MoneyGram 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

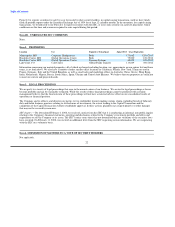

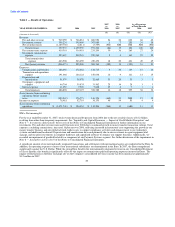

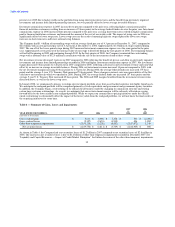

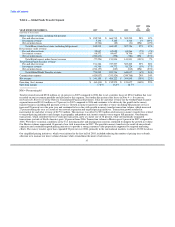

Table 1 — Results of Operations

2007 2006 As a Percentage

vs. vs. of Total Revenue

YEAR ENDED DECEMBER 31, 2007 2006 2005 2006 2005 2007 2006 2005

(%) (%) (%) (%) (%)

(Amounts in thousands)

Revenue:

Fee and other revenue $ 949,059 $ 766,881 $ 606,956 24 26 602 66 62

Investment revenue 398,234 395,489 367,989 1 7 253 34 38

Net securities losses (1,189,756) (2,811) (3,709) NM NM NM NM NM

Total revenue 157,537 1,159,559 971,236 (86) 19 100 100 100

Fee commissions expense 410,301 314,418 231,209 30 36 260 27 24

Investment commissions

expense 253,607 249,241 239,263 2 4 161 22 25

Total commissions

expense 663,908 563,659 470,472 18 20 421 49 49

Net (losses) revenue (506,371) 595,900 500,764 (185) 19 (321) 51 51

Expenses:

Compensation and benefits 188,092 172,264 132,715 9 30 119 15 14

Transaction and operations

support 191,066 164,122 150,038 16 9 121 14 15

Depreciation and

amortization 51,979 38,978 32,465 33 20 33 3 3

Occupancy, equipment and

supplies 44,704 35,835 31,562 25 14 28 3 3

Interest expense 11,055 7,928 7,608 39 4 7 1 1

Total expenses 486,896 419,127 354,388 16 18 309 36 36

(Loss) income from continuing

operations before income

taxes (993,267) 176,773 146,376 (662) 21 NM 15 15

Income tax expense 78,481 52,719 34,170 49 54 50 4 4

(Loss) income from continuing

operations $ (1,071,748) $ 124,054 $ 112,206 (964) 11 (680) 11 11

NM = Not meaningful

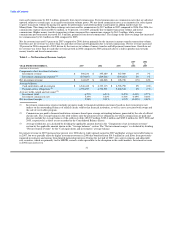

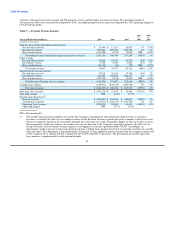

For the year ended December 31, 2007, total revenue decreased 86 percent from 2006 due to the net securities losses of $1.2 billion

resulting from other-than-temporary impairments. See "Liquidity and Capital Resources — Impact of Credit Market Disruption" and

Note 4 — Investments (Substantially Restricted) of the Notes to Consolidated Financial Statements for further information on our

investments. Fee and other revenue increased 24 percent over 2006 due to continued growth in money transfer transaction volume. Total

expenses, excluding commissions, increased 16 percent over 2006, reflecting increased infrastructure costs supporting the growth in our

money transfer business and our global network, higher costs to support compliance activities and enhancements to our technology

systems and additional headcount. Depreciation and amortization increased primarily due to our investment in agent equipment and

signage, and our prior investments in computer hardware and capitalized software to enhance our support functions. Additionally, we

recorded an impairment of goodwill related to a component of our Payment Systems segment. See further discussion of the impairment in

Note 8 — Intangibles and Goodwill of the Notes to Consolidated Financial Statements.

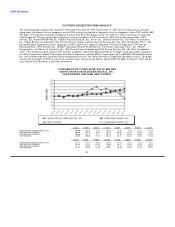

A significant amount of our internationally originated transactions and settlements with international agents are conducted in the Euro. In

addition, the operating expenses of most of our international subsidiaries are denominated in the Euro. In 2007, the Euro strengthened

significantly against the U.S. Dollar. While the strong Euro benefits the internationally originated revenue in our Consolidated Statement

of (Loss) Income, this benefit is significantly offset by the impact on commissions paid and operating expenses incurred in Euros. The

impact of fluctuations in the Euro exchange rate on the Company's consolidated net (loss) income has been minimal at approximately

$3.2 million in 2007.

29