MoneyGram 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

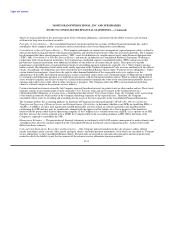

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Foreign Currency Translation — The Company converts assets and liabilities of foreign operations to their U.S. dollar equivalents at

rates in effect at the balance sheet dates, and records translation adjustments in "Accumulated other comprehensive loss" in the

Consolidated Balance Sheets. Income statements of foreign operations are translated from the operation's functional currency to

U.S. dollar equivalents at the average exchange rate for the month. Foreign currency exchange transaction gains and losses are reported in

"Transaction and operations support" in the Consolidated Statements of (Loss) Income.

Revenue Recognition — The Company derives revenue primarily through service fees charged to consumers and its investing activity. A

description of these revenues and recognition policies is as follows:

• Fee and other revenues primarily consist of transaction fees, foreign exchange revenue and other revenue.

– Transaction fees consist primarily of fees earned on the sale of money transfers, retail money orders and bill payment services.

The money transfer transaction fees are fixed fees per transaction that may vary based upon the face value of the amount of the

transaction and the locations in which these money transfers originate and to which they are sent. The money order and bill

payment transaction fees are fixed fees charged on a per item basis. Transaction fees are recognized at the time of the transaction

or sale of the product.

– Foreign exchange revenue is derived from the management of currency exchange spreads (as a percentage of face value of the

transaction) on international money transfer transactions. Foreign exchange revenue is recognized at the time the exchange in

funds occurs.

– Other revenue consists of processing fees on rebate checks and controlled disbursements, service charges on aged outstanding

money orders, money order dispenser fees and other miscellaneous charges. These fees are recognized in earnings in the period

the item is processed or billed.

• Investment revenue is derived from the investment of funds generated from the sale of official checks, money orders and other

payment instruments and consists of interest income, dividend income and amortization of premiums and discounts. These funds are

available for investment until the items are presented for payment. Interest and dividends are recognized as earned. Premiums and

discounts on investments are amortized using a straight-line method over the life of the investment.

• Securities gains and losses are recognized upon the sale of securities using the specific identification method to determine the cost

basis of securities sold. Impairments are recognized in the period the security is deemed to be other-than-temporarily impaired.

Fee Commissions Expense — The Company pays fee commissions to third-party agents for money transfer services. In a money transfer

transaction, both the agent initiating the transaction and the agent disbursing the funds receive a commission. The commission amount is

generally based on a percentage of the fee charged to the customer. The Company generally does not pay commissions to agents on the

sale of money orders. Fee commissions are recognized at the time of the transaction. Fee commissions also include the amortization of

the capitalized incentive payments to agents.

Investment Commissions Expense — Investment commissions expense includes amounts paid to financial institution customers based

upon average outstanding balances generated by the sale of official checks and costs associated with swaps and the sale of receivables

program. Commissions paid to financial institution customers generally are variable based on short-term interest rates; however, a portion

of the commission expense has been fixed through the use of interest rate swap agreements. Investment commissions are generally

recognized each month based on the average outstanding balances and the contractual variable rate for that month.

Marketing & Advertising Expense — Marketing, and advertising costs are expensed as incurred or at the time the advertising first takes

place. Marketing and advertising expense was $56.5 million, $53.4 million and $38.3 million for 2007, 2006 and 2005, respectively.

F-17