MoneyGram 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

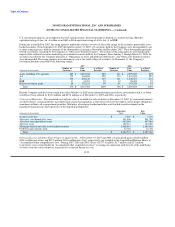

Substantially Restricted — The Company is regulated by various state agencies which generally require the Company to maintain liquid

assets and investments with an investment rating of A or higher in an amount generally equal to the payment service obligation ("PSO")

for those regulated payment instruments, namely teller checks, agent checks, money orders, and money transfers. The regulatory

requirements are similar to, but less restrictive than, the Company's unrestricted assets measure. The regulatory PSO measure varies by

state, but in all cases is substantially lower than the Company's PSO as disclosed in the Consolidated Balance Sheets because the

Company is not regulated by state agencies for PSO resulting from outstanding cashier's checks or for amounts payable to agents and

brokers. Consequently, a significant amount of cash and cash equivalents, receivables and investments are restricted to satisfy the liability

to pay the face amount of regulated payment service obligations upon presentment. The Company is not regulated by state agencies for

payment service obligations resulting from outstanding cashier's checks; however, the Company restricts a portion of the funds related to

these payment instruments due to contractual arrangements and/or Company policy. Assets restricted for regulatory or contractual

reasons are not available to satisfy working capital or other financing requirements. The regulatory and contractual requirements do not

require the Company to specify individual assets held to meet our payment service obligations; nor is the Company required to deposit

specific assets into a trust, escrow or other special account. Rather, the Company must maintain a pool of liquid assets. No third party

places limitations, legal or otherwise, on the Company regarding the use of its individual liquid assets. The Company is able to withdraw,

deposit or sell its individual liquid assets at will, with no prior notice or penalty, provided the Company maintains a total pool of liquid

assets sufficient to meet the regulatory and contractual requirements.

Regulatory requirements also require MPSI, the licensed entity and wholly-owned operating subsidiary of the Company, to maintain

positive net worth, with one state also requiring that MPSI maintain positive tangible net worth. As of December 31, 2007, the Company

was in compliance with state regulatory requirements, with the exception of the requirement of one state to maintain positive tangible net

worth. As of December 31, 2007, the Company had excess assets over the states' payment service obligations ("cushion") under our most

restrictive state of $157.9 million. All other states had substantially higher cushions at December 31, 2007. Subsequent to December 31,

2007, the Company was out of compliance with certain other state regulatory requirements. The Company has not received notice of any

enforcement actions contemplated by the regulators, but the regulators reserve the right to take action in the future and could impose fines

and penalties related to the compliance failure. With the completion of the Capital Transaction, as of March 25, 2008, the Company was

in compliance with all regulatory requirements for all states.

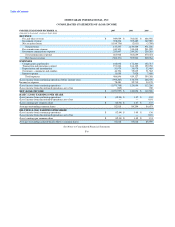

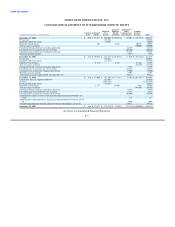

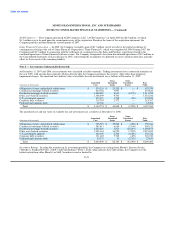

The Company has unrestricted cash and cash equivalents, receivables and investments to the extent those assets exceed all payment

service obligations. These amounts are generally available; however, management considers a portion of these amounts as providing

additional assurance that regulatory requirements are maintained during the normal fluctuations in the value of investments. The

following table shows the total amount of unrestricted assets at December 31. The Company had a shortfall in its unrestricted assets at

December 31, 2007 due to the decline in the fair value of its investment portfolio.

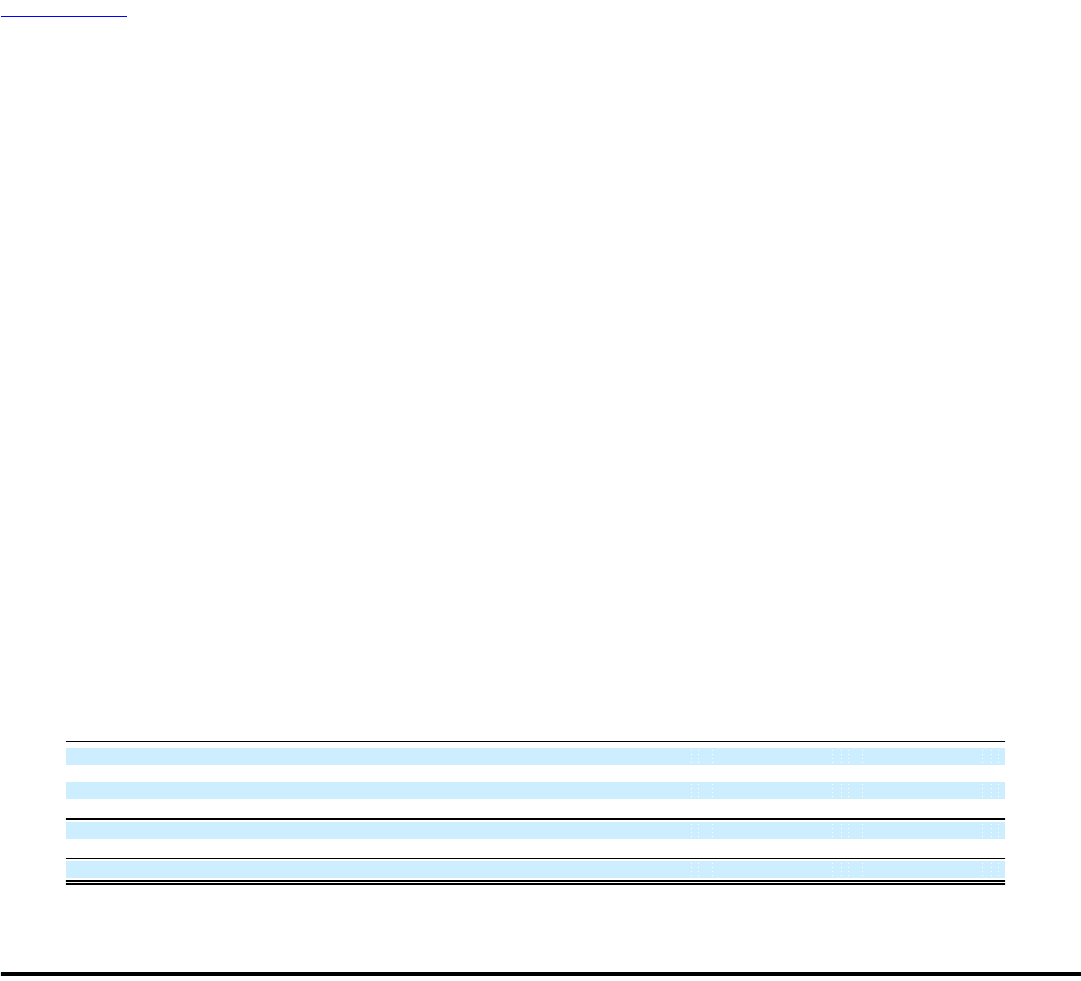

(Amounts in thousands) 2007 2006

Cash and cash equivalents (substantially restricted) $ 1,552,949 $ 973,931

Receivables, net (substantially restricted) 1,408,220 1,758,682

Trading investments (substantially restricted) 62,105 145,500

Available for sale investments (substantially restricted) 4,187,384 5,690,600

7,210,658 8,568,713

Amounts restricted to cover payment service obligations (7,762,470) (8,209,789)

(Shortfall) excess in unrestricted assets $ (551,812) $ 358,924

See Note 18 — Subsequent Events for the impact of the Capital Transaction on the Company's unrestricted assets measure.

F-13