MoneyGram 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

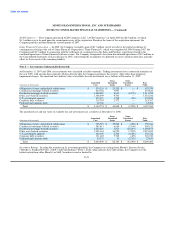

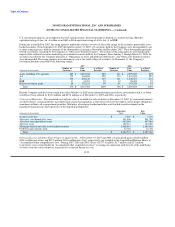

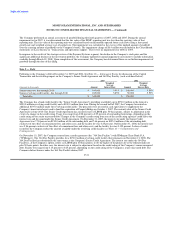

Gross realized gains and losses on sales of investments, using the specific identification method, and other-than-temporary impairments

were as follows for the year ended December 31:

(Amounts in thousands) 2007 2006 2005

Gross realized gains $ 5,611 $ 5,080 $ 7,378

Gross realized losses (2,157) (2,653) (4,535)

Other-than-temporary impairments (1,193,210) (5,238) (6,552)

Net securities losses $ (1,189,756) $ (2,811) $ (3,709)

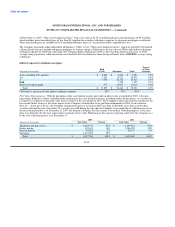

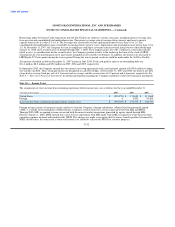

Through September 30, 2007, the Company recognized $6.1 million of other-than-temporary impairments due to adverse changes in cash

flows resulting from rating downgrades on the collateral securities underlying the Company's investment, as well as widening spreads in

the commercial paper market.

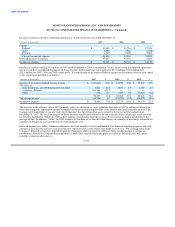

In late November and December 2007, the asset-backed securities and credit markets experienced substantial deterioration due to

increasing concerns over defaults on mortgages and debt in general, as well as an increasingly negative view towards all structured

investments and the credit market in general. This deterioration caused the market to demand higher risk premiums and liquidity

discounts on asset-backed securities, as well as assume higher rates of defaults than previously anticipated. As a result, the fair value for

asset-backed securities in general substantially declined from the September and October 2007 levels. In addition, the rating agencies

continued their review of securities, issuing broad rating downgrades based on high levels of assumed future defaults. Under the terms of

most asset-backed securities, ratings downgrades of collateral securities can reduce the cash flows to all but the most senior investors

even if there have been no actual losses incurred by the collateral securities. Based on these developments, the Company believes that it is

probable that actual losses would have been incurred by many of its asset-backed securities in the future. However, the Company believes

that the impact of broad rating downgrades combined with the uncertainty in the marketplace caused these losses to accelerate and be

higher than what may ultimately be realized by the underlying collateral securities.

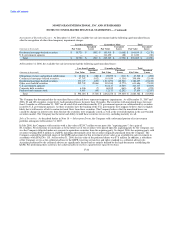

In connection with the Capital Transaction described in Note 1 — Description of the Business and Note 18 — Subsequent Events, the

Company commenced a plan in January 2008 to realign its investment portfolio away from asset-backed securities and into highly liquid

assets through the sale of a substantial portion of the investment portfolio. Based on these developments, the Company determined that it

no longer had the intent to hold substantially all of its investments classified as "Obligations of states and political subdivisions,"

"Commercial mortgage-backed securities," "Residential mortgage-backed securities," "Other asset-backed securities," "Corporate debt

securities" and "Preferred and common stock."

F-23