MoneyGram 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

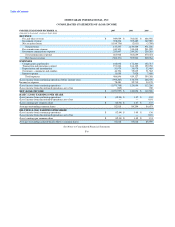

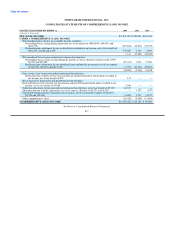

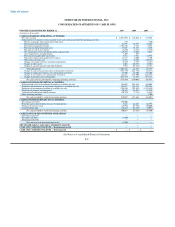

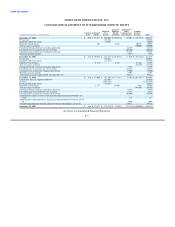

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Description of the Business

MoneyGram International, Inc. ("MoneyGram") offers products and services under its two operating segments, Global Funds Transfer

and Payment Systems. The Global Funds Transfer segment provides global money transfer services, money orders and bill payment

services to consumers through a network of agents. The Payment Systems segment provides financial institutions with payment

processing services, primarily official check outsourcing services and money orders for sale to their customers and processes controlled

disbursements.

MoneyGram has offices in six states in the United States, seven countries in Europe, six countries in Asia, two countries in Africa and in

Australia. The Company's headquarters are located in Minneapolis, Minnesota, U.S.A.

MoneyGram International, Inc. ("MoneyGram") was incorporated on December 18, 2003 in the state of Delaware as a subsidiary of Viad

Corp ("Viad") to effect the spin-off of Viad's payment services business operated by Travelers Express Company, Inc. ("Travelers") to its

stockholders (the "spin-off"). On June 30, 2004 (the "Distribution Date"), Travelers was merged with a subsidiary of MoneyGram and

Viad then distributed 88,556,077 shares of MoneyGram common stock in a tax-free distribution (the "Distribution"). Stockholders of

Viad received one share of MoneyGram common stock for every share of Viad common stock owned on the record date of June 24,

2004. Due to the relative significance of MoneyGram to Viad, MoneyGram is the divesting entity and treated as the "accounting

successor" to Viad for financial reporting purposes in accordance with Emerging Issues Task Force ("EITF") Issue No. 02-11, Accounting

for Reverse Spinoffs. Effective December 31, 2005, the entity that was formerly Travelers was merged into MoneyGram Payment

Systems, Inc., a wholly owned subsidiary of MoneyGram ("MPSI"), with MPSI remaining as the surviving corporation. References to

"MoneyGram," the "Company," "we," "us" and "our" are to MoneyGram International, Inc. and its subsidiaries and consolidated entities.

Capital Transaction — During September 2007, the asset-backed securities market and broader credit markets began to show significant

disruption, with a general lack of liquidity in the markets and deterioration in fair value of mortgage-backed securities triggered by

concerns surrounding sub-prime mortgages. In response to these concerns, the rating agencies undertook extensive reviews of asset-

backed securities, particularly mortgage-backed securities. In November and December 2007, the asset-backed securities and credit

markets experienced further substantial deterioration under increasing concerns over defaults on mortgages and debt in general, as well as

an increasingly negative view of all structured investments and the credit market in general. In addition, the rating agencies continued

their review of securities, issuing broad rating downgrades based on high levels of assumed future defaults. Under the terms of certain of

the Company's asset-backed securities, ratings downgrades of collateral securities can reduce the cash flows to all but the most senior

investors even if there have been no actual losses incurred by the collateral securities. In December 2007, the Company began to

experience adverse changes to the cash flows from some of its asset-backed investments as a result of the accumulating rating

downgrades of collateral securities. As the market continued its substantial deterioration, the Company identified a need for additional

capital. Through meetings with potential investors in late December 2007 and early January 2008, it became evident that the Company

would need to divest certain investments in connection with any recapitalization to eliminate the risk of any further deterioration in the

investment portfolio. The Company commenced a plan in January 2008 to realign its investment portfolio away from asset-backed

securities and into highly liquid assets through the sale of a substantial portion of the investment portfolio. As a result of these

developments, the Company recognized $1.2 billion of other-than-temporary impairments in December 2007.

On March 25, 2008, the Company completed a recapitalization transaction pursuant to which the Company received a substantial infusion

of both equity and debt capital (the "Capital Transaction"). See Note 18 — Subsequent Events for further discussion of the Capital

Transaction.

Note 2 — Summary of Significant Accounting Policies

Basis of Presentation — The consolidated financial statements of MoneyGram are prepared in conformity with accounting principles

generally accepted in the United States of America ("GAAP"). The Consolidated Balance

F-10