MoneyGram 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

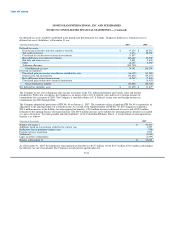

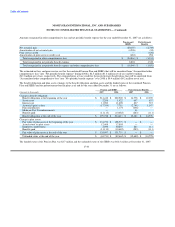

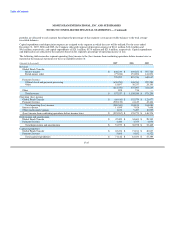

Postretirement Benefits Other Than Pensions — The Company has unfunded defined benefit postretirement plans that provide medical

and life insurance for eligible employees, retirees and dependents. The related postretirement benefit liabilities are recognized over the

period that services are provided by the employees. Upon the Distribution, the Company assumed the benefit obligation for current and

former employees assigned to MoneyGram. Viad retained the benefit obligation for postretirement benefits other than pensions for all

Viad and non-MoneyGram employees, with the exception of one executive. The Company's funding policy is to make contributions to

the postretirement benefits plans as benefits are required to be paid. During 2007, the Company amended the postretirement benefit plan

for certain benefits relating to co-payments, deductibles, coinsurance and maximum benefit payments which resulted in a $0.6 million

gain to the change in the benefit obligation.

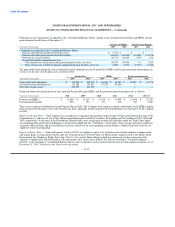

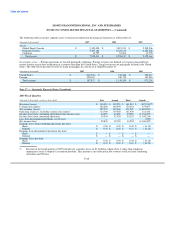

In May 2004, the FASB issued FSP FAS 106-2, Accounting and Disclosure Requirements Related to the Medicare Prescription Drug,

Improvement and Modernization Act of 2003, on the accounting for the effects of the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (the "Medicare Act"), which was enacted into law on December 8, 2003. The Medicare Act introduces a

Medicare prescription drug benefit, as well as a federal subsidy to sponsors of retiree health care plans that provide a benefit that is at

least substantially equivalent to the Medicare benefit. The Company adopted FSP FAS 106-2 in the third quarter of 2004 using the

prospective method, which means the reduction of the Accumulated Postretirement Benefit Obligation ("APBO") of $1.4 million is

recognized over future periods. This reduction in the APBO is due to a subsidy available on prescription drug benefits provided to plan

participants determined to be actuarially equivalent to the Medicare Act. The Company has determined that its postretirement plan is

actuarially equivalent to the Medicare Act and its application for determination of actuarial equivalence has been approved by the

Medicare Retiree Drug Subsidy program. The postretirement benefits expense for 2007, 2006, 2005 was reduced by less than

$0.3 million due to the reductions in the APBO and the current period service cost. Subsidies to be received under the Medicare Act in

2008 are not expected to be material.

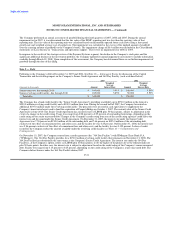

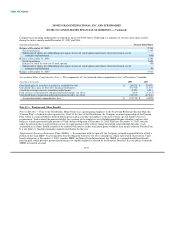

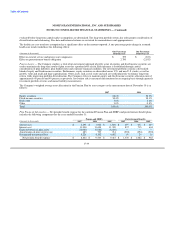

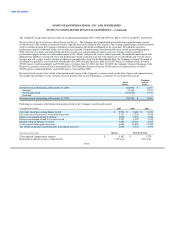

Actuarial Valuation Assumptions — The measurement date for the Company's Pension Plan, SERPs and postretirement benefit plans is

November 30. Following are the weighted average actuarial assumptions used in calculating the benefit obligation and net benefit cost as

of and for the years ended December 31:

Pension and SERPs Postretirement Benefits

2007 2006 2005 2007 2006 2005

Net periodic benefit cost:

Discount rate 5.70% 5.90% 6.00% 5.70% 5.90% 6.00%

Expected return on plan assets 8.00% 8.00% 8.50% — — —

Rate of compensation increase 5.75% 5.75% 4.50% — — —

Initial healthcare cost trend rate — — — 9.50% 10.00% 10.00%

Ultimate healthcare cost trend rate — — — 5.00% 5.00% 5.00%

Year ultimate healthcare cost trend rate is reached — — — 2013 2013 2013

Projected benefit obligation:

Discount rate 6.50% 5.70% 5.90% 6.50% 5.70% 5.90%

Rate of compensation increase 5.75% 5.75% 5.75% — — —

Initial healthcare cost trend rate — — — 9.00% 9.50% 10.00%

Ultimate healthcare cost trend rate — — — 5.00% 5.00% 5.00%

Year ultimate healthcare cost trend rate is reached — — — 2013 2013 2013

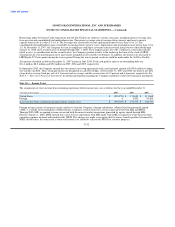

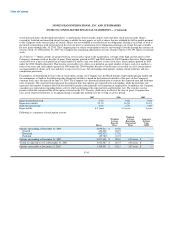

The Company utilizes a building-block approach in determining the long-term expected rate of return on plan assets. Historical markets

are studied and long-term historical relationships between equity securities and fixed income securities are preserved consistent with the

widely accepted capital market principle that assets with higher volatility generate a greater return over the long run. Current market

factors such as inflation and interest rates are

F-38