MoneyGram 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

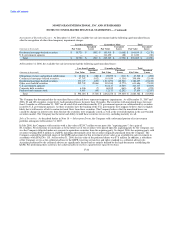

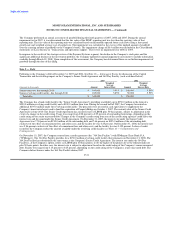

U.S. government agencies are included in the AAA rating category. Investment grade is defined as a security having a Moody's

equivalent rating of Aaa, Aa, A or Baa or an S&P or Fitch equivalent rating of AAA, AA, A or BBB.

During the second half of 2007, the rating agencies undertook extensive reviews of the credit ratings of all securities, particularly asset-

backed securities. From September 30, 2007 through December 31, 2007, 123 securities held by the Company were downgraded by one

or more rating agencies, with the majority of the downgrades occurring in November and December 2007. These downgrades primarily

related to securities classified by the Company as "Other asset-backed securities." The actions of the rating agencies also significantly

impacted the collateral securities underlying asset-backed securities held by the Company. From January 1 through March 19, 2008, 66

securities classified by the Company primarily as "Obligations of states and political subdivisions" and "Other asset-backed securities"

were downgraded. The rating agencies are continuing to review the credit ratings of securities. At December 31, the Company's

investment portfolio consisted of the following ratings:

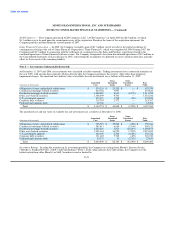

2007 2006

Number of Fair % of Total Number of Fair % of Total

(Amounts in thousands) Securities Value Portfolio Securities Value Portfolio

AAA, including U.S. agencies 287 $ 2,410,548 58% 324 $ 2,999,500 53%

AA 172 944,804 22% 173 1,233,254 22%

A 134 668,120 16% 141 1,206,583 21%

BBB 11 41,701 1% 10 58,009 1%

Below investment grade 66 122,211 3% 56 193,254 3%

Total 670 $ 4,187,384 100% 704 $ 5,690,600 100%

Had the Company used the lowest rating from either Moody's or S&P in the information presented above, investments rated A or better

would have been reduced by $32.2 million and $15.4 million as of December 31, 2007 and 2006, respectively.

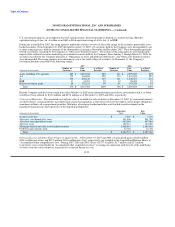

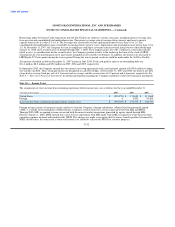

Contractual Maturities: The amortized cost and fair value of available-for-sale securities at December 31, 2007, by contractual maturity,

are shown below. Actual maturities may differ from contractual maturities as borrowers may have the right to call or prepay obligations,

sometimes without call or prepayment penalties. Maturities of mortgage-backed and other asset-backed securities depend on the

repayment characteristics and experience of the underlying obligations.

Amortized Fair

(Amounts in thousands) Cost Value

In one year or less $ 7,645 $ 7,716

After one year through five years 491,066 501,520

After five years through ten years 482,069 497,084

After ten years 182,312 184,280

Mortgage-backed and other asset-backed securities 2,968,914 2,984,016

Preferred and common stock 12,768 12,768

Total $ 4,144,774 $ 4,187,384

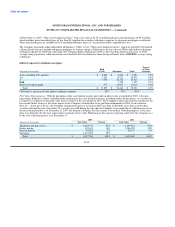

Gains and Losses and Other-Than-Temporary Impairments: At December 31, 2007 and 2006, net unrealized gains of $42.6 million

($26.4 million net of tax) and $39.7 million ($24.6 million net of tax), respectively, are included in the Consolidated Balance Sheets in

"Accumulated other comprehensive loss." During 2007, 2006 and 2005, losses of $737.6 million, $1.7 million and $2.3 million,

respectively, were reclassified from "Accumulated other comprehensive loss" to earnings in connection with the sale of the underlying

securities and other-than-temporary impairments recognized during the year.

F-22