MoneyGram 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

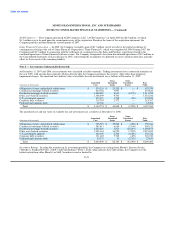

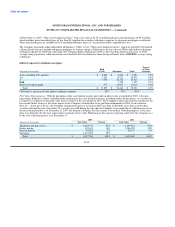

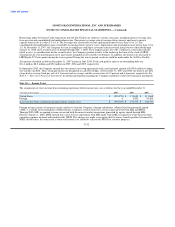

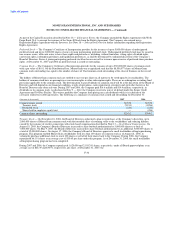

Assessment of Unrealized Losses: At December 31, 2007, the available-for-sale investments had the following aged unrealized losses

after the recognition of other-than-temporary impairment charges:

Less than 12 months 12 months or More Total

Unrealized Unrealized Unrealized

(Amounts in thousands) Fair Value Losses Fair Value Losses Fair Value Losses

Residential mortgage-backed securities $ 30,720 $ (502) $ 153,919 $ (1,668) $ 184,639 $ (2,170)

U.S. government agencies — — 111,430 (88) 111,430 (88)

Total $ 30,720 $ (502) $ 265,349 $ (1,756) $ 296,069 $ (2,258)

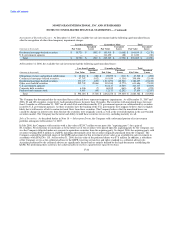

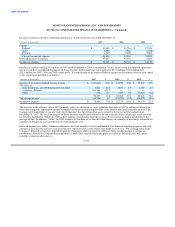

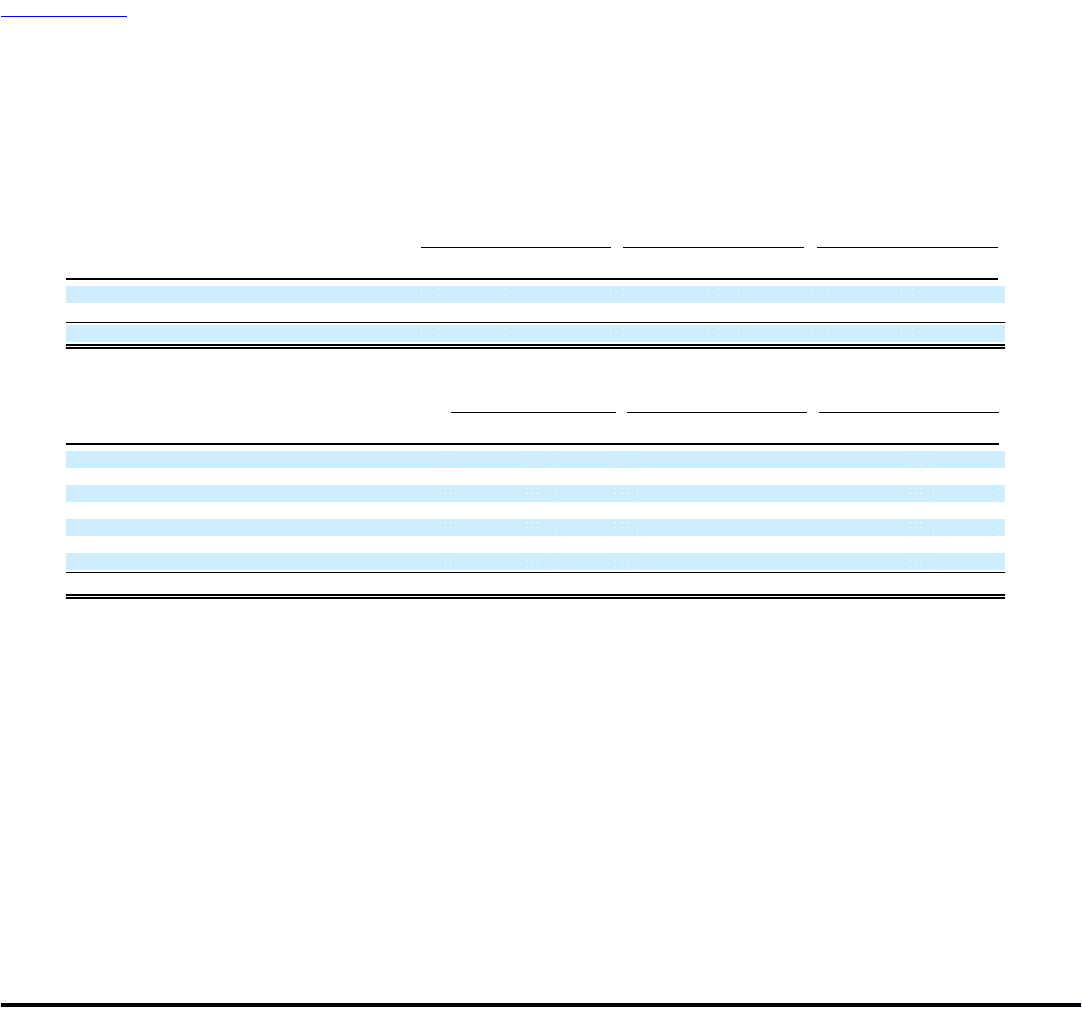

At December 31, 2006, the available-for-sale investments had the following aged unrealized losses:

Less than 12 months 12 months or More Total

Unrealized Unrealized Unrealized

(Amounts in thousands) Fair Value Losses Fair Value Losses Fair Value Losses

Obligations of states and political subdivisions $ 22,467 $ (180) $ 25,075 $ (310) $ 47,542 $ (490)

Commercial mortgage-backed securities 97,747 (812) 110,859 (1,336) 208,606 (2,148)

Residential mortgage-backed securities 173,179 (653) 1,213,278 (22,566) 1,386,457 (23,219)

Other asset-backed securities 292,742 (2,066) 318,944 (5,773) 611,686 (7,839)

U.S. government agencies — — 321,117 (6,589) 321,117 (6,589)

Corporate debt securities 6,306 (7) 60,832 (463) 67,138 (470)

Preferred and common stock 5,663 (45) 12,173 (2,292) 17,836 (2,337)

Total $ 598,104 $ (3,763) $ 2,062,278 $ (39,329) $ 2,660,382 $ (43,092)

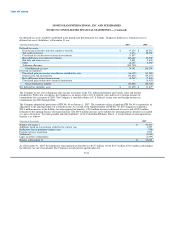

The Company has determined that the unrealized losses reflected above represent temporary impairments. As of December 31, 2007 and

2006, 20 and 188 securities, respectively, had unrealized losses for more than 12 months. The securities with unrealized losses for more

than 12 months as of December 31, 2007 are all rated AAA and either issued by U.S. government agencies or collateralized by securities

issued by U.S. government agencies. As these securities have the backing of the U.S. government, the Company believes that it is highly

likely that it will receive all of its contractual cash flows from these securities. The Company believes that the unrealized losses are

caused by changes in interest rates from the date the securities were originally issued, as well as the overall disruption in the asset-backed

securities market. The Company has the intent and ability to hold these securities to recovery, including maturity or call.

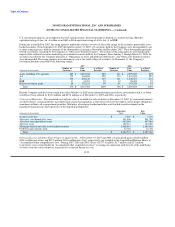

Sale of Securities: As described further in Note 18 — Subsequent Events, the Company sold a substantial portion of its investment

portfolio subsequent to December 31, 2007.

In July 2006, the Company sold securities with a fair value of $259.7 million to one party (the "acquiring party") for a gain of

$0.1 million. No restrictions or constraints as to the future use of the securities were placed upon the acquiring party by the Company, nor

was the Company obligated under any scenario to repurchase securities from the acquiring party. In August 2006, the acquiring party sold

securities totaling $646.8 million to a QSPE, including substantially all of the securities originally purchased from the Company. The

Company acquired the preferred shares of the QSPE and accounts for this investment at fair value as an available-for-sale investment in

accordance with SFAS No. 115. At December 31, 2006, the fair value of the preferred shares was $7.8 million. In addition, a subsidiary

of the Company serves as the collateral advisor to the QSPE, receiving certain fees and rights standard to a collateral advisor role.

Activities performed by the collateral advisor are significantly limited and are entirely defined by the legal documents establishing the

QSPE. For performing these activities, the collateral advisor receives a quarterly fee equal to ten basis

F-26