Professional fees increased

$5.3 million primarily due to increased contractor and consulting fees to support compliance activities and enhancements to our

technology systems and increased credit servicing fees. Marketing costs increased $3.2 million, agent forms and supplies costs increased

$2.7 million and licensing fees increased by $2.5 million, all primarily due to the increase in agent locations. These increases were offset

by a decrease of $4.1 million in the directors deferred compensation accrual related to the decrease in the price of our common stock. The

change in the Euro exchange rate, which is reflected in each of the amounts discussed above, increased transaction and operations support

by approximately $6.0 million compared to 2006.

Transaction and operations support costs were up $14.1 million, or nine percent, in 2006 compared to 2005, primarily driven by an

increase of $15.0 million in marketing expenditures as we continue to invest in our brand and support our agent growth and an increase of

$9.0 million in professional fees to support enhancements to our technology systems. These increases were partially offset by a

$9.0 million decline in provision for uncollectible receivables primarily resulting from the additional provision of $6.7 million in 2005 for

one agent. In addition, in 2006, we recognized an impairment of $0.9 million due to the discontinuation of a software development

project.

33