MoneyGram 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Operation in Politically Volatile Areas. Offering money transfer transactions through agents in regions that are politically volatile

or, in a limited number of cases, are subject to certain Office of Foreign Assets Control ("OFAC") restrictions could cause

contravention of U.S. law or regulations, subject us to fines and penalties and cause us reputational harm.

• Network and Data Security. If we suffer system interruptions and system failures due to defects in our software, development

delays and installation difficulties, or we suffer a material security breach of our systems, our business could be harmed.

• Business Interruption. In the event of a breakdown, catastrophic event, security breach, improper operation or any other event

impacting our systems or processes or our vendors' systems or processes, or improper action by our employees, agents, customer

financial institutions or third-party vendors, we could suffer financial loss, loss of customers, regulatory sanctions and damage to

our reputation.

• Technology Scalability. We may be unable to scale our technology to match our business and transactional growth.

• Agent Credit and Fraud Risks. We may face credit and fraud exposure if we are unable to collect funds from our agents who

receive the proceeds from the sale of our payment instruments.

• Reputational Damage. Inability by us to manage reputational damage to the Company's brand due to the events leading to the

Capital Transaction, as well as fraudulent or other unintended uses of our services could reduce the use and acceptance of our

services.

• New Retail Locations and Acquisitions. Opening new Company-owned retail locations and acquiring businesses subjects us to new

risks and may cause a diversion of capital and management's attention from our core business.

• International Migration Patterns. Changes in immigration laws or other circumstances that discourage international migration

could adversely affect our money transfer remittance volume or growth rate.

• International Risks. Our business and results of operation may be adversely affected by political, economic or other instability in

countries in which we have material agent relationships.

• Internal Controls. Our inability to maintain compliance with the internal control provisions of Section 404 of the Sarbanes-Oxley

Act of 2002 could have a material adverse effect on our business and stock price.

• Overhang of Convertible Preferred Stock to Float. Sales of a substantial number of shares of our common stock or the perception

that significant sales could occur, may depress the trading price of our common stock.

• Change in Control Restrictions. An Agreement between the Investors and Wal-Mart could prevent an acquisition of the Company.

• Anti-Takeover Provisions. Provisions in our charter documents and specific provisions of Delaware law may have the effect of

delaying, deterring or preventing a merger or change in control of our Company.

• NYSE Delisting. We may be unable to continue to satisfy the NYSE criteria for listing on the exchange.

• Inability to use Form S-3. We are currently unable to use the short-form registration statement, Form S-3, to register securities with

the SEC which could increase the time and resources necessary to raise capital.

• Other Factors. Additional risk factors may be described in our other filings with the Securities and Exchange Commission from

time to time.

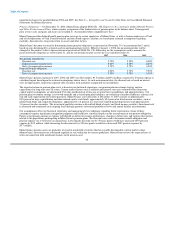

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk disclosure is discussed under "Enterprise Risk Management" in Item 7 of this Annual Report on Form 10-K.

61