MoneyGram 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

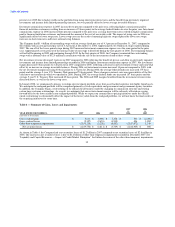

Table of Contents

Statements and "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital

Resources — Sale of Investments and Capital Transaction".

Interest expense increased four percent in 2006 as compared to 2005, primarily due to higher average interest rates, which were partially

offset by receipts under our cash flow hedges. In connection with the amendment of our $350.0 million bank credit facility in the second

quarter of 2005, we expensed $0.9 million of unamortized financing costs related to the original facility. Also see "Management's

Discussion and Analysis — Other Funding Sources and Requirements" for further information regarding our bank credit facility.

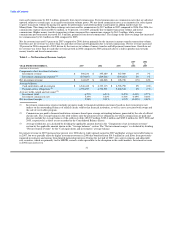

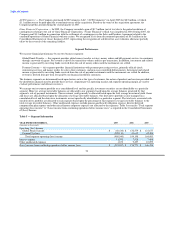

Income taxes — In 2007, we had $78.5 million of tax expense on a pre-tax loss of $993.3 million resulting in a negative effective tax rate

of 7.9 percent. The effective tax rate was 29.8 percent in 2006 and 23.3 percent in 2005. The decrease in the effective tax rate in 2007 is

primarily due to establishing a deferred tax asset valuation allowance of $417.6 million for the impairment of securities. Due to the

amount and characterization of losses, as of December 31, 2007, we determined that it was not "more likely than not" that the deferred

tax assets related to the losses will be realized. We are continuing to evaluate available tax positions related to the net securities losses,

which may result in future tax benefits.

The corporate tax rate in 2006 and 2005 is lower than the statutory rate primarily due to income from tax-exempt bonds in our investment

portfolio. The tax rate in 2005 benefited from a reduction in provision of $5.6 million due to reversal of tax reserves no longer needed due

to the passage of time and changes in estimates of tax amounts. These benefits in 2006 were partially offset by the decline in tax-exempt

investment income as a percentage of total pre-tax income.

Acquisitions and Discontinued Operations

PropertyBridge, Inc. — On October 1, 2007, the Company acquired PropertyBridge for $28.1 million, plus a potential earn-out payment

of up to $10.0 million contingent on PropertyBridge's performance during 2008. PropertyBridge is a provider of electronic payment

processing services for the real estate management industry. PropertyBridge offers a complete solution to the resident payment cycle,

including the ability to electronically accept deposits and rent payments. Residents can pay rent online, by phone or in person and set up

recurring payments. PropertyBridge is a component of the Company's Global Funds Transfer segment.

The Company has finalized its purchase price allocation, resulting in goodwill of $24.1 million and purchased intangible assets of

$6.0 million, consisting primarily of customer lists, developed technology and a non-compete agreement. The intangible assets will be

amortized over useful lives ranging from three to fifteen years. Goodwill was assigned to the Company's Global Funds Transfer segment.

The acquisition cost includes $0.2 million of transaction costs.

The operating results of PropertyBridge subsequent to October 1, 2007 are included in the Company's Consolidated Statements of (Loss)

Income.

Money Express — On May 31, 2006, MoneyGram completed the acquisition of Money Express S.r.l. ("Money Express"), the Company's

former money transfer super agent in Italy, for $15.0 million. In connection with the acquisition, the Company formed MoneyGram

Payment Systems Italy, S.r.l., a wholly-owned subsidiary, to operate the former Money Express agent network. The acquisition provides

the Company with the opportunity for further network expansion and more control of marketing and promotional activities in the region.

The Company finalized its purchase price allocation in 2007, resulting in a decrease of $0.3 million to goodwill. Purchased intangible

assets of $7.7 million, consisting primarily of customer lists and a noncompetition agreement, will be amortized over useful lives ranging

from three to five years. Goodwill of $16.7 million was recorded and assigned to the Company's Global Funds Transfer segment. The

acquisition cost includes $1.3 million of transaction costs and the forgiveness of $0.7 million of liabilities.

The operating results of Money Express subsequent to May 31, 2006 are included in the Company's Consolidated Statements of (Loss)

Income.

35