MoneyGram 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

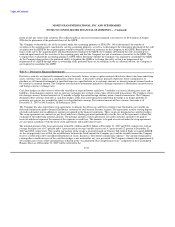

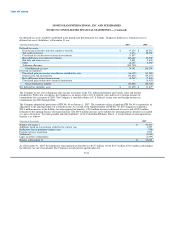

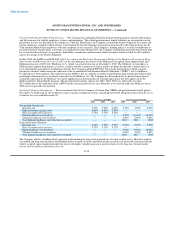

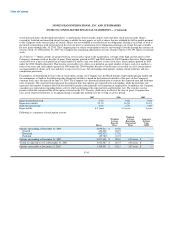

Company has remaining authorization to repurchase up to 5,205,000 shares. Following is a summary of treasury stock share activity

during the twelve months ended December 31, 2007 and 2006:

(Amounts in thousands) Treasury Stock Shares

Balance at December 31, 2005 2,701

Stock repurchases 2,195

Submission of shares for withholding taxes upon exercise of stock options and release of restricted stock, net of

issuances and forfeitures (610)

Balance at December 31, 2006 4,286

Stock repurchases 1,620

Issuance of stock for exercise of stock options (85)

Submission of shares for withholding taxes upon exercise of stock options and release of restricted stock, net of

issuances and forfeitures 90

Balance at December 31, 2007 5,911

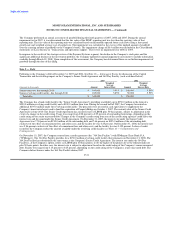

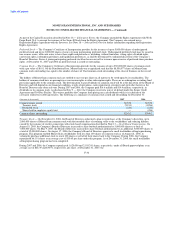

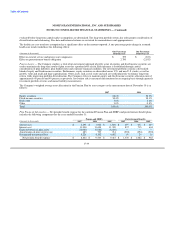

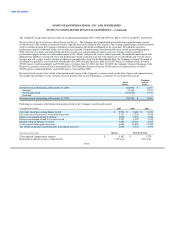

Accumulated Other Comprehensive Loss — The components of "Accumulated other comprehensive loss" at December 31 include:

(Amounts in thousands) 2007 2006

Unrealized gain on securities classified as available-for-sale $ 26,418 $ 24,607

Unrealized (loss) gain on derivative financial instruments (19,345) 11,345

Cumulative foreign currency translation adjustments 2,329 6,011

Prior service cost for pension and postretirement benefits, net of tax (603) (1,115)

Unrealized losses on pension and postretirement benefits, net of tax (30,514) (47,140)

Accumulated other comprehensive loss $ (21,715) $ (6,292)

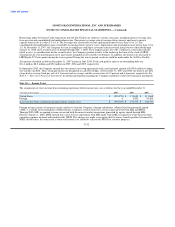

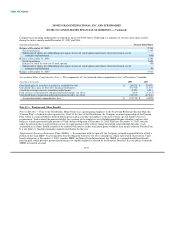

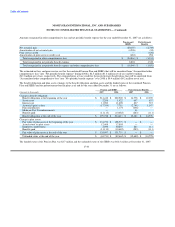

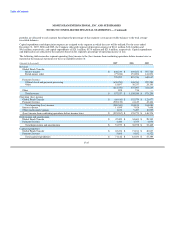

Note 12 — Pensions and Other Benefits

Pension Benefits — Prior to the Distribution, MoneyGram was a participating employer in the Viad Corp Retirement Income Plan (the

"Pension Plan") of which the plan sponsor was Viad. At the time of the Distribution, the Company assumed sponsorship of the Pension

Plan, which is a noncontributory defined benefit pension plan covering all employees who meet certain age and length-of-service

requirements. Viad retained the pension liability for a portion of the employees in its Exhibitgroup/Giltspur subsidiary and one sold

business, which represented eight percent of Viad's benefit obligation at December 31, 2003. Effective December 31, 2003, benefits

under the pension plan ceased accruing service or compensation credits with no change in benefits earned through this date. Cash

accumulation accounts should continue to be credited with interest credits until participants withdraw their money from the Pension Plan.

It is our policy to fund the minimum required contribution for the year.

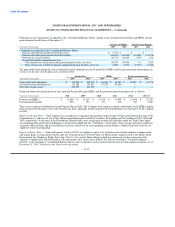

Supplemental Executive Retirement Plans (SERPs) — In connection with the spin-off, the Company assumed responsibility for all but a

portion of the Viad SERP. Viad retained the benefit obligation related to two of its subsidiaries, which represented 13 percent of Viad's

benefit obligation at December 31, 2003. Another SERP, the MoneyGram International, Inc. SERP, is a nonqualified defined benefit

pension plan, which provides postretirement income to eligible employees selected by the Board of Directors. It is our policy to fund the

SERPs as benefits are paid.

F-37